Nomura Asset Management Co. Ltd. lifted its stake in shares of Howmet Aerospace Inc. (NYSE:HWM - Free Report) by 5.4% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 112,482 shares of the company's stock after acquiring an additional 5,731 shares during the quarter. Nomura Asset Management Co. Ltd.'s holdings in Howmet Aerospace were worth $11,276,000 at the end of the most recent reporting period.

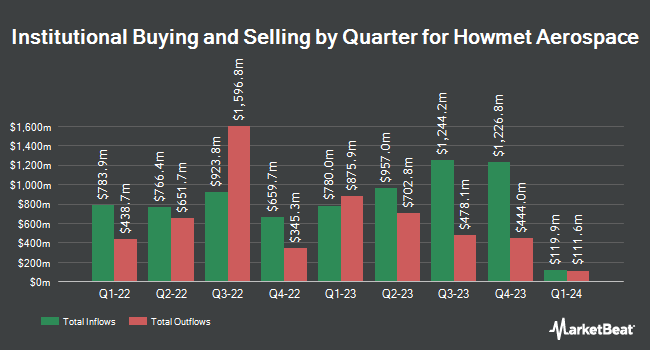

A number of other hedge funds have also modified their holdings of HWM. MML Investors Services LLC boosted its position in shares of Howmet Aerospace by 7.0% in the 3rd quarter. MML Investors Services LLC now owns 37,497 shares of the company's stock valued at $3,759,000 after purchasing an additional 2,442 shares during the period. Dorsey Wright & Associates purchased a new stake in Howmet Aerospace during the third quarter valued at about $2,073,000. Orion Portfolio Solutions LLC increased its position in shares of Howmet Aerospace by 25.3% in the third quarter. Orion Portfolio Solutions LLC now owns 14,373 shares of the company's stock worth $1,441,000 after acquiring an additional 2,902 shares in the last quarter. Zacks Investment Management raised its holdings in shares of Howmet Aerospace by 110.8% during the third quarter. Zacks Investment Management now owns 180,754 shares of the company's stock valued at $18,121,000 after acquiring an additional 94,993 shares during the period. Finally, National Bank of Canada FI lifted its position in shares of Howmet Aerospace by 134.2% in the 3rd quarter. National Bank of Canada FI now owns 254,251 shares of the company's stock valued at $25,489,000 after acquiring an additional 145,675 shares in the last quarter. 90.46% of the stock is currently owned by institutional investors and hedge funds.

Howmet Aerospace Stock Down 2.1 %

Shares of HWM stock traded down $2.38 on Thursday, hitting $113.70. The company's stock had a trading volume of 2,118,983 shares, compared to its average volume of 2,903,123. The stock has a market capitalization of $46.19 billion, a price-to-earnings ratio of 44.31, a P/E/G ratio of 1.59 and a beta of 1.48. Howmet Aerospace Inc. has a fifty-two week low of $52.36 and a fifty-two week high of $120.71. The firm's fifty day moving average price is $109.54 and its 200-day moving average price is $95.67. The company has a debt-to-equity ratio of 0.76, a current ratio of 2.24 and a quick ratio of 0.98.

Howmet Aerospace Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, November 25th. Shareholders of record on Friday, November 8th were given a $0.08 dividend. The ex-dividend date of this dividend was Friday, November 8th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.28%. Howmet Aerospace's dividend payout ratio is currently 12.21%.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on HWM. Robert W. Baird lifted their price objective on shares of Howmet Aerospace from $113.00 to $144.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Royal Bank of Canada lifted their price target on Howmet Aerospace from $105.00 to $135.00 and gave the company an "outperform" rating in a report on Thursday, November 7th. Sanford C. Bernstein increased their price objective on Howmet Aerospace from $113.00 to $127.00 and gave the stock an "outperform" rating in a research note on Monday, October 21st. Wells Fargo & Company raised their price objective on Howmet Aerospace from $129.00 to $132.00 and gave the stock an "overweight" rating in a research report on Wednesday. Finally, UBS Group upped their target price on Howmet Aerospace from $103.00 to $120.00 and gave the company a "neutral" rating in a report on Thursday, November 7th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and fourteen have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $115.59.

View Our Latest Report on HWM

Howmet Aerospace Profile

(

Free Report)

Howmet Aerospace Inc provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally. It operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

Read More

Before you consider Howmet Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howmet Aerospace wasn't on the list.

While Howmet Aerospace currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.