NexPoint Residential Trust (NYSE:NXRT - Get Free Report) was downgraded by research analysts at StockNews.com from a "hold" rating to a "sell" rating in a report issued on Friday.

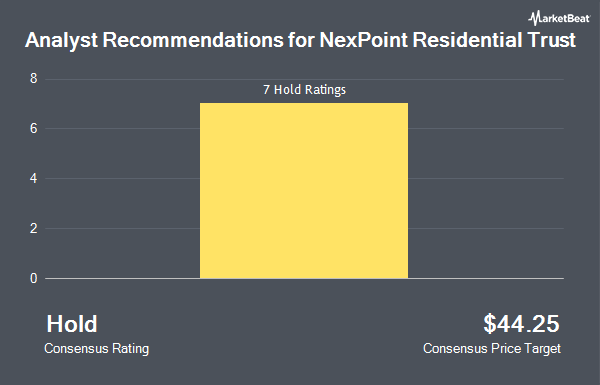

NXRT has been the topic of several other research reports. Deutsche Bank Aktiengesellschaft upped their price target on shares of NexPoint Residential Trust from $38.00 to $44.00 and gave the stock a "hold" rating in a report on Tuesday, September 10th. Truist Financial upped their price objective on shares of NexPoint Residential Trust from $37.00 to $46.00 and gave the stock a "hold" rating in a research report on Tuesday, August 27th. Finally, Raymond James raised shares of NexPoint Residential Trust from a "market perform" rating to an "outperform" rating and set a $50.00 price target for the company in a research note on Monday, October 21st. One analyst has rated the stock with a sell rating, three have given a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $46.83.

Read Our Latest Stock Analysis on NexPoint Residential Trust

NexPoint Residential Trust Stock Performance

NexPoint Residential Trust stock traded up $0.88 during mid-day trading on Friday, reaching $42.52. The company's stock had a trading volume of 874,741 shares, compared to its average volume of 139,843. NexPoint Residential Trust has a 12-month low of $28.20 and a 12-month high of $48.37. The firm's fifty day moving average price is $44.87 and its two-hundred day moving average price is $43.21. The company has a debt-to-equity ratio of 3.25, a quick ratio of 1.79 and a current ratio of 1.79. The company has a market capitalization of $1.08 billion, a P/E ratio of 24.30, a PEG ratio of 2.69 and a beta of 1.40.

NexPoint Residential Trust (NYSE:NXRT - Get Free Report) last issued its earnings results on Tuesday, October 29th. The financial services provider reported ($0.35) EPS for the quarter, missing the consensus estimate of $0.66 by ($1.01). NexPoint Residential Trust had a return on equity of 9.54% and a net margin of 17.54%. The company had revenue of $64.10 million during the quarter, compared to the consensus estimate of $64.69 million. During the same quarter in the prior year, the business earned $0.76 EPS. Sell-side analysts predict that NexPoint Residential Trust will post 2.78 EPS for the current fiscal year.

Institutional Investors Weigh In On NexPoint Residential Trust

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in NXRT. Mirae Asset Global Investments Co. Ltd. raised its stake in shares of NexPoint Residential Trust by 34.7% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 900 shares of the financial services provider's stock valued at $39,000 after acquiring an additional 232 shares during the last quarter. Van ECK Associates Corp grew its position in shares of NexPoint Residential Trust by 7.3% in the 2nd quarter. Van ECK Associates Corp now owns 3,473 shares of the financial services provider's stock worth $137,000 after buying an additional 236 shares during the last quarter. Quantinno Capital Management LP increased its stake in shares of NexPoint Residential Trust by 4.1% during the third quarter. Quantinno Capital Management LP now owns 6,059 shares of the financial services provider's stock valued at $267,000 after buying an additional 240 shares during the period. Creative Planning lifted its stake in NexPoint Residential Trust by 3.0% in the third quarter. Creative Planning now owns 11,785 shares of the financial services provider's stock worth $519,000 after acquiring an additional 341 shares during the period. Finally, Federated Hermes Inc. boosted its holdings in NexPoint Residential Trust by 4.1% in the second quarter. Federated Hermes Inc. now owns 9,094 shares of the financial services provider's stock valued at $359,000 after acquiring an additional 359 shares in the last quarter. 76.61% of the stock is currently owned by institutional investors.

NexPoint Residential Trust Company Profile

(

Get Free Report)

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NexPoint Residential Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexPoint Residential Trust wasn't on the list.

While NexPoint Residential Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.