Nomura Asset Management Co. Ltd. raised its position in shares of Rollins, Inc. (NYSE:ROL - Free Report) by 65.8% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 131,362 shares of the business services provider's stock after purchasing an additional 52,112 shares during the period. Nomura Asset Management Co. Ltd.'s holdings in Rollins were worth $6,644,000 at the end of the most recent reporting period.

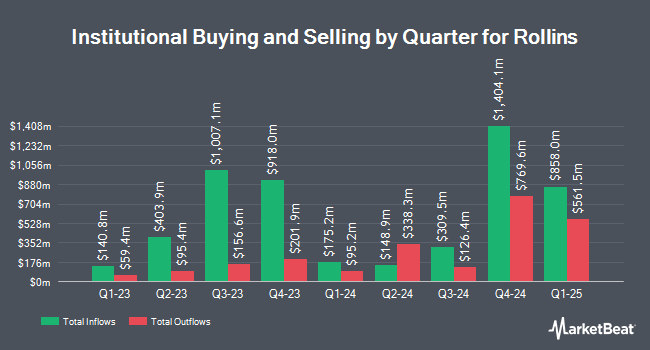

Other hedge funds have also recently added to or reduced their stakes in the company. Kayne Anderson Rudnick Investment Management LLC lifted its position in Rollins by 1.5% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 10,023,281 shares of the business services provider's stock worth $489,036,000 after buying an additional 148,316 shares during the last quarter. Montrusco Bolton Investments Inc. boosted its position in Rollins by 14.0% during the 3rd quarter. Montrusco Bolton Investments Inc. now owns 9,397,497 shares of the business services provider's stock valued at $465,503,000 after buying an additional 1,154,722 shares during the period. Renaissance Technologies LLC grew its holdings in Rollins by 4.9% in the 2nd quarter. Renaissance Technologies LLC now owns 2,825,569 shares of the business services provider's stock worth $137,860,000 after acquiring an additional 133,100 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Rollins by 1.5% during the third quarter. Charles Schwab Investment Management Inc. now owns 2,167,949 shares of the business services provider's stock worth $109,655,000 after purchasing an additional 31,458 shares during the period. Finally, Dimensional Fund Advisors LP grew its stake in shares of Rollins by 8.7% in the second quarter. Dimensional Fund Advisors LP now owns 2,156,892 shares of the business services provider's stock worth $105,247,000 after purchasing an additional 172,009 shares during the last quarter. Institutional investors own 51.79% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have weighed in on ROL. Morgan Stanley increased their price objective on Rollins from $46.00 to $48.00 and gave the stock an "equal weight" rating in a report on Thursday. Barclays initiated coverage on shares of Rollins in a report on Monday, November 4th. They issued an "equal weight" rating and a $50.00 price objective for the company. Wells Fargo & Company lifted their target price on shares of Rollins from $54.00 to $56.00 and gave the company an "overweight" rating in a research note on Tuesday, October 15th. Finally, StockNews.com lowered shares of Rollins from a "buy" rating to a "hold" rating in a report on Thursday, October 24th. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $50.67.

View Our Latest Stock Analysis on Rollins

Insider Transactions at Rollins

In related news, major shareholder Timothy Curtis Rollins sold 14,750 shares of the business's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $49.88, for a total transaction of $735,730.00. Following the completion of the transaction, the insider now directly owns 124,214 shares in the company, valued at approximately $6,195,794.32. The trade was a 10.61 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Elizabeth B. Chandler sold 4,685 shares of Rollins stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $50.49, for a total transaction of $236,545.65. Following the transaction, the insider now owns 84,653 shares in the company, valued at approximately $4,274,129.97. This trade represents a 5.24 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 4.69% of the company's stock.

Rollins Price Performance

NYSE:ROL remained flat at $48.77 during mid-day trading on Friday. 1,233,525 shares of the company traded hands, compared to its average volume of 1,692,546. Rollins, Inc. has a 1-year low of $40.41 and a 1-year high of $52.16. The company has a 50 day moving average price of $49.38 and a two-hundred day moving average price of $49.15. The stock has a market cap of $23.62 billion, a P/E ratio of 50.80 and a beta of 0.72. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.72 and a current ratio of 0.78.

Rollins (NYSE:ROL - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The business services provider reported $0.29 EPS for the quarter, missing the consensus estimate of $0.30 by ($0.01). Rollins had a net margin of 14.18% and a return on equity of 38.67%. The firm had revenue of $916.27 million for the quarter, compared to analysts' expectations of $911.15 million. During the same period last year, the company posted $0.28 earnings per share. The business's revenue for the quarter was up 9.0% compared to the same quarter last year. On average, equities analysts forecast that Rollins, Inc. will post 0.99 EPS for the current fiscal year.

Rollins Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, December 10th. Stockholders of record on Tuesday, November 12th were issued a dividend of $0.165 per share. This represents a $0.66 annualized dividend and a dividend yield of 1.35%. This is a boost from Rollins's previous quarterly dividend of $0.15. The ex-dividend date of this dividend was Tuesday, November 12th. Rollins's dividend payout ratio is presently 68.75%.

Rollins Company Profile

(

Free Report)

Rollins, Inc, through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally. The company offers pest control services to residential properties protecting from common pests, including rodents, insects, and wildlife.

See Also

Before you consider Rollins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rollins wasn't on the list.

While Rollins currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.