NewEdge Advisors LLC lifted its holdings in shares of Palo Alto Networks, Inc. (NASDAQ:PANW - Free Report) by 92.2% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 94,645 shares of the network technology company's stock after purchasing an additional 45,409 shares during the period. NewEdge Advisors LLC's holdings in Palo Alto Networks were worth $17,222,000 at the end of the most recent reporting period.

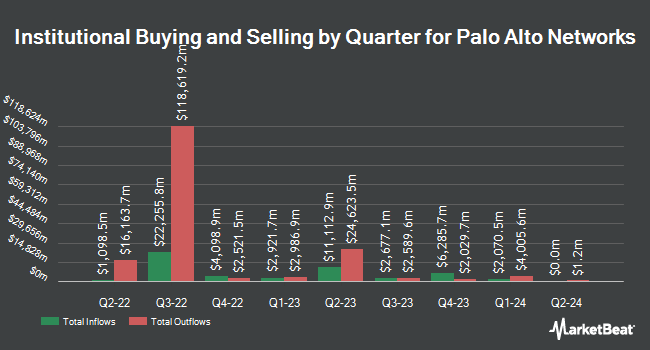

Several other institutional investors also recently added to or reduced their stakes in PANW. Vanguard Group Inc. lifted its stake in shares of Palo Alto Networks by 104.4% during the 4th quarter. Vanguard Group Inc. now owns 61,233,907 shares of the network technology company's stock valued at $11,142,122,000 after buying an additional 31,281,359 shares in the last quarter. Geode Capital Management LLC lifted its position in shares of Palo Alto Networks by 87.8% during the fourth quarter. Geode Capital Management LLC now owns 14,382,116 shares of the network technology company's stock worth $2,611,013,000 after acquiring an additional 6,725,148 shares in the last quarter. Norges Bank bought a new position in shares of Palo Alto Networks in the fourth quarter worth $970,736,000. Jennison Associates LLC grew its position in shares of Palo Alto Networks by 83.0% in the fourth quarter. Jennison Associates LLC now owns 5,759,689 shares of the network technology company's stock valued at $1,048,033,000 after purchasing an additional 2,612,474 shares in the last quarter. Finally, Clearbridge Investments LLC lifted its holdings in Palo Alto Networks by 86.9% during the 4th quarter. Clearbridge Investments LLC now owns 4,775,171 shares of the network technology company's stock worth $868,890,000 after purchasing an additional 2,220,130 shares in the last quarter. Institutional investors own 79.82% of the company's stock.

Palo Alto Networks Stock Performance

Shares of PANW traded down $2.07 during mid-day trading on Friday, reaching $167.69. The stock had a trading volume of 4,768,742 shares, compared to its average volume of 5,872,875. The firm has a market cap of $111.03 billion, a price-to-earnings ratio of 94.47, a PEG ratio of 5.64 and a beta of 1.07. Palo Alto Networks, Inc. has a 12 month low of $137.60 and a 12 month high of $208.39. The business has a fifty day moving average of $180.06 and a 200 day moving average of $184.73.

Palo Alto Networks (NASDAQ:PANW - Get Free Report) last posted its quarterly earnings data on Thursday, February 13th. The network technology company reported $0.81 EPS for the quarter, topping the consensus estimate of $0.75 by $0.06. The company had revenue of $2.26 billion during the quarter, compared to analyst estimates of $2.24 billion. Palo Alto Networks had a net margin of 14.64% and a return on equity of 21.93%. On average, research analysts forecast that Palo Alto Networks, Inc. will post 1.76 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts have recently commented on the stock. Guggenheim lowered shares of Palo Alto Networks from a "neutral" rating to a "sell" rating and set a $130.00 price target for the company. in a research report on Monday, January 6th. Deutsche Bank Aktiengesellschaft restated a "hold" rating and issued a $190.00 price objective (down from $207.00) on shares of Palo Alto Networks in a research report on Wednesday, January 8th. Royal Bank of Canada reissued an "outperform" rating and issued a $225.00 price target on shares of Palo Alto Networks in a research note on Monday, February 10th. BTIG Research downgraded shares of Palo Alto Networks from a "buy" rating to a "neutral" rating in a report on Wednesday, January 8th. Finally, Citigroup raised their price target on Palo Alto Networks from $205.00 to $220.00 and gave the company a "buy" rating in a research report on Tuesday, February 25th. Two research analysts have rated the stock with a sell rating, thirteen have assigned a hold rating, twenty-eight have given a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $203.06.

Check Out Our Latest Stock Analysis on PANW

Insider Buying and Selling at Palo Alto Networks

In other Palo Alto Networks news, EVP Lee Klarich sold 120,774 shares of the company's stock in a transaction on Monday, April 7th. The stock was sold at an average price of $151.13, for a total value of $18,252,574.62. Following the completion of the sale, the executive vice president now directly owns 321,774 shares in the company, valued at approximately $48,629,704.62. This represents a 27.29 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO Josh D. Paul sold 700 shares of the stock in a transaction on Monday, February 3rd. The stock was sold at an average price of $181.22, for a total value of $126,854.00. Following the transaction, the chief accounting officer now directly owns 47,976 shares in the company, valued at $8,694,210.72. The trade was a 1.44 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 1,039,318 shares of company stock valued at $181,925,602 in the last quarter. 2.50% of the stock is owned by insiders.

Palo Alto Networks Company Profile

(

Free Report)

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

Featured Stories

Before you consider Palo Alto Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palo Alto Networks wasn't on the list.

While Palo Alto Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report