NewEdge Advisors LLC increased its position in shares of Automatic Data Processing, Inc. (NASDAQ:ADP - Free Report) by 1.5% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 195,169 shares of the business services provider's stock after purchasing an additional 2,909 shares during the period. NewEdge Advisors LLC's holdings in Automatic Data Processing were worth $57,131,000 as of its most recent SEC filing.

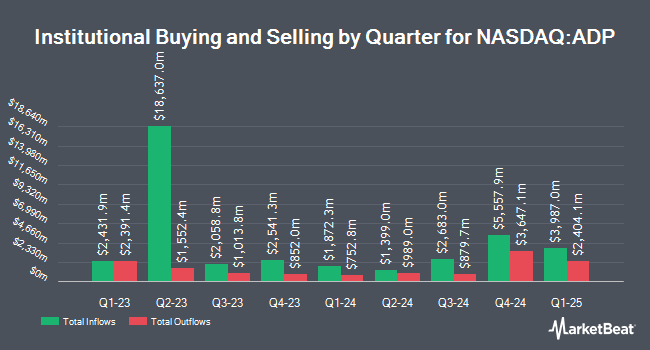

Several other large investors have also modified their holdings of ADP. Norges Bank acquired a new position in shares of Automatic Data Processing in the 4th quarter valued at $455,993,000. Winslow Capital Management LLC acquired a new stake in Automatic Data Processing during the 4th quarter worth approximately $396,714,000. Raymond James Financial Inc. acquired a new position in Automatic Data Processing during the fourth quarter valued at approximately $342,942,000. Proficio Capital Partners LLC lifted its stake in shares of Automatic Data Processing by 41,710.7% during the fourth quarter. Proficio Capital Partners LLC now owns 1,090,422 shares of the business services provider's stock worth $319,199,000 after purchasing an additional 1,087,814 shares in the last quarter. Finally, Amundi increased its stake in Automatic Data Processing by 16.8% during the 4th quarter. Amundi now owns 3,120,039 shares of the business services provider's stock worth $910,972,000 after buying an additional 449,431 shares during the period. 80.03% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on the company. StockNews.com cut Automatic Data Processing from a "buy" rating to a "hold" rating in a research note on Wednesday, February 5th. Barclays upped their price target on shares of Automatic Data Processing from $325.00 to $350.00 and gave the stock an "overweight" rating in a research report on Monday, February 3rd. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $315.00 price target on shares of Automatic Data Processing in a report on Thursday, January 30th. Jefferies Financial Group boosted their price target on Automatic Data Processing from $290.00 to $305.00 and gave the stock a "hold" rating in a research report on Thursday, January 30th. Finally, UBS Group raised their price objective on shares of Automatic Data Processing from $318.00 to $324.00 and gave the company a "neutral" rating in a research note on Tuesday, March 4th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating and two have issued a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $302.30.

View Our Latest Research Report on ADP

Automatic Data Processing Stock Down 2.3 %

Shares of ADP traded down $6.61 during midday trading on Monday, reaching $286.67. 436,118 shares of the stock were exchanged, compared to its average volume of 1,672,997. The company has a market cap of $116.81 billion, a price-to-earnings ratio of 29.89, a P/E/G ratio of 3.62 and a beta of 0.74. Automatic Data Processing, Inc. has a 12-month low of $231.27 and a 12-month high of $322.84. The firm has a 50 day simple moving average of $301.27 and a 200-day simple moving average of $298.30. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.59.

Automatic Data Processing (NASDAQ:ADP - Get Free Report) last posted its quarterly earnings data on Wednesday, January 29th. The business services provider reported $2.35 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.30 by $0.05. Automatic Data Processing had a net margin of 19.76% and a return on equity of 80.86%. Research analysts forecast that Automatic Data Processing, Inc. will post 9.93 EPS for the current year.

Automatic Data Processing Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Stockholders of record on Friday, June 13th will be given a dividend of $1.54 per share. This represents a $6.16 dividend on an annualized basis and a dividend yield of 2.15%. The ex-dividend date is Friday, June 13th. Automatic Data Processing's dividend payout ratio is currently 64.23%.

Insider Transactions at Automatic Data Processing

In related news, VP Christopher D'ambrosio sold 473 shares of the firm's stock in a transaction on Monday, March 10th. The stock was sold at an average price of $306.20, for a total transaction of $144,832.60. Following the completion of the sale, the vice president now directly owns 7,244 shares of the company's stock, valued at $2,218,112.80. This trade represents a 6.13 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Brian L. Michaud sold 1,500 shares of the firm's stock in a transaction that occurred on Tuesday, April 1st. The shares were sold at an average price of $305.38, for a total transaction of $458,070.00. Following the completion of the sale, the vice president now directly owns 12,073 shares of the company's stock, valued at approximately $3,686,852.74. This represents a 11.05 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 4,775 shares of company stock valued at $1,447,893. 0.21% of the stock is owned by corporate insiders.

Automatic Data Processing Company Profile

(

Free Report)

Automatic Data Processing, Inc provides cloud-based human capital management solutions worldwide. It operates in two segments, Employer Services and Professional Employer Organization (PEO). The Employer Services segment offers strategic, cloud-based platforms, and human resources (HR) outsourcing solutions.

Recommended Stories

Before you consider Automatic Data Processing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Automatic Data Processing wasn't on the list.

While Automatic Data Processing currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.