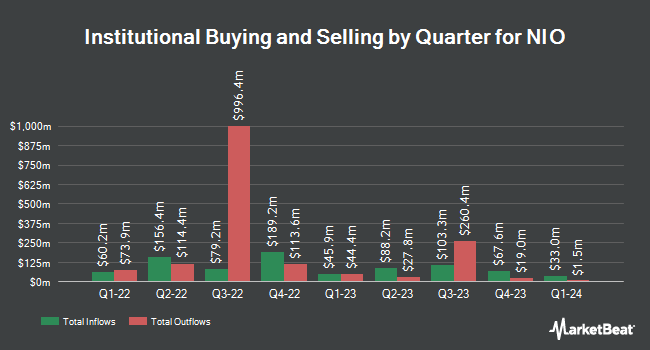

Swiss National Bank trimmed its position in Nio Inc - (NYSE:NIO - Free Report) by 67.4% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,005,483 shares of the company's stock after selling 2,075,048 shares during the quarter. Swiss National Bank owned approximately 0.06% of NIO worth $6,717,000 at the end of the most recent quarter.

Other institutional investors have also made changes to their positions in the company. Bayesian Capital Management LP acquired a new position in NIO during the first quarter valued at $185,000. B. Riley Wealth Advisors Inc. lifted its position in shares of NIO by 29.8% in the first quarter. B. Riley Wealth Advisors Inc. now owns 40,876 shares of the company's stock worth $184,000 after purchasing an additional 9,375 shares in the last quarter. California State Teachers Retirement System boosted its holdings in shares of NIO by 12.4% during the first quarter. California State Teachers Retirement System now owns 424,836 shares of the company's stock worth $1,912,000 after purchasing an additional 46,987 shares during the period. Tidal Investments LLC grew its position in NIO by 33.2% during the first quarter. Tidal Investments LLC now owns 254,730 shares of the company's stock valued at $1,146,000 after purchasing an additional 63,491 shares in the last quarter. Finally, Swedbank AB acquired a new position in NIO in the 1st quarter valued at approximately $5,343,000. 48.55% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts have issued reports on NIO shares. JPMorgan Chase & Co. raised shares of NIO from a "neutral" rating to an "overweight" rating and lifted their target price for the company from $5.30 to $8.00 in a research note on Friday, September 6th. Wolfe Research assumed coverage on NIO in a research note on Thursday, September 5th. They issued a "peer perform" rating on the stock. Bank of America raised their price target on NIO from $5.00 to $5.30 and gave the stock a "neutral" rating in a research note on Thursday, September 5th. Citigroup lowered their price target on NIO from $8.50 to $7.00 and set a "buy" rating for the company in a research note on Wednesday, September 4th. Finally, Daiwa America raised shares of NIO to a "strong-buy" rating in a research report on Monday, September 30th. Two equities research analysts have rated the stock with a sell rating, seven have issued a hold rating, two have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, NIO presently has a consensus rating of "Hold" and an average target price of $5.71.

Read Our Latest Report on NIO

NIO Stock Performance

Shares of NIO stock traded up $0.07 on Wednesday, reaching $4.38. The stock had a trading volume of 45,288,023 shares, compared to its average volume of 56,891,523. Nio Inc - has a fifty-two week low of $3.61 and a fifty-two week high of $9.57. The business's 50-day moving average price is $5.45 and its two-hundred day moving average price is $4.89. The company has a debt-to-equity ratio of 0.98, a quick ratio of 0.93 and a current ratio of 1.04. The stock has a market cap of $7.53 billion, a P/E ratio of -2.91 and a beta of 1.91.

NIO (NYSE:NIO - Get Free Report) last issued its quarterly earnings results on Thursday, September 5th. The company reported ($2.21) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($2.21). NIO had a negative return on equity of 113.83% and a negative net margin of 33.41%. The company had revenue of $17.45 billion for the quarter, compared to the consensus estimate of $17.49 billion. During the same period last year, the business posted ($0.51) earnings per share. The firm's revenue was up 98.9% compared to the same quarter last year. On average, sell-side analysts forecast that Nio Inc - will post -1.39 EPS for the current year.

NIO Company Profile

(

Free Report)

NIO Inc designs, manufactures, and sells electric vehicles in the People's Republic of China. The company is also involved in the manufacture of e-powertrain, battery packs, and components; and racing management, technology development, and sales and after-sales management activities. In addition, it offers power solutions for battery charging needs; and other value-added services.

Recommended Stories

Before you consider NIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIO wasn't on the list.

While NIO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.