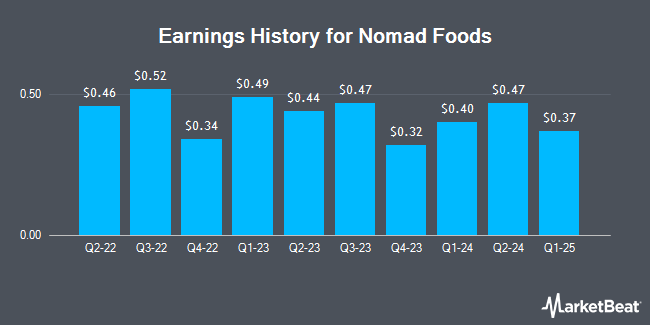

Nomad Foods (NYSE:NOMD - Get Free Report) will likely be posting its quarterly earnings results before the market opens on Monday, March 3rd. Analysts expect Nomad Foods to post earnings of $0.40 per share and revenue of $789.63 million for the quarter. Individual interested in listening to the company's earnings conference call can do so using this link.

Nomad Foods Stock Performance

NYSE NOMD traded up $0.30 during trading hours on Friday, hitting $18.91. The company had a trading volume of 665,181 shares, compared to its average volume of 603,046. The company has a debt-to-equity ratio of 0.79, a quick ratio of 0.72 and a current ratio of 1.20. Nomad Foods has a 1-year low of $15.43 and a 1-year high of $20.05. The company has a market cap of $3.08 billion, a PE ratio of 14.22 and a beta of 0.79. The business has a 50 day moving average of $17.31 and a 200-day moving average of $17.80.

Nomad Foods Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, February 26th. Shareholders of record on Monday, February 10th were paid a $0.17 dividend. This represents a $0.68 annualized dividend and a yield of 3.60%. The ex-dividend date was Monday, February 10th. This is an increase from Nomad Foods's previous quarterly dividend of $0.15. Nomad Foods's dividend payout ratio is currently 51.13%.

Analyst Upgrades and Downgrades

NOMD has been the subject of several research analyst reports. StockNews.com upgraded shares of Nomad Foods from a "hold" rating to a "buy" rating in a research note on Monday, November 18th. Deutsche Bank Aktiengesellschaft decreased their price objective on shares of Nomad Foods from $25.00 to $23.00 and set a "buy" rating for the company in a research note on Monday, November 4th. Barclays decreased their price objective on shares of Nomad Foods from $21.00 to $19.00 and set an "overweight" rating for the company in a research note on Friday, January 17th. Finally, Mizuho decreased their price objective on shares of Nomad Foods from $28.00 to $24.00 and set an "outperform" rating for the company in a research note on Wednesday, December 18th.

View Our Latest Report on NOMD

About Nomad Foods

(

Get Free Report)

Nomad Foods Limited, together with its subsidiaries, manufactures, markets, and distributes a range of frozen food products in the United Kingdom and internationally. The company offers frozen fish products, including fish fingers, coated fish, and natural fish; ready-to-cook vegetable products, such as peas and spinach; and frozen poultry and meat products comprising nuggets, grills, and burgers.

See Also

Before you consider Nomad Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomad Foods wasn't on the list.

While Nomad Foods currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.