Nomura Asset Management Co. Ltd. boosted its position in Yum! Brands, Inc. (NYSE:YUM - Free Report) by 10.9% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 116,456 shares of the restaurant operator's stock after acquiring an additional 11,422 shares during the period. Nomura Asset Management Co. Ltd.'s holdings in Yum! Brands were worth $16,270,000 at the end of the most recent reporting period.

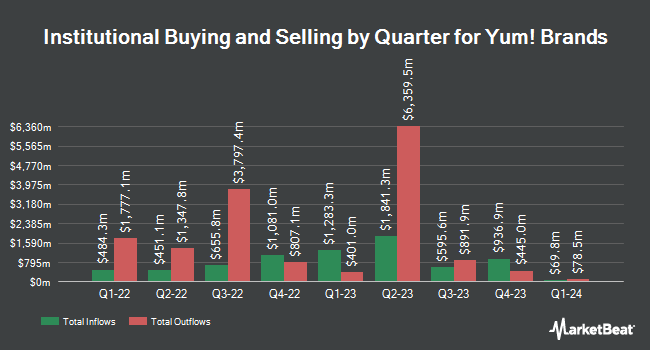

Several other institutional investors also recently bought and sold shares of YUM. Sequoia Financial Advisors LLC lifted its position in Yum! Brands by 4.3% during the second quarter. Sequoia Financial Advisors LLC now owns 13,580 shares of the restaurant operator's stock worth $1,799,000 after buying an additional 564 shares during the period. Diversified Trust Co boosted its position in shares of Yum! Brands by 16.5% in the second quarter. Diversified Trust Co now owns 3,242 shares of the restaurant operator's stock worth $429,000 after acquiring an additional 459 shares during the last quarter. Wealth Enhancement Advisory Services LLC grew its holdings in Yum! Brands by 18.2% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 50,807 shares of the restaurant operator's stock valued at $6,730,000 after purchasing an additional 7,814 shares during the period. ORG Partners LLC increased its position in Yum! Brands by 3,858.8% during the second quarter. ORG Partners LLC now owns 673 shares of the restaurant operator's stock worth $87,000 after purchasing an additional 656 shares during the last quarter. Finally, Envestnet Portfolio Solutions Inc. raised its stake in Yum! Brands by 12.7% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 9,349 shares of the restaurant operator's stock worth $1,238,000 after purchasing an additional 1,053 shares during the period. 82.37% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research firms have recently commented on YUM. Deutsche Bank Aktiengesellschaft dropped their price objective on Yum! Brands from $147.00 to $145.00 and set a "hold" rating for the company in a report on Wednesday, November 6th. Redburn Atlantic downgraded Yum! Brands from a "strong-buy" rating to a "hold" rating in a report on Monday, November 11th. TD Cowen reiterated a "hold" rating and set a $145.00 target price on shares of Yum! Brands in a report on Wednesday, November 6th. Bank of America cut their price target on shares of Yum! Brands from $147.00 to $145.00 and set a "neutral" rating on the stock in a report on Tuesday, October 22nd. Finally, JPMorgan Chase & Co. boosted their price objective on shares of Yum! Brands from $137.00 to $144.00 and gave the stock a "neutral" rating in a research note on Monday, September 16th. Twelve research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $145.94.

Get Our Latest Stock Analysis on Yum! Brands

Yum! Brands Trading Up 0.2 %

YUM stock traded up $0.32 during mid-day trading on Wednesday, hitting $138.54. 1,305,560 shares of the company were exchanged, compared to its average volume of 1,919,065. The firm has a fifty day simple moving average of $135.43 and a 200 day simple moving average of $134.45. The company has a market capitalization of $38.66 billion, a PE ratio of 25.82, a price-to-earnings-growth ratio of 2.38 and a beta of 1.10. Yum! Brands, Inc. has a twelve month low of $124.76 and a twelve month high of $143.20.

Yum! Brands (NYSE:YUM - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The restaurant operator reported $1.37 earnings per share for the quarter, missing the consensus estimate of $1.41 by ($0.04). The firm had revenue of $1.83 billion during the quarter, compared to the consensus estimate of $1.90 billion. Yum! Brands had a net margin of 21.13% and a negative return on equity of 18.93%. The firm's quarterly revenue was up 6.9% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.44 earnings per share. As a group, sell-side analysts anticipate that Yum! Brands, Inc. will post 5.47 earnings per share for the current year.

Yum! Brands Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Monday, December 2nd will be given a dividend of $0.67 per share. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $2.68 dividend on an annualized basis and a yield of 1.93%. Yum! Brands's dividend payout ratio is currently 50.09%.

Insider Activity

In other Yum! Brands news, CEO David W. Gibbs sold 7,005 shares of the company's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $134.43, for a total value of $941,682.15. Following the transaction, the chief executive officer now owns 155,883 shares of the company's stock, valued at approximately $20,955,351.69. This represents a 4.30 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Over the last quarter, insiders sold 21,069 shares of company stock valued at $2,842,965. 0.31% of the stock is currently owned by company insiders.

Yum! Brands Profile

(

Free Report)

Yum! Brands, Inc, together with its subsidiaries, develops, operates, and franchises quick service restaurants worldwide. The company operates through the KFC Division, the Taco Bell Division, the Pizza Hut Division, and the Habit Burger Grill Division segments. It also operates restaurants under the KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill brands, which specialize in chicken, pizza, made-to-order chargrilled burgers, sandwiches, Mexican-style food categories, and other food products.

Read More

Before you consider Yum! Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum! Brands wasn't on the list.

While Yum! Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.