JPMorgan Chase & Co. upgraded shares of Nokia Oyj (NYSE:NOK - Free Report) from a neutral rating to an overweight rating in a research note released on Monday, Marketbeat reports. The brokerage currently has $6.35 price target on the technology company's stock, up from their prior price target of $4.35.

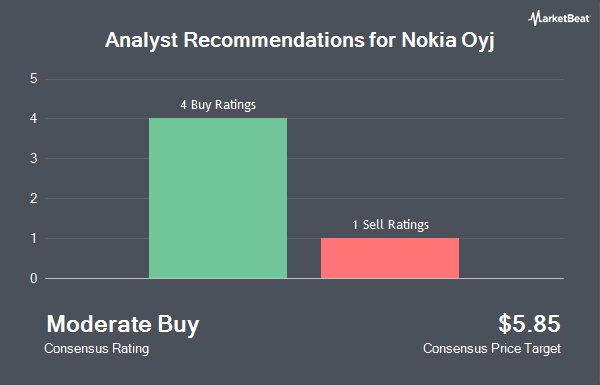

Several other brokerages also recently commented on NOK. Danske upgraded shares of Nokia Oyj from a "hold" rating to a "buy" rating in a report on Friday, October 18th. StockNews.com lowered shares of Nokia Oyj from a "strong-buy" rating to a "buy" rating in a report on Saturday, October 26th. Craig Hallum raised shares of Nokia Oyj from a "hold" rating to a "strong-buy" rating in a research note on Thursday, October 17th. Finally, Northland Securities reissued an "outperform" rating and issued a $6.50 price target on shares of Nokia Oyj in a research note on Friday, October 18th. Two research analysts have rated the stock with a sell rating, two have given a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $5.06.

Check Out Our Latest Stock Analysis on NOK

Nokia Oyj Trading Up 3.5 %

Shares of NOK stock traded up $0.15 on Monday, hitting $4.39. The stock had a trading volume of 19,742,947 shares, compared to its average volume of 16,011,406. The company has a current ratio of 1.72, a quick ratio of 1.46 and a debt-to-equity ratio of 0.14. Nokia Oyj has a twelve month low of $3.11 and a twelve month high of $4.95. The company has a fifty day moving average price of $4.45 and a two-hundred day moving average price of $4.14. The firm has a market cap of $23.94 billion, a P/E ratio of 55.00, a PEG ratio of 5.49 and a beta of 1.08.

Nokia Oyj (NYSE:NOK - Get Free Report) last posted its earnings results on Thursday, October 17th. The technology company reported $0.07 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.07. The firm had revenue of $4.75 billion during the quarter, compared to analysts' expectations of $5.10 billion. Nokia Oyj had a return on equity of 8.32% and a net margin of 2.18%. As a group, analysts forecast that Nokia Oyj will post 0.34 earnings per share for the current fiscal year.

Institutional Trading of Nokia Oyj

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Truist Financial Corp increased its holdings in Nokia Oyj by 15.7% during the second quarter. Truist Financial Corp now owns 19,990 shares of the technology company's stock worth $76,000 after buying an additional 2,710 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in shares of Nokia Oyj by 3.2% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 89,592 shares of the technology company's stock worth $392,000 after acquiring an additional 2,776 shares during the period. Caprock Group LLC increased its holdings in shares of Nokia Oyj by 5.5% in the third quarter. Caprock Group LLC now owns 57,766 shares of the technology company's stock valued at $252,000 after purchasing an additional 3,023 shares during the last quarter. V Square Quantitative Management LLC grew its stake in Nokia Oyj by 3.9% in the 2nd quarter. V Square Quantitative Management LLC now owns 83,509 shares of the technology company's stock valued at $328,000 after buying an additional 3,097 shares during the last quarter. Finally, Bleakley Financial Group LLC grew its position in shares of Nokia Oyj by 30.8% in the third quarter. Bleakley Financial Group LLC now owns 13,580 shares of the technology company's stock valued at $59,000 after purchasing an additional 3,199 shares during the last quarter. Institutional investors own 5.28% of the company's stock.

Nokia Oyj Company Profile

(

Get Free Report)

Nokia Oyj provides mobile, fixed, and cloud network solutions worldwide. The company operates through four segments: Network Infrastructure, Mobile Networks, Cloud and Network Services, and Nokia Technologies. The company provides fixed networking solutions, such as fiber and copper-based access infrastructure, in-home Wi-Fi solutions, and cloud and virtualization services; IP networking solutions, including IP access, aggregation, and edge and core routing for residential, mobile, enterprise and cloud applications; optical networks solutions that provides optical transport networks for metro, regional, and long-haul applications, and subsea applications; and submarine networks for undersea cable transmission.

Read More

Before you consider Nokia Oyj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nokia Oyj wasn't on the list.

While Nokia Oyj currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.