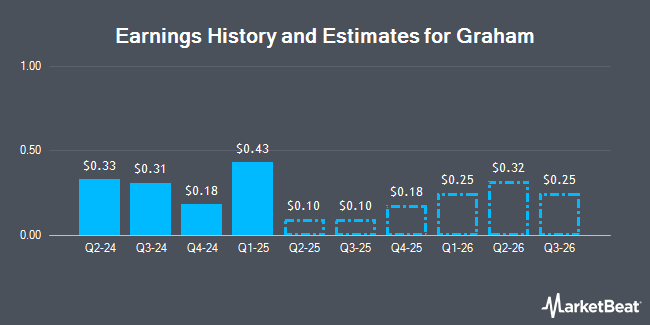

Graham Co. (NYSE:GHM - Free Report) - Investment analysts at Noble Financial cut their Q3 2025 earnings per share (EPS) estimates for shares of Graham in a research note issued on Monday, November 11th. Noble Financial analyst J. Gomes now anticipates that the industrial products company will post earnings of $0.13 per share for the quarter, down from their previous estimate of $0.21. The consensus estimate for Graham's current full-year earnings is $1.03 per share. Noble Financial also issued estimates for Graham's Q4 2025 earnings at $0.26 EPS.

Graham (NYSE:GHM - Get Free Report) last issued its quarterly earnings data on Friday, November 8th. The industrial products company reported $0.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.13. Graham had a return on equity of 7.91% and a net margin of 3.95%. The business had revenue of $53.56 million during the quarter, compared to analyst estimates of $50.50 million. During the same period in the previous year, the firm earned $0.04 EPS.

Separately, StockNews.com upgraded Graham from a "hold" rating to a "buy" rating in a research note on Thursday, September 5th.

View Our Latest Stock Report on Graham

Graham Stock Performance

NYSE GHM traded down $0.89 during trading on Thursday, hitting $40.70. The stock had a trading volume of 113,954 shares, compared to its average volume of 71,272. The company has a market capitalization of $443.22 million, a PE ratio of 58.58 and a beta of 0.56. The company's 50-day moving average price is $30.66 and its two-hundred day moving average price is $29.77. Graham has a 12 month low of $16.80 and a 12 month high of $42.65.

Institutional Investors Weigh In On Graham

A number of institutional investors and hedge funds have recently made changes to their positions in GHM. Itau Unibanco Holding S.A. bought a new stake in shares of Graham during the 2nd quarter worth approximately $31,000. nVerses Capital LLC bought a new stake in Graham in the 2nd quarter valued at $37,000. SG Americas Securities LLC bought a new stake in Graham in the 3rd quarter valued at $112,000. Lazard Asset Management LLC raised its stake in Graham by 8,163.5% in the 1st quarter. Lazard Asset Management LLC now owns 4,297 shares of the industrial products company's stock valued at $117,000 after acquiring an additional 4,245 shares during the period. Finally, BNP Paribas Financial Markets raised its stake in Graham by 36.9% in the 3rd quarter. BNP Paribas Financial Markets now owns 5,096 shares of the industrial products company's stock valued at $151,000 after acquiring an additional 1,374 shares during the period. Institutional investors own 69.46% of the company's stock.

About Graham

(

Get Free Report)

Graham Corporation, together with its subsidiaries, designs and manufactures fluid, power, heat transfer, and vacuum equipment for chemical and petrochemical processing, defense, space, petroleum refining, cryogenic, energy, and other industries. It offers power plant systems, including ejectors and surface condensers; torpedo ejection, propulsion, and power systems, such as turbines, alternators, regulators, pumps, and blowers; and thermal management systems comprising pumps, blowers, and drive electronics for defense sector.

Featured Articles

Before you consider Graham, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graham wasn't on the list.

While Graham currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.