Nicola Wealth Management LTD. lessened its holdings in Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU by 2.1% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 599,022 shares of the oil and gas producer's stock after selling 12,700 shares during the quarter. Suncor Energy makes up approximately 2.0% of Nicola Wealth Management LTD.'s holdings, making the stock its 14th biggest holding. Nicola Wealth Management LTD.'s holdings in Suncor Energy were worth $22,116,000 at the end of the most recent quarter.

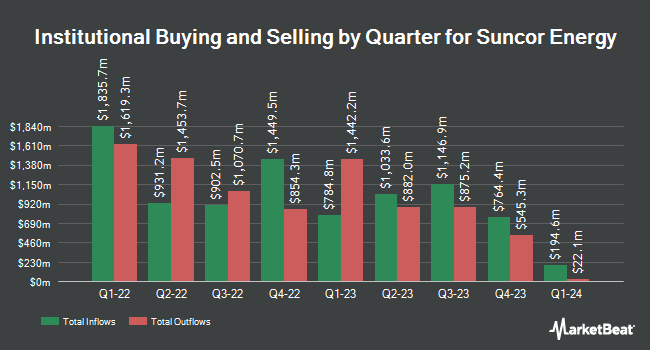

Other institutional investors also recently modified their holdings of the company. Eastern Bank acquired a new position in shares of Suncor Energy during the 3rd quarter worth about $25,000. Trust Co. of Vermont acquired a new stake in Suncor Energy in the second quarter worth $26,000. Summit Securities Group LLC acquired a new stake in Suncor Energy in the second quarter worth $27,000. Richardson Financial Services Inc. boosted its position in shares of Suncor Energy by 82.8% during the second quarter. Richardson Financial Services Inc. now owns 724 shares of the oil and gas producer's stock worth $28,000 after purchasing an additional 328 shares in the last quarter. Finally, Ridgewood Investments LLC acquired a new position in shares of Suncor Energy in the 2nd quarter valued at $29,000. Institutional investors and hedge funds own 67.37% of the company's stock.

Suncor Energy Price Performance

Suncor Energy stock traded up $0.84 during mid-day trading on Thursday, reaching $40.44. 8,426,287 shares of the company were exchanged, compared to its average volume of 4,270,598. The firm has a market cap of $51.02 billion, a PE ratio of 8.63, a PEG ratio of 2.70 and a beta of 1.12. The company has a debt-to-equity ratio of 0.26, a current ratio of 1.46 and a quick ratio of 0.93. The company has a fifty day simple moving average of $38.29 and a 200-day simple moving average of $38.74. Suncor Energy Inc. has a 12 month low of $29.45 and a 12 month high of $41.94.

Suncor Energy Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 24th. Investors of record on Tuesday, December 3rd will be paid a $0.4089 dividend. This represents a $1.64 dividend on an annualized basis and a yield of 4.05%. The ex-dividend date is Tuesday, December 3rd. This is an increase from Suncor Energy's previous quarterly dividend of $0.40. Suncor Energy's payout ratio is 35.29%.

Analyst Upgrades and Downgrades

SU has been the subject of a number of research analyst reports. BMO Capital Markets raised Suncor Energy from a "market perform" rating to an "outperform" rating in a research note on Wednesday, August 7th. Wolfe Research assumed coverage on Suncor Energy in a report on Thursday, July 18th. They set an "outperform" rating and a $68.00 price target for the company. Desjardins upgraded shares of Suncor Energy from a "hold" rating to a "buy" rating in a report on Thursday. TD Securities raised shares of Suncor Energy from a "hold" rating to a "buy" rating in a research report on Wednesday, August 7th. Finally, StockNews.com raised shares of Suncor Energy from a "hold" rating to a "buy" rating in a report on Thursday, November 7th. Two research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat, Suncor Energy presently has a consensus rating of "Moderate Buy" and a consensus price target of $56.40.

Check Out Our Latest Stock Analysis on Suncor Energy

Suncor Energy Profile

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Featured Stories

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.