Nicholas Company Inc. raised its stake in Nomad Foods Limited (NYSE:NOMD - Free Report) by 7.9% during the fourth quarter, according to its most recent disclosure with the SEC. The fund owned 427,602 shares of the company's stock after buying an additional 31,437 shares during the quarter. Nicholas Company Inc. owned approximately 0.26% of Nomad Foods worth $7,175,000 as of its most recent SEC filing.

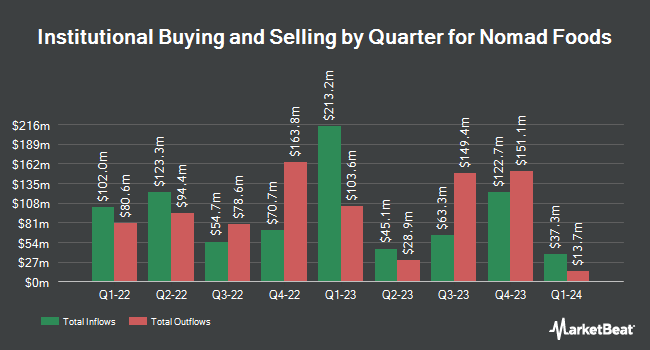

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. Atria Investments Inc grew its holdings in Nomad Foods by 34.0% in the 3rd quarter. Atria Investments Inc now owns 19,201 shares of the company's stock worth $366,000 after buying an additional 4,870 shares in the last quarter. Victory Capital Management Inc. boosted its position in Nomad Foods by 0.9% during the 3rd quarter. Victory Capital Management Inc. now owns 2,069,181 shares of the company's stock worth $39,439,000 after acquiring an additional 18,189 shares during the period. Natixis Advisors LLC grew its stake in shares of Nomad Foods by 20.8% in the third quarter. Natixis Advisors LLC now owns 71,647 shares of the company's stock worth $1,366,000 after purchasing an additional 12,343 shares in the last quarter. Seizert Capital Partners LLC increased its holdings in shares of Nomad Foods by 42.7% during the third quarter. Seizert Capital Partners LLC now owns 270,164 shares of the company's stock valued at $5,149,000 after purchasing an additional 80,807 shares during the period. Finally, Mutual of America Capital Management LLC raised its stake in shares of Nomad Foods by 9.0% during the third quarter. Mutual of America Capital Management LLC now owns 201,273 shares of the company's stock valued at $3,836,000 after purchasing an additional 16,549 shares in the last quarter. 75.26% of the stock is owned by institutional investors and hedge funds.

Nomad Foods Price Performance

Nomad Foods stock traded up $0.03 during midday trading on Thursday, hitting $19.60. The company's stock had a trading volume of 290,660 shares, compared to its average volume of 595,475. Nomad Foods Limited has a 12 month low of $15.43 and a 12 month high of $20.81. The company has a quick ratio of 0.72, a current ratio of 1.20 and a debt-to-equity ratio of 0.79. The company has a market capitalization of $3.01 billion, a PE ratio of 14.74 and a beta of 0.77. The stock's 50-day moving average price is $18.18 and its 200-day moving average price is $17.94.

Nomad Foods Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, February 26th. Stockholders of record on Monday, February 10th were given a dividend of $0.17 per share. The ex-dividend date of this dividend was Monday, February 10th. This is a positive change from Nomad Foods's previous quarterly dividend of $0.15. This represents a $0.68 dividend on an annualized basis and a dividend yield of 3.47%. Nomad Foods's payout ratio is 45.03%.

Wall Street Analyst Weigh In

A number of equities analysts recently issued reports on the stock. Barclays increased their target price on shares of Nomad Foods from $19.00 to $23.00 and gave the company an "overweight" rating in a research report on Monday, March 3rd. Mizuho raised their price objective on shares of Nomad Foods from $24.00 to $26.00 and gave the company an "outperform" rating in a research note on Tuesday, March 4th.

Get Our Latest Stock Analysis on Nomad Foods

About Nomad Foods

(

Free Report)

Nomad Foods Limited, together with its subsidiaries, manufactures, markets, and distributes a range of frozen food products in the United Kingdom and internationally. The company offers frozen fish products, including fish fingers, coated fish, and natural fish; ready-to-cook vegetable products, such as peas and spinach; and frozen poultry and meat products comprising nuggets, grills, and burgers.

Featured Stories

Before you consider Nomad Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomad Foods wasn't on the list.

While Nomad Foods currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.