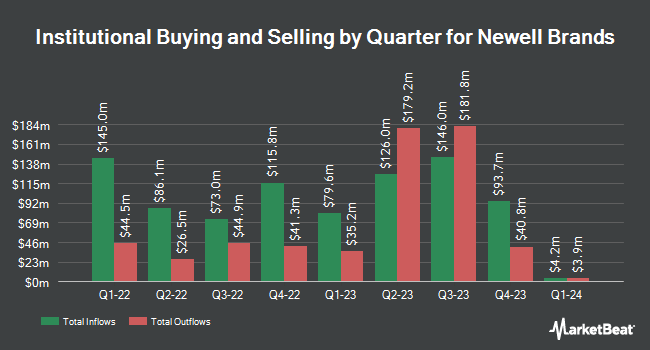

M&G PLC boosted its position in Newell Brands Inc. (NASDAQ:NWL - Free Report) by 46.2% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,462,030 shares of the company's stock after purchasing an additional 462,030 shares during the quarter. M&G PLC owned about 0.35% of Newell Brands worth $11,696,000 at the end of the most recent reporting period.

Several other large investors have also recently added to or reduced their stakes in the company. Centaurus Financial Inc. grew its position in Newell Brands by 5.9% during the second quarter. Centaurus Financial Inc. now owns 31,599 shares of the company's stock worth $203,000 after buying an additional 1,762 shares in the last quarter. Arizona State Retirement System raised its stake in Newell Brands by 2.1% in the second quarter. Arizona State Retirement System now owns 116,226 shares of the company's stock valued at $745,000 after purchasing an additional 2,394 shares in the last quarter. Tidal Investments LLC lifted its position in Newell Brands by 3.0% during the first quarter. Tidal Investments LLC now owns 83,559 shares of the company's stock worth $671,000 after purchasing an additional 2,407 shares during the period. Raymond James Trust N.A. grew its stake in Newell Brands by 9.9% during the second quarter. Raymond James Trust N.A. now owns 27,541 shares of the company's stock worth $177,000 after buying an additional 2,490 shares in the last quarter. Finally, Xcel Wealth Management LLC grew its stake in Newell Brands by 8.3% during the second quarter. Xcel Wealth Management LLC now owns 32,773 shares of the company's stock worth $210,000 after buying an additional 2,500 shares in the last quarter. Institutional investors own 92.50% of the company's stock.

Insider Transactions at Newell Brands

In related news, insider Bradford R. Turner sold 20,000 shares of the stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $8.96, for a total value of $179,200.00. Following the transaction, the insider now owns 230,254 shares of the company's stock, valued at $2,063,075.84. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 0.58% of the company's stock.

Newell Brands Stock Performance

Shares of NASDAQ NWL traded up $0.11 during midday trading on Friday, hitting $9.22. The stock had a trading volume of 5,572,859 shares, compared to its average volume of 6,995,475. Newell Brands Inc. has a 52 week low of $5.39 and a 52 week high of $9.68. The company has a current ratio of 0.99, a quick ratio of 0.50 and a debt-to-equity ratio of 1.43. The business's 50 day moving average is $7.74 and its 200-day moving average is $7.43.

Newell Brands (NASDAQ:NWL - Get Free Report) last announced its earnings results on Friday, October 25th. The company reported $0.16 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.16. The company had revenue of $1.95 billion during the quarter, compared to analyst estimates of $1.96 billion. Newell Brands had a negative net margin of 3.22% and a positive return on equity of 10.22%. The firm's quarterly revenue was down 2.6% compared to the same quarter last year. During the same period in the previous year, the business posted $0.39 earnings per share. As a group, analysts predict that Newell Brands Inc. will post 0.65 EPS for the current year.

Newell Brands Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, September 13th. Investors of record on Friday, August 30th were issued a $0.07 dividend. This represents a $0.28 dividend on an annualized basis and a dividend yield of 3.04%. The ex-dividend date of this dividend was Friday, August 30th. Newell Brands's payout ratio is -46.67%.

Analysts Set New Price Targets

Several research firms have weighed in on NWL. Canaccord Genuity Group upped their target price on Newell Brands from $12.00 to $13.00 and gave the stock a "buy" rating in a research note on Monday, October 28th. JPMorgan Chase & Co. decreased their price target on Newell Brands from $9.00 to $8.00 and set a "neutral" rating for the company in a research note on Friday, October 11th. Deutsche Bank Aktiengesellschaft increased their price target on Newell Brands from $8.00 to $9.00 and gave the stock a "hold" rating in a report on Monday, July 29th. Truist Financial boosted their target price on shares of Newell Brands from $8.00 to $10.00 and gave the company a "hold" rating in a research report on Tuesday, July 30th. Finally, Citigroup cut Newell Brands from a "hold" rating to a "strong sell" rating in a report on Tuesday, August 13th. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating and one has assigned a buy rating to the company. According to MarketBeat, Newell Brands currently has a consensus rating of "Hold" and a consensus target price of $8.90.

Get Our Latest Research Report on NWL

Newell Brands Profile

(

Free Report)

Newell Brands Inc engages in the design, manufacture, sourcing, and distribution of consumer and commercial products worldwide. The company operates in three segments: Home and Commercial Solutions, Learning and Development, and Outdoor and Recreation. The Commercial Solutions segment provides commercial cleaning and maintenance solution products under the Rubbermaid, Rubbermaid Commercial Products, Mapa, and Spontex brands; closet and garage organization products; hygiene systems and material handling solutions; household products, such as kitchen appliances under the Crockpot, Mr.

See Also

Before you consider Newell Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newell Brands wasn't on the list.

While Newell Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.