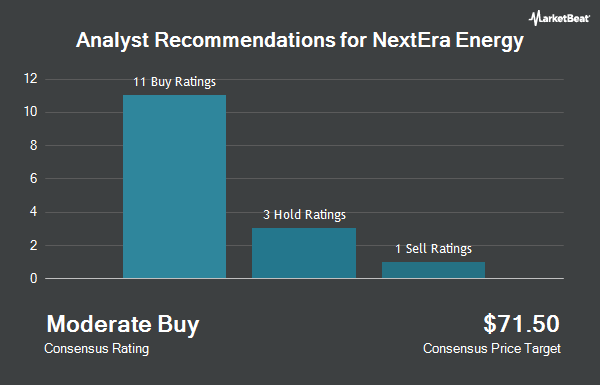

NextEra Energy, Inc. (NYSE:NEE - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the fourteen brokerages that are covering the stock, MarketBeat Ratings reports. Seven research analysts have rated the stock with a hold recommendation and seven have assigned a buy recommendation to the company. The average twelve-month price objective among brokers that have covered the stock in the last year is $87.15.

Several brokerages have issued reports on NEE. Barclays increased their target price on shares of NextEra Energy from $80.00 to $82.00 and gave the stock an "equal weight" rating in a report on Friday, October 25th. Bank of America lifted their price objective on shares of NextEra Energy from $77.00 to $81.00 and gave the company a "neutral" rating in a report on Thursday, August 29th. Wells Fargo & Company upped their target price on NextEra Energy from $95.00 to $102.00 and gave the stock an "overweight" rating in a report on Tuesday, September 3rd. Guggenheim lifted their price target on NextEra Energy from $90.00 to $92.00 and gave the company a "buy" rating in a report on Thursday, October 24th. Finally, Morgan Stanley decreased their price objective on NextEra Energy from $95.00 to $94.00 and set an "overweight" rating for the company in a research note on Friday, November 22nd.

View Our Latest Report on NEE

Insiders Place Their Bets

In other NextEra Energy news, EVP Nicole J. Daggs sold 4,007 shares of the firm's stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of $75.57, for a total transaction of $302,808.99. Following the completion of the transaction, the executive vice president now directly owns 15,792 shares of the company's stock, valued at approximately $1,193,401.44. This trade represents a 20.24 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. 0.18% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in NEE. Proffitt & Goodson Inc. lifted its holdings in NextEra Energy by 64.0% in the second quarter. Proffitt & Goodson Inc. now owns 369 shares of the utilities provider's stock valued at $26,000 after acquiring an additional 144 shares during the period. Semmax Financial Advisors Inc. boosted its holdings in NextEra Energy by 197.4% during the second quarter. Semmax Financial Advisors Inc. now owns 339 shares of the utilities provider's stock worth $26,000 after buying an additional 225 shares in the last quarter. Reston Wealth Management LLC acquired a new stake in NextEra Energy during the third quarter valued at $27,000. Valley Wealth Managers Inc. purchased a new position in NextEra Energy in the second quarter valued at $33,000. Finally, Quarry LP acquired a new position in shares of NextEra Energy in the third quarter worth about $33,000. Hedge funds and other institutional investors own 78.72% of the company's stock.

NextEra Energy Trading Up 0.5 %

NEE stock traded up $0.40 during mid-day trading on Friday, reaching $73.62. The company had a trading volume of 7,671,173 shares, compared to its average volume of 10,796,225. The company has a market capitalization of $151.39 billion, a PE ratio of 21.78, a price-to-earnings-growth ratio of 2.67 and a beta of 0.56. The firm has a 50 day moving average of $78.41 and a 200 day moving average of $77.74. NextEra Energy has a 12 month low of $53.95 and a 12 month high of $86.10. The company has a debt-to-equity ratio of 1.11, a current ratio of 0.41 and a quick ratio of 0.33.

NextEra Energy (NYSE:NEE - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The utilities provider reported $1.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.98 by $0.05. NextEra Energy had a return on equity of 11.94% and a net margin of 26.49%. The company had revenue of $7.57 billion for the quarter, compared to analysts' expectations of $8.11 billion. During the same quarter in the prior year, the firm earned $0.94 earnings per share. NextEra Energy's revenue was up 5.5% compared to the same quarter last year. On average, equities analysts predict that NextEra Energy will post 3.41 earnings per share for the current fiscal year.

NextEra Energy Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 22nd will be given a $0.515 dividend. This represents a $2.06 annualized dividend and a dividend yield of 2.80%. The ex-dividend date is Friday, November 22nd. NextEra Energy's payout ratio is 60.95%.

About NextEra Energy

(

Get Free ReportNextEra Energy, Inc, through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear,natural gas, and other clean energy. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

Recommended Stories

Before you consider NextEra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy wasn't on the list.

While NextEra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.