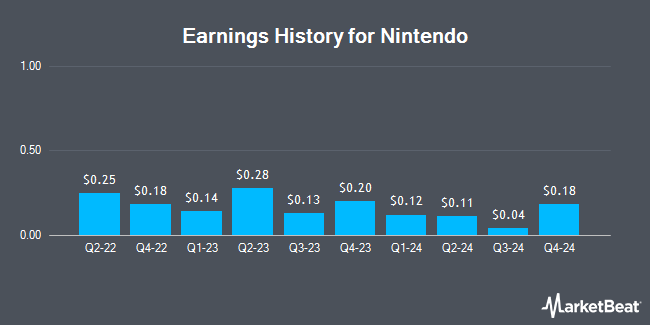

Nintendo (OTCMKTS:NTDOY - Get Free Report) is anticipated to release its earnings data on Tuesday, February 4th. Analysts expect Nintendo to post earnings of $0.19 per share and revenue of $2.32 billion for the quarter. Nintendo has set its FY 2025 guidance at 1.730-1.730 EPS.

Nintendo (OTCMKTS:NTDOY - Get Free Report) last announced its earnings results on Tuesday, November 5th. The company reported $0.04 earnings per share for the quarter, missing the consensus estimate of $0.10 by ($0.06). Nintendo had a net margin of 23.37% and a return on equity of 12.78%. The business had revenue of $1.86 billion for the quarter, compared to the consensus estimate of $2.25 billion. On average, analysts expect Nintendo to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Nintendo Price Performance

NTDOY stock traded up $0.45 on Friday, reaching $16.70. 3,664,444 shares of the company were exchanged, compared to its average volume of 1,811,758. The firm has a market capitalization of $86.75 billion, a PE ratio of 35.53 and a beta of 0.45. The stock's fifty day moving average price is $14.83 and its 200 day moving average price is $13.88. Nintendo has a 12 month low of $11.36 and a 12 month high of $16.90.

Analysts Set New Price Targets

Separately, TD Cowen initiated coverage on shares of Nintendo in a research report on Monday, October 7th. They set a "buy" rating on the stock.

View Our Latest Research Report on NTDOY

Nintendo Company Profile

(

Get Free Report)

Nintendo Co, Ltd., together with its subsidiaries, develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally. It also offers video game platforms, playing cards, Karuta, and other products; and handheld and home console hardware systems and related software.

See Also

Before you consider Nintendo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nintendo wasn't on the list.

While Nintendo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.