Franklin Resources Inc. reduced its stake in NICE Ltd. (NASDAQ:NICE - Free Report) by 19.4% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 557,902 shares of the technology company's stock after selling 134,545 shares during the quarter. Franklin Resources Inc. owned about 0.89% of NICE worth $96,679,000 as of its most recent filing with the Securities & Exchange Commission.

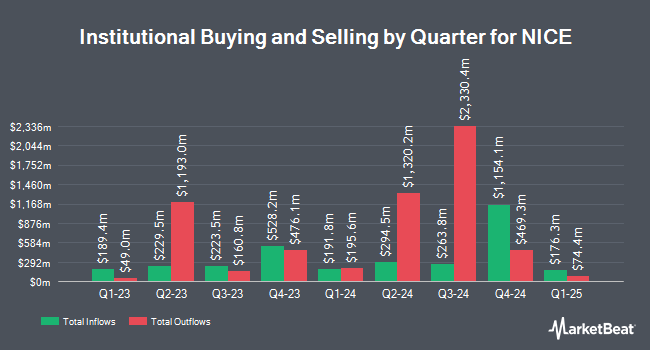

Several other hedge funds and other institutional investors also recently made changes to their positions in NICE. Creative Financial Designs Inc. ADV lifted its position in NICE by 208.3% in the 3rd quarter. Creative Financial Designs Inc. ADV now owns 148 shares of the technology company's stock valued at $26,000 after acquiring an additional 100 shares in the last quarter. Allspring Global Investments Holdings LLC raised its holdings in shares of NICE by 135.4% during the second quarter. Allspring Global Investments Holdings LLC now owns 186 shares of the technology company's stock valued at $32,000 after purchasing an additional 107 shares during the last quarter. ORG Wealth Partners LLC bought a new position in NICE during the third quarter valued at approximately $38,000. Wilmington Savings Fund Society FSB purchased a new stake in NICE in the third quarter worth approximately $41,000. Finally, GAMMA Investing LLC grew its position in NICE by 89.9% in the 3rd quarter. GAMMA Investing LLC now owns 245 shares of the technology company's stock worth $43,000 after purchasing an additional 116 shares during the period. Hedge funds and other institutional investors own 63.34% of the company's stock.

NICE Price Performance

Shares of NICE traded down $0.37 during mid-day trading on Monday, reaching $186.30. 382,332 shares of the company's stock traded hands, compared to its average volume of 515,585. NICE Ltd. has a 12 month low of $151.52 and a 12 month high of $270.73. The stock has a market cap of $11.71 billion, a P/E ratio of 28.84, a P/E/G ratio of 1.43 and a beta of 1.05. The stock's 50-day moving average is $179.72 and its two-hundred day moving average is $173.99.

Wall Street Analysts Forecast Growth

NICE has been the topic of a number of research reports. Northland Securities dropped their price target on NICE from $275.00 to $250.00 and set an "outperform" rating on the stock in a research note on Friday, November 15th. StockNews.com raised shares of NICE from a "buy" rating to a "strong-buy" rating in a research report on Wednesday, December 11th. Jefferies Financial Group lowered their price objective on shares of NICE from $230.00 to $215.00 and set a "buy" rating on the stock in a research note on Friday, November 15th. DA Davidson reduced their price target on NICE from $300.00 to $225.00 and set a "buy" rating for the company in a research report on Friday, November 15th. Finally, Citigroup boosted their price objective on NICE from $330.00 to $334.00 and gave the company a "buy" rating in a research note on Wednesday, November 13th. Two analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, NICE presently has an average rating of "Moderate Buy" and a consensus price target of $260.57.

Get Our Latest Stock Analysis on NICE

NICE Company Profile

(

Free Report)

NICE Ltd., together with its subsidiaries, provides cloud platforms for AI-driven digital business solutions worldwide. It offers CXone, a cloud native open platform; Enlighten, an AI engine for the customer engagement market; and smart self service enable organizations to address consumers' needs; and journey orchestration solutions that empower organizations to connect and route customers to deal with the customer's request, and connects them using real time AI-based routing.

Featured Articles

Before you consider NICE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NICE wasn't on the list.

While NICE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.