Nomura Asset Management Co. Ltd. grew its holdings in shares of Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 138.2% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 161,835 shares of the company's stock after acquiring an additional 93,899 shares during the quarter. Nomura Asset Management Co. Ltd. owned 0.06% of Royal Caribbean Cruises worth $28,703,000 at the end of the most recent quarter.

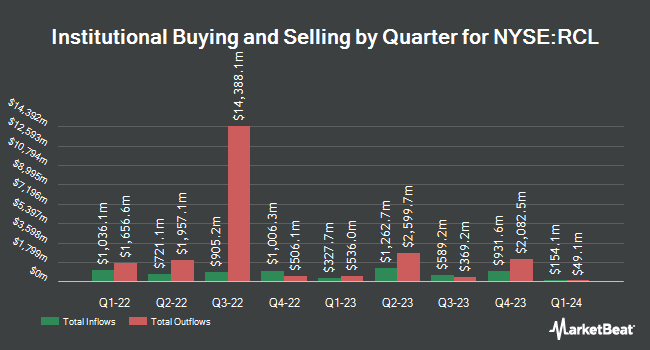

Other hedge funds have also recently made changes to their positions in the company. Plato Investment Management Ltd purchased a new position in Royal Caribbean Cruises in the 3rd quarter worth approximately $26,000. Safe Harbor Fiduciary LLC bought a new stake in Royal Caribbean Cruises in the 3rd quarter worth $27,000. DiNuzzo Private Wealth Inc. raised its stake in shares of Royal Caribbean Cruises by 257.4% during the third quarter. DiNuzzo Private Wealth Inc. now owns 168 shares of the company's stock valued at $30,000 after acquiring an additional 121 shares during the last quarter. Unique Wealth Strategies LLC purchased a new stake in shares of Royal Caribbean Cruises during the second quarter worth about $27,000. Finally, AlphaMark Advisors LLC grew its stake in shares of Royal Caribbean Cruises by 233.3% in the second quarter. AlphaMark Advisors LLC now owns 200 shares of the company's stock worth $32,000 after purchasing an additional 140 shares during the last quarter. 87.53% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

RCL has been the topic of a number of recent analyst reports. Bank of America lifted their price objective on Royal Caribbean Cruises from $210.00 to $240.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 13th. Truist Financial lifted their price target on shares of Royal Caribbean Cruises from $204.00 to $272.00 and gave the company a "buy" rating in a report on Monday, December 2nd. Stifel Nicolaus upped their price objective on shares of Royal Caribbean Cruises from $250.00 to $310.00 and gave the stock a "buy" rating in a report on Friday, December 6th. Sanford C. Bernstein started coverage on shares of Royal Caribbean Cruises in a research report on Tuesday, November 26th. They issued an "outperform" rating and a $290.00 target price for the company. Finally, Citigroup boosted their price target on shares of Royal Caribbean Cruises from $257.00 to $283.00 and gave the company a "buy" rating in a research report on Wednesday. Three research analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company's stock. According to MarketBeat, Royal Caribbean Cruises presently has an average rating of "Moderate Buy" and a consensus target price of $237.13.

Check Out Our Latest Stock Analysis on Royal Caribbean Cruises

Royal Caribbean Cruises Stock Down 0.1 %

RCL stock traded down $0.14 during trading on Wednesday, hitting $245.52. 1,976,118 shares of the stock traded hands, compared to its average volume of 2,330,434. The stock has a market cap of $66.01 billion, a price-to-earnings ratio of 25.32, a price-to-earnings-growth ratio of 0.68 and a beta of 2.59. The company has a debt-to-equity ratio of 2.63, a current ratio of 0.19 and a quick ratio of 0.16. Royal Caribbean Cruises Ltd. has a 1 year low of $113.10 and a 1 year high of $258.70. The firm's 50 day moving average is $218.22 and its two-hundred day moving average is $180.34.

Royal Caribbean Cruises (NYSE:RCL - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The company reported $5.20 EPS for the quarter, beating analysts' consensus estimates of $5.05 by $0.15. Royal Caribbean Cruises had a net margin of 16.21% and a return on equity of 52.92%. The firm had revenue of $4.89 billion for the quarter, compared to analysts' expectations of $4.89 billion. During the same quarter in the prior year, the company posted $3.85 earnings per share. The business's revenue for the quarter was up 17.5% on a year-over-year basis. On average, sell-side analysts anticipate that Royal Caribbean Cruises Ltd. will post 11.65 EPS for the current year.

Royal Caribbean Cruises Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, January 13th. Stockholders of record on Friday, December 27th will be issued a dividend of $0.55 per share. This represents a $2.20 dividend on an annualized basis and a dividend yield of 0.90%. Royal Caribbean Cruises's payout ratio is currently 16.44%.

Insider Activity at Royal Caribbean Cruises

In other Royal Caribbean Cruises news, CAO Henry L. Pujol sold 6,723 shares of the stock in a transaction on Wednesday, October 30th. The stock was sold at an average price of $208.51, for a total value of $1,401,812.73. Following the completion of the sale, the chief accounting officer now owns 9,964 shares in the company, valued at approximately $2,077,593.64. This represents a 40.29 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Arne Alexander Wilhelmsen sold 230,000 shares of Royal Caribbean Cruises stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $233.62, for a total transaction of $53,732,600.00. Following the sale, the director now owns 18,556,860 shares in the company, valued at approximately $4,335,253,633.20. The trade was a 1.22 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 404,332 shares of company stock valued at $94,299,521 over the last ninety days. Insiders own 7.95% of the company's stock.

Royal Caribbean Cruises Company Profile

(

Free Report)

Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands, which comprise a range of itineraries. As of February 21, 2024, it operated 65 ships. Royal Caribbean Cruises Ltd.

Read More

Before you consider Royal Caribbean Cruises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Caribbean Cruises wasn't on the list.

While Royal Caribbean Cruises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.