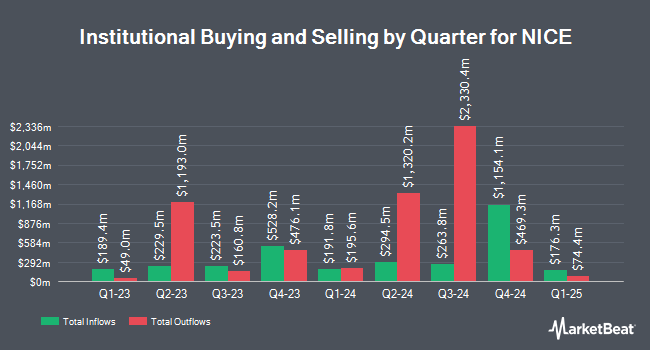

Migdal Insurance & Financial Holdings Ltd. boosted its stake in shares of NICE Ltd. (NASDAQ:NICE - Free Report) by 21.6% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,575,645 shares of the technology company's stock after purchasing an additional 279,375 shares during the period. NICE makes up approximately 4.4% of Migdal Insurance & Financial Holdings Ltd.'s portfolio, making the stock its 4th biggest holding. Migdal Insurance & Financial Holdings Ltd. owned approximately 2.51% of NICE worth $273,642,000 at the end of the most recent reporting period.

A number of other hedge funds also recently made changes to their positions in the stock. Creative Financial Designs Inc. ADV lifted its stake in shares of NICE by 208.3% in the 3rd quarter. Creative Financial Designs Inc. ADV now owns 148 shares of the technology company's stock valued at $26,000 after purchasing an additional 100 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its position in NICE by 135.4% during the second quarter. Allspring Global Investments Holdings LLC now owns 186 shares of the technology company's stock valued at $32,000 after buying an additional 107 shares in the last quarter. ORG Wealth Partners LLC purchased a new stake in NICE during the third quarter worth approximately $38,000. GAMMA Investing LLC increased its position in shares of NICE by 89.9% in the third quarter. GAMMA Investing LLC now owns 245 shares of the technology company's stock worth $43,000 after acquiring an additional 116 shares in the last quarter. Finally, Rothschild Investment LLC purchased a new position in shares of NICE in the 2nd quarter valued at $72,000. Institutional investors and hedge funds own 63.34% of the company's stock.

NICE Stock Performance

NICE stock traded up $4.68 during mid-day trading on Friday, reaching $189.99. The company's stock had a trading volume of 890,855 shares, compared to its average volume of 454,646. The company has a current ratio of 2.45, a quick ratio of 2.45 and a debt-to-equity ratio of 0.13. NICE Ltd. has a twelve month low of $151.52 and a twelve month high of $270.73. The business has a 50 day moving average price of $170.69 and a 200-day moving average price of $179.37. The firm has a market cap of $11.94 billion, a price-to-earnings ratio of 31.72, a PEG ratio of 1.42 and a beta of 1.04.

NICE (NASDAQ:NICE - Get Free Report) last posted its quarterly earnings results on Thursday, August 15th. The technology company reported $2.64 EPS for the quarter, beating the consensus estimate of $2.58 by $0.06. The business had revenue of $664.40 million during the quarter, compared to analyst estimates of $664.10 million. NICE had a net margin of 15.55% and a return on equity of 14.68%. The company's quarterly revenue was up 14.3% on a year-over-year basis. During the same period in the previous year, the business posted $1.63 EPS. Sell-side analysts predict that NICE Ltd. will post 8.5 EPS for the current fiscal year.

Analysts Set New Price Targets

NICE has been the subject of a number of research reports. JMP Securities reaffirmed a "market outperform" rating and set a $300.00 price target on shares of NICE in a research report on Friday, August 16th. Northland Securities decreased their target price on NICE from $305.00 to $275.00 and set an "outperform" rating for the company in a research report on Friday, August 16th. Wedbush reiterated an "outperform" rating and set a $250.00 target price on shares of NICE in a report on Friday, August 16th. Rosenblatt Securities reissued a "buy" rating and set a $225.00 price target on shares of NICE in a research report on Tuesday, August 13th. Finally, Barclays lowered their price objective on shares of NICE from $320.00 to $286.00 and set an "overweight" rating for the company in a research report on Thursday, July 25th. Sixteen analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus price target of $269.64.

Check Out Our Latest Stock Analysis on NICE

About NICE

(

Free Report)

NICE Ltd., together with its subsidiaries, provides cloud platforms for AI-driven digital business solutions worldwide. It offers CXone, a cloud native open platform; Enlighten, an AI engine for the customer engagement market; and smart self service enable organizations to address consumers' needs; and journey orchestration solutions that empower organizations to connect and route customers to deal with the customer's request, and connects them using real time AI-based routing.

Featured Articles

Before you consider NICE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NICE wasn't on the list.

While NICE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.