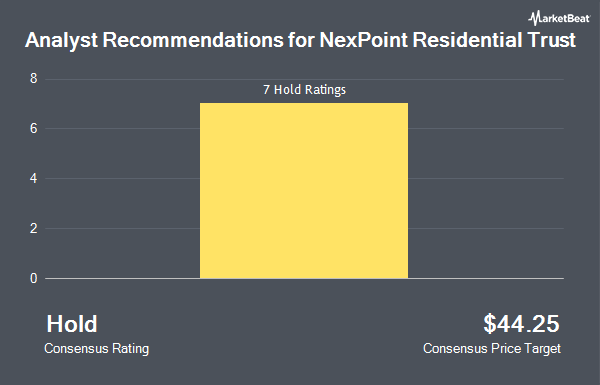

Shares of NexPoint Residential Trust, Inc. (NYSE:NXRT - Get Free Report) have been given an average recommendation of "Moderate Buy" by the six research firms that are presently covering the company, MarketBeat reports. Three analysts have rated the stock with a hold recommendation and three have assigned a buy recommendation to the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $46.83.

A number of research firms recently commented on NXRT. Truist Financial lifted their price objective on NexPoint Residential Trust from $37.00 to $46.00 and gave the stock a "hold" rating in a research note on Tuesday, August 27th. Deutsche Bank Aktiengesellschaft lifted their price objective on NexPoint Residential Trust from $38.00 to $44.00 and gave the stock a "hold" rating in a research note on Tuesday, September 10th. StockNews.com upgraded NexPoint Residential Trust from a "sell" rating to a "hold" rating in a report on Thursday, December 12th. Finally, Raymond James upgraded NexPoint Residential Trust from a "market perform" rating to an "outperform" rating and set a $50.00 target price for the company in a report on Monday, October 21st.

View Our Latest Research Report on NXRT

Institutional Investors Weigh In On NexPoint Residential Trust

Several hedge funds and other institutional investors have recently modified their holdings of NXRT. Franklin Resources Inc. grew its holdings in NexPoint Residential Trust by 164.0% during the third quarter. Franklin Resources Inc. now owns 34,865 shares of the financial services provider's stock worth $1,506,000 after buying an additional 21,660 shares in the last quarter. Tidal Investments LLC bought a new stake in NexPoint Residential Trust during the third quarter worth $1,166,000. Geode Capital Management LLC grew its holdings in NexPoint Residential Trust by 0.5% during the third quarter. Geode Capital Management LLC now owns 576,084 shares of the financial services provider's stock worth $25,358,000 after buying an additional 2,740 shares in the last quarter. Nomura Asset Management Co. Ltd. grew its holdings in NexPoint Residential Trust by 4.0% during the third quarter. Nomura Asset Management Co. Ltd. now owns 28,530 shares of the financial services provider's stock worth $1,256,000 after buying an additional 1,100 shares in the last quarter. Finally, Jane Street Group LLC grew its holdings in NexPoint Residential Trust by 160.3% during the third quarter. Jane Street Group LLC now owns 58,040 shares of the financial services provider's stock worth $2,554,000 after buying an additional 35,741 shares in the last quarter. Institutional investors own 76.61% of the company's stock.

NexPoint Residential Trust Trading Down 4.9 %

Shares of NXRT stock traded down $2.20 during mid-day trading on Wednesday, reaching $42.47. 137,283 shares of the stock traded hands, compared to its average volume of 136,945. The stock's fifty day simple moving average is $44.88 and its two-hundred day simple moving average is $43.19. NexPoint Residential Trust has a 1-year low of $28.20 and a 1-year high of $48.37. The company has a market cap of $1.08 billion, a price-to-earnings ratio of 24.27, a price-to-earnings-growth ratio of 2.69 and a beta of 1.40. The company has a quick ratio of 1.79, a current ratio of 1.79 and a debt-to-equity ratio of 3.25.

NexPoint Residential Trust (NYSE:NXRT - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The financial services provider reported ($0.35) EPS for the quarter, missing analysts' consensus estimates of $0.66 by ($1.01). The company had revenue of $64.10 million during the quarter, compared to analyst estimates of $64.69 million. NexPoint Residential Trust had a return on equity of 9.54% and a net margin of 17.54%. During the same period in the prior year, the firm earned $0.76 earnings per share. On average, research analysts anticipate that NexPoint Residential Trust will post 2.78 EPS for the current fiscal year.

NexPoint Residential Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be issued a dividend of $0.51 per share. This is an increase from NexPoint Residential Trust's previous quarterly dividend of $0.46. The ex-dividend date of this dividend is Friday, December 13th. This represents a $2.04 annualized dividend and a dividend yield of 4.80%. NexPoint Residential Trust's payout ratio is currently 105.71%.

About NexPoint Residential Trust

(

Get Free ReportNexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States.

Read More

Before you consider NexPoint Residential Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexPoint Residential Trust wasn't on the list.

While NexPoint Residential Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.