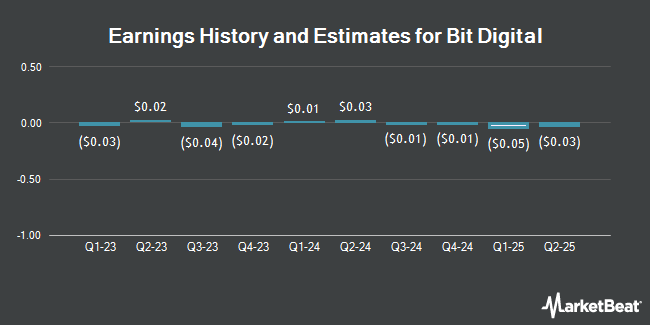

Bit Digital, Inc. (NASDAQ:BTBT - Free Report) - Investment analysts at Noble Financial decreased their FY2024 earnings per share estimates for shares of Bit Digital in a research note issued to investors on Tuesday, November 19th. Noble Financial analyst J. Gomes now anticipates that the company will post earnings of ($0.23) per share for the year, down from their previous estimate of ($0.02). The consensus estimate for Bit Digital's current full-year earnings is ($0.06) per share. Noble Financial also issued estimates for Bit Digital's Q4 2024 earnings at ($0.03) EPS and FY2025 earnings at $0.19 EPS.

Bit Digital (NASDAQ:BTBT - Get Free Report) last issued its earnings results on Monday, August 19th. The company reported ($0.01) EPS for the quarter, beating analysts' consensus estimates of ($0.03) by $0.02. The business had revenue of $28.95 million during the quarter, compared to analysts' expectations of $26.63 million. Bit Digital had a negative net margin of 2.75% and a negative return on equity of 5.69%.

Other equities research analysts have also issued reports about the company. B. Riley initiated coverage on Bit Digital in a research report on Thursday, October 24th. They issued a "buy" rating and a $6.00 price target for the company. HC Wainwright restated a "buy" rating and set a $7.00 price objective on shares of Bit Digital in a research report on Tuesday.

Read Our Latest Report on Bit Digital

Bit Digital Price Performance

NASDAQ BTBT traded up $0.05 during trading hours on Thursday, hitting $4.10. 19,886,236 shares of the company's stock traded hands, compared to its average volume of 10,089,747. The company has a market capitalization of $332.41 million, a PE ratio of 70.17 and a beta of 4.79. Bit Digital has a 52-week low of $1.76 and a 52-week high of $5.74. The firm's 50-day moving average is $3.70 and its 200-day moving average is $3.27.

Institutional Investors Weigh In On Bit Digital

A number of institutional investors have recently modified their holdings of the company. State Street Corp grew its position in Bit Digital by 1.7% in the 3rd quarter. State Street Corp now owns 5,597,517 shares of the company's stock valued at $19,647,000 after acquiring an additional 94,762 shares in the last quarter. Van ECK Associates Corp lifted its holdings in Bit Digital by 25.2% during the 3rd quarter. Van ECK Associates Corp now owns 4,459,689 shares of the company's stock worth $17,259,000 after buying an additional 898,329 shares in the last quarter. Millennium Management LLC boosted its position in Bit Digital by 66.6% in the 2nd quarter. Millennium Management LLC now owns 2,586,392 shares of the company's stock valued at $8,225,000 after buying an additional 1,033,767 shares during the period. Geode Capital Management LLC grew its stake in shares of Bit Digital by 1.8% in the third quarter. Geode Capital Management LLC now owns 2,425,057 shares of the company's stock worth $8,512,000 after acquiring an additional 42,375 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its stake in shares of Bit Digital by 192.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 806,631 shares of the company's stock valued at $2,831,000 after acquiring an additional 530,411 shares in the last quarter. 47.70% of the stock is owned by institutional investors and hedge funds.

About Bit Digital

(

Get Free Report)

Bit Digital, Inc, together with its subsidiaries, engages in the bitcoin mining business. It is also involved in the treasury management activities; and digital asset staking and digital asset mining businesses, as well as ethereum staking activities. In addition, it provides specialized cloud-infrastructure services for artificial intelligence applications.

Further Reading

Before you consider Bit Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bit Digital wasn't on the list.

While Bit Digital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.