Nikko Asset Management Americas Inc. increased its position in shares of Iridium Communications Inc. (NASDAQ:IRDM - Free Report) by 13.2% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 2,827,580 shares of the technology company's stock after acquiring an additional 329,915 shares during the quarter. Nikko Asset Management Americas Inc. owned about 2.48% of Iridium Communications worth $82,028,000 as of its most recent SEC filing.

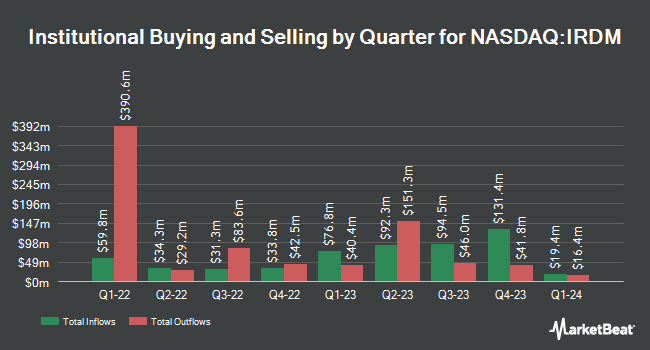

Other hedge funds and other institutional investors have also bought and sold shares of the company. Plato Investment Management Ltd bought a new position in Iridium Communications in the fourth quarter valued at approximately $32,000. SBI Securities Co. Ltd. bought a new position in Iridium Communications in the fourth quarter valued at approximately $37,000. Fifth Third Bancorp lifted its stake in Iridium Communications by 19.8% in the fourth quarter. Fifth Third Bancorp now owns 2,162 shares of the technology company's stock valued at $63,000 after buying an additional 357 shares in the last quarter. GAMMA Investing LLC lifted its stake in Iridium Communications by 44.8% in the fourth quarter. GAMMA Investing LLC now owns 3,473 shares of the technology company's stock valued at $101,000 after buying an additional 1,074 shares in the last quarter. Finally, KBC Group NV lifted its stake in Iridium Communications by 25.9% in the third quarter. KBC Group NV now owns 3,796 shares of the technology company's stock valued at $116,000 after buying an additional 781 shares in the last quarter. Institutional investors own 84.36% of the company's stock.

Insider Activity at Iridium Communications

In related news, Director Thomas Fitzpatrick sold 12,500 shares of the company's stock in a transaction dated Friday, January 10th. The stock was sold at an average price of $28.53, for a total transaction of $356,625.00. Following the sale, the director now owns 241,030 shares in the company, valued at $6,876,585.90. This represents a 4.93 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 2.00% of the stock is owned by corporate insiders.

Iridium Communications Price Performance

IRDM traded down $0.29 on Tuesday, reaching $27.36. The stock had a trading volume of 1,119,488 shares, compared to its average volume of 1,070,185. Iridium Communications Inc. has a fifty-two week low of $24.14 and a fifty-two week high of $35.85. The firm has a 50-day moving average of $29.48 and a 200-day moving average of $29.39. The company has a current ratio of 1.73, a quick ratio of 1.25 and a debt-to-equity ratio of 3.05. The company has a market capitalization of $2.98 billion, a price-to-earnings ratio of 28.80, a price-to-earnings-growth ratio of 1.28 and a beta of 0.70.

Iridium Communications (NASDAQ:IRDM - Get Free Report) last issued its quarterly earnings results on Thursday, February 13th. The technology company reported $0.31 earnings per share for the quarter, beating the consensus estimate of $0.15 by $0.16. The company had revenue of $212.99 million during the quarter, compared to analysts' expectations of $203.78 million. Iridium Communications had a return on equity of 15.66% and a net margin of 13.58%. As a group, sell-side analysts anticipate that Iridium Communications Inc. will post 0.89 EPS for the current year.

Iridium Communications Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, March 31st. Investors of record on Monday, March 17th will be given a dividend of $0.14 per share. The ex-dividend date of this dividend is Monday, March 17th. This represents a $0.56 annualized dividend and a dividend yield of 2.05%. Iridium Communications's payout ratio is 58.95%.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on IRDM. Barclays cut their price target on shares of Iridium Communications from $45.00 to $38.00 and set an "overweight" rating on the stock in a research note on Monday, March 10th. Cantor Fitzgerald started coverage on shares of Iridium Communications in a report on Friday, January 24th. They issued an "overweight" rating and a $40.00 price objective on the stock. Finally, StockNews.com downgraded shares of Iridium Communications from a "buy" rating to a "hold" rating in a report on Thursday, March 13th.

Check Out Our Latest Report on Iridium Communications

Iridium Communications Company Profile

(

Free Report)

Iridium Communications Inc provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide. The company offers postpaid mobile voice and data satellite communications; prepaid mobile voice satellite communications; push-to-talk; broadband data; and Internet of Things (IoT) services.

Featured Articles

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.