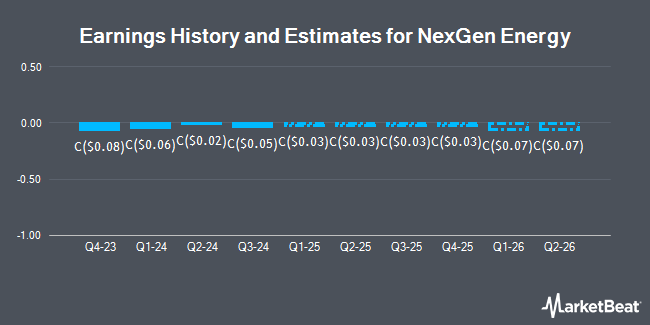

NexGen Energy Ltd. (TSE:NXE - Free Report) - Investment analysts at Ventum Cap Mkts raised their FY2024 EPS estimates for shares of NexGen Energy in a research report issued to clients and investors on Tuesday, November 12th. Ventum Cap Mkts analyst A. Terentiew now forecasts that the company will earn ($0.06) per share for the year, up from their prior forecast of ($0.12). The consensus estimate for NexGen Energy's current full-year earnings is ($0.07) per share. Ventum Cap Mkts also issued estimates for NexGen Energy's FY2025 earnings at ($0.12) EPS, FY2026 earnings at ($0.08) EPS and FY2027 earnings at ($0.19) EPS.

NexGen Energy (TSE:NXE - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The company reported C($0.05) earnings per share for the quarter, missing analysts' consensus estimates of C($0.04) by C($0.01). During the same period in the prior year, the firm earned ($0.03) EPS.

Other equities analysts have also recently issued reports about the stock. Raymond James lowered their price target on shares of NexGen Energy from C$13.00 to C$12.00 and set an "outperform" rating on the stock in a report on Friday, August 2nd. Scotiabank cut their price target on shares of NexGen Energy from C$12.50 to C$12.00 in a report on Monday, August 19th. National Bankshares raised their target price on NexGen Energy from C$11.00 to C$13.00 and gave the company an "outperform" rating in a research note on Thursday, October 24th. TD Securities lowered their target price on NexGen Energy from C$13.00 to C$12.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Finally, Royal Bank of Canada dropped their target price on shares of NexGen Energy from C$11.00 to C$10.00 and set an "outperform" rating for the company in a research report on Monday, August 12th. Seven equities research analysts have rated the stock with a buy rating and three have issued a strong buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Buy" and an average target price of C$13.38.

Get Our Latest Stock Report on NexGen Energy

NexGen Energy Price Performance

NXE stock traded up C$0.02 during trading hours on Friday, hitting C$10.41. 2,336,938 shares of the stock traded hands, compared to its average volume of 1,940,823. The company has a current ratio of 1.20, a quick ratio of 8.20 and a debt-to-equity ratio of 39.09. NexGen Energy has a one year low of C$7.04 and a one year high of C$12.14. The company has a market cap of C$5.88 billion, a P/E ratio of 63.24 and a beta of 1.76. The stock has a 50-day simple moving average of C$9.36 and a 200 day simple moving average of C$9.47.

About NexGen Energy

(

Get Free Report)

NexGen Energy Ltd., an exploration and development stage company, engages in the acquisition, exploration, and evaluation and development of uranium properties in Canada. It holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

Featured Stories

Before you consider NexGen Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexGen Energy wasn't on the list.

While NexGen Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.