Newell Brands (NASDAQ:NWL - Get Free Report) updated its FY 2025 earnings guidance on Friday. The company provided earnings per share (EPS) guidance of 0.700-0.760 for the period, compared to the consensus estimate of 0.750. The company issued revenue guidance of $7.3 billion-$7.4 billion, compared to the consensus revenue estimate of $7.6 billion. Newell Brands also updated its Q1 2025 guidance to -0.090--0.060 EPS.

Analyst Upgrades and Downgrades

A number of research firms recently issued reports on NWL. Truist Financial upgraded shares of Newell Brands from a "hold" rating to a "buy" rating and raised their target price for the company from $10.00 to $17.00 in a research note on Monday, December 9th. Barclays raised their target price on shares of Newell Brands from $10.00 to $11.00 and gave the company an "overweight" rating in a research note on Friday, January 17th. JPMorgan Chase & Co. raised their target price on shares of Newell Brands from $9.00 to $10.00 and gave the company a "neutral" rating in a research note on Thursday, January 16th. Citigroup decreased their price target on shares of Newell Brands from $10.50 to $7.75 and set a "neutral" rating on the stock in a research report on Monday. Finally, UBS Group raised their price target on shares of Newell Brands from $9.50 to $10.50 and gave the stock a "neutral" rating in a research report on Thursday, January 16th. Eight equities research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $10.50.

Read Our Latest Stock Report on NWL

Newell Brands Price Performance

Shares of Newell Brands stock traded up $0.45 during trading on Tuesday, hitting $7.46. 7,961,295 shares of the company's stock traded hands, compared to its average volume of 7,242,417. The company has a debt-to-equity ratio of 1.43, a current ratio of 0.99 and a quick ratio of 0.50. The firm's fifty day moving average price is $10.10 and its 200 day moving average price is $8.72. Newell Brands has a twelve month low of $5.39 and a twelve month high of $11.78. The company has a market cap of $3.10 billion, a PE ratio of -12.32, a PEG ratio of 1.09 and a beta of 0.89.

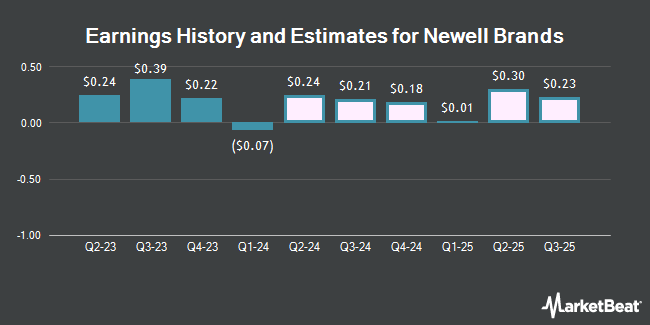

Newell Brands (NASDAQ:NWL - Get Free Report) last issued its earnings results on Friday, February 7th. The company reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.14 by $0.02. Newell Brands had a negative net margin of 3.22% and a positive return on equity of 10.22%. During the same quarter last year, the company posted $0.22 EPS. Analysts forecast that Newell Brands will post 0.65 earnings per share for the current year.

Insider Activity

In related news, insider Tracy L. Platt sold 23,343 shares of Newell Brands stock in a transaction dated Friday, December 6th. The shares were sold at an average price of $10.31, for a total transaction of $240,666.33. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 0.58% of the stock is owned by company insiders.

Newell Brands Company Profile

(

Get Free Report)

Newell Brands Inc engages in the design, manufacture, sourcing, and distribution of consumer and commercial products worldwide. The company operates in three segments: Home and Commercial Solutions, Learning and Development, and Outdoor and Recreation. The Commercial Solutions segment provides commercial cleaning and maintenance solution products under the Rubbermaid, Rubbermaid Commercial Products, Mapa, and Spontex brands; closet and garage organization products; hygiene systems and material handling solutions; household products, such as kitchen appliances under the Crockpot, Mr.

Featured Articles

Before you consider Newell Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newell Brands wasn't on the list.

While Newell Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.