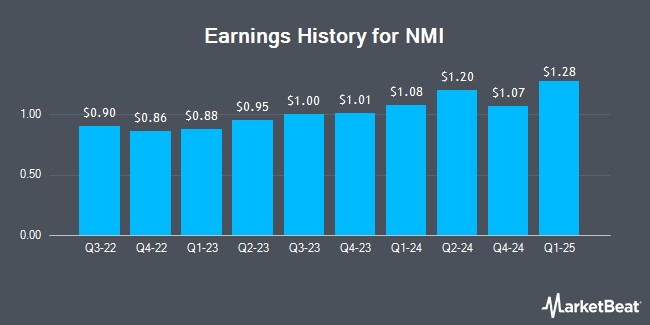

NMI (NASDAQ:NMIH - Get Free Report) announced its earnings results on Wednesday. The financial services provider reported $1.07 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.14 by ($0.07), Zacks reports. NMI had a return on equity of 17.64% and a net margin of 55.32%.

NMI Trading Down 1.3 %

NMIH stock traded down $0.47 during midday trading on Monday, hitting $36.48. 652,856 shares of the company's stock were exchanged, compared to its average volume of 450,468. NMI has a 1-year low of $28.73 and a 1-year high of $42.49. The business has a 50-day simple moving average of $37.57 and a two-hundred day simple moving average of $38.78. The stock has a market capitalization of $2.89 billion, a PE ratio of 8.23, a P/E/G ratio of 0.92 and a beta of 1.12. The company has a current ratio of 0.83, a quick ratio of 0.83 and a debt-to-equity ratio of 0.19.

Wall Street Analyst Weigh In

NMIH has been the topic of several research reports. Keefe, Bruyette & Woods decreased their price target on shares of NMI from $44.00 to $43.00 and set a "market perform" rating on the stock in a research note on Wednesday, January 8th. Royal Bank of Canada decreased their target price on shares of NMI from $48.00 to $47.00 and set an "outperform" rating on the stock in a research note on Thursday, November 7th. Barclays lowered NMI from an "overweight" rating to an "equal weight" rating and dropped their price target for the company from $48.00 to $41.00 in a research report on Monday, January 6th. Finally, JPMorgan Chase & Co. reduced their price objective on NMI from $46.00 to $41.00 and set an "overweight" rating on the stock in a research report on Monday, December 9th. Four equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $42.00.

Get Our Latest Stock Analysis on NMI

About NMI

(

Get Free Report)

NMI Holdings, Inc provides private mortgage guaranty insurance services in the United States. The company offers mortgage insurance services, such as primary and pool insurance; and outsourced loan review services to mortgage loan originators. It serves national and regional mortgage banks, money center banks, credit unions, community banks, builder-owned mortgage lenders, internet-sourced lenders, and other non-bank lenders.

See Also

Before you consider NMI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NMI wasn't on the list.

While NMI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.