Nomura Asset Management Co. Ltd. boosted its stake in Teradyne, Inc. (NASDAQ:TER - Free Report) by 17.6% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 77,092 shares of the company's stock after purchasing an additional 11,541 shares during the quarter. Nomura Asset Management Co. Ltd.'s holdings in Teradyne were worth $10,325,000 as of its most recent filing with the SEC.

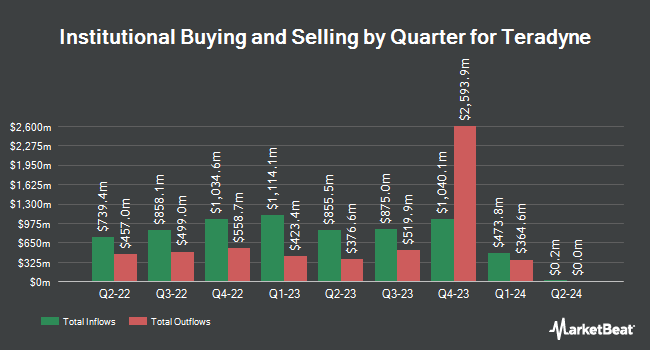

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Whittier Trust Co. raised its holdings in shares of Teradyne by 10.2% in the 3rd quarter. Whittier Trust Co. now owns 950 shares of the company's stock worth $127,000 after purchasing an additional 88 shares during the period. Wealth Alliance increased its position in Teradyne by 3.3% during the 2nd quarter. Wealth Alliance now owns 3,044 shares of the company's stock worth $451,000 after purchasing an additional 98 shares in the last quarter. Whittier Trust Co. of Nevada Inc. raised its holdings in Teradyne by 10.2% in the third quarter. Whittier Trust Co. of Nevada Inc. now owns 1,115 shares of the company's stock valued at $149,000 after buying an additional 103 shares during the period. Thrivent Financial for Lutherans lifted its position in Teradyne by 1.7% during the third quarter. Thrivent Financial for Lutherans now owns 6,403 shares of the company's stock valued at $858,000 after buying an additional 104 shares in the last quarter. Finally, VELA Investment Management LLC grew its stake in Teradyne by 0.9% during the third quarter. VELA Investment Management LLC now owns 12,782 shares of the company's stock worth $1,712,000 after buying an additional 113 shares during the period. Institutional investors and hedge funds own 99.77% of the company's stock.

Teradyne Stock Performance

Shares of TER stock traded up $0.75 during trading hours on Thursday, hitting $120.95. 2,254,345 shares of the company were exchanged, compared to its average volume of 2,061,877. The stock has a market capitalization of $19.70 billion, a price-to-earnings ratio of 38.16, a P/E/G ratio of 2.56 and a beta of 1.51. Teradyne, Inc. has a one year low of $92.29 and a one year high of $163.21. The business's 50-day simple moving average is $115.49 and its two-hundred day simple moving average is $129.95.

Teradyne (NASDAQ:TER - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The company reported $0.90 EPS for the quarter, topping the consensus estimate of $0.78 by $0.12. Teradyne had a return on equity of 18.56% and a net margin of 18.75%. The company had revenue of $737.30 million during the quarter, compared to analyst estimates of $716.40 million. During the same quarter last year, the firm earned $0.80 EPS. The business's revenue was up 4.8% on a year-over-year basis. As a group, analysts anticipate that Teradyne, Inc. will post 3.17 EPS for the current fiscal year.

Teradyne Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Monday, November 25th will be issued a dividend of $0.12 per share. The ex-dividend date is Monday, November 25th. This represents a $0.48 dividend on an annualized basis and a dividend yield of 0.40%. Teradyne's dividend payout ratio (DPR) is 15.24%.

Teradyne announced that its Board of Directors has authorized a stock buyback plan on Monday, November 11th that permits the company to repurchase $100.00 million in outstanding shares. This repurchase authorization permits the company to purchase up to 0.6% of its stock through open market purchases. Stock repurchase plans are often an indication that the company's leadership believes its stock is undervalued.

Analyst Upgrades and Downgrades

TER has been the topic of several recent research reports. Craig Hallum reduced their target price on shares of Teradyne from $124.00 to $111.00 and set a "hold" rating on the stock in a report on Friday, October 25th. Northland Securities reduced their price objective on Teradyne from $126.00 to $117.00 and set a "market perform" rating on the stock in a research note on Friday, October 25th. StockNews.com upgraded Teradyne from a "sell" rating to a "hold" rating in a report on Sunday, October 27th. Robert W. Baird lowered their price objective on shares of Teradyne from $140.00 to $133.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Finally, Cantor Fitzgerald upgraded shares of Teradyne from a "neutral" rating to an "overweight" rating and set a $160.00 price objective on the stock in a research note on Friday, August 16th. One analyst has rated the stock with a sell rating, six have issued a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average target price of $142.62.

View Our Latest Stock Report on TER

Insider Activity

In other Teradyne news, insider Richard John Burns sold 789 shares of the stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $132.80, for a total value of $104,779.20. Following the sale, the insider now directly owns 21,864 shares of the company's stock, valued at $2,903,539.20. This trade represents a 3.48 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Gregory Stephen Smith sold 3,080 shares of the firm's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total value of $409,024.00. Following the completion of the sale, the chief executive officer now owns 80,736 shares in the company, valued at $10,721,740.80. The trade was a 3.67 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 4,494 shares of company stock valued at $596,803. Company insiders own 0.36% of the company's stock.

Teradyne Company Profile

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Read More

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report