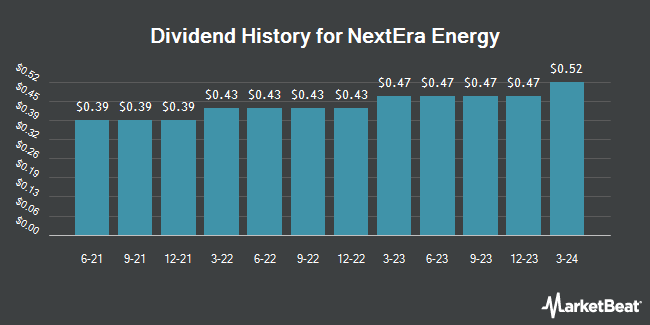

NextEra Energy, Inc. (NYSE:NEE - Get Free Report) declared a quarterly dividend on Friday, February 14th,RTT News reports. Investors of record on Friday, February 28th will be paid a dividend of 0.5665 per share by the utilities provider on Monday, March 17th. This represents a $2.27 annualized dividend and a yield of 3.31%. The ex-dividend date is Friday, February 28th. This is a positive change from NextEra Energy's previous quarterly dividend of $0.52.

NextEra Energy has increased its dividend by an average of 10.2% per year over the last three years and has increased its dividend every year for the last 30 years. NextEra Energy has a dividend payout ratio of 51.5% meaning its dividend is sufficiently covered by earnings. Analysts expect NextEra Energy to earn $3.96 per share next year, which means the company should continue to be able to cover its $2.06 annual dividend with an expected future payout ratio of 52.0%.

NextEra Energy Trading Up 0.5 %

NextEra Energy stock traded up $0.31 during trading hours on Tuesday, hitting $68.37. The company had a trading volume of 12,090,251 shares, compared to its average volume of 11,446,257. The firm has a market cap of $140.59 billion, a P/E ratio of 20.29, a P/E/G ratio of 2.42 and a beta of 0.58. The company has a debt-to-equity ratio of 1.20, a quick ratio of 0.38 and a current ratio of 0.47. NextEra Energy has a 1 year low of $53.95 and a 1 year high of $86.10. The company has a 50-day moving average price of $70.84 and a two-hundred day moving average price of $76.77.

NextEra Energy (NYSE:NEE - Get Free Report) last released its quarterly earnings data on Friday, January 24th. The utilities provider reported $0.53 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.53. NextEra Energy had a net margin of 28.06% and a return on equity of 11.85%. On average, sell-side analysts anticipate that NextEra Energy will post 3.68 earnings per share for the current year.

Analyst Upgrades and Downgrades

NEE has been the subject of several research reports. Royal Bank of Canada cut shares of NextEra Energy from a "moderate buy" rating to a "hold" rating in a research report on Tuesday, October 22nd. Evercore ISI lowered their price objective on shares of NextEra Energy from $84.00 to $79.00 and set an "in-line" rating for the company in a research report on Monday, January 27th. JPMorgan Chase & Co. lowered their price target on shares of NextEra Energy from $99.00 to $90.00 in a research report on Monday, January 27th. Barclays upped their price target on shares of NextEra Energy from $80.00 to $82.00 and gave the stock an "equal weight" rating in a research report on Friday, October 25th. Finally, BMO Capital Markets upped their price target on shares of NextEra Energy from $82.00 to $84.00 in a research report on Monday, January 27th. Eight analysts have rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat, NextEra Energy currently has an average rating of "Hold" and an average price target of $85.85.

Read Our Latest Research Report on NEE

NextEra Energy Company Profile

(

Get Free Report)

NextEra Energy, Inc, through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear,natural gas, and other clean energy. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

Further Reading

Before you consider NextEra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy wasn't on the list.

While NextEra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.