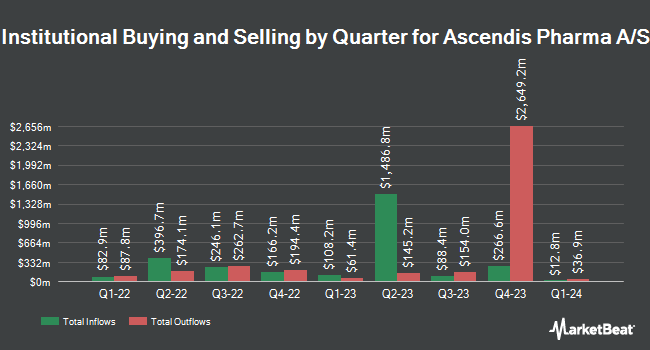

Nomura Asset Management Co. Ltd. increased its stake in shares of Ascendis Pharma A/S (NASDAQ:ASND - Free Report) by 13.9% during the fourth quarter, according to its most recent filing with the SEC. The institutional investor owned 20,506 shares of the biotechnology company's stock after purchasing an additional 2,506 shares during the period. Nomura Asset Management Co. Ltd.'s holdings in Ascendis Pharma A/S were worth $2,823,000 as of its most recent SEC filing.

Other large investors have also added to or reduced their stakes in the company. Groupama Asset Managment purchased a new position in shares of Ascendis Pharma A/S during the 3rd quarter valued at $60,000. Frazier Life Sciences Management L.P. bought a new stake in Ascendis Pharma A/S during the third quarter valued at $19,908,000. Zimmer Partners LP purchased a new position in Ascendis Pharma A/S during the third quarter worth about $11,646,000. American Century Companies Inc. grew its position in Ascendis Pharma A/S by 17.5% during the fourth quarter. American Century Companies Inc. now owns 407,294 shares of the biotechnology company's stock worth $56,072,000 after buying an additional 60,548 shares in the last quarter. Finally, Maven Securities LTD bought a new position in Ascendis Pharma A/S in the 3rd quarter worth about $7,466,000.

Analysts Set New Price Targets

ASND has been the subject of several recent analyst reports. The Goldman Sachs Group boosted their price objective on Ascendis Pharma A/S from $200.00 to $225.00 and gave the stock a "buy" rating in a report on Thursday, February 13th. Morgan Stanley set a $180.00 price target on shares of Ascendis Pharma A/S in a research note on Tuesday, February 18th. UBS Group began coverage on shares of Ascendis Pharma A/S in a report on Tuesday, January 7th. They issued a "buy" rating and a $196.00 price target on the stock. Cantor Fitzgerald increased their target price on Ascendis Pharma A/S from $170.00 to $200.00 and gave the company an "overweight" rating in a research note on Tuesday, February 25th. Finally, JPMorgan Chase & Co. raised their price target on Ascendis Pharma A/S from $168.00 to $200.00 and gave the company an "overweight" rating in a research report on Tuesday, March 18th. Two equities research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $204.64.

Get Our Latest Stock Analysis on ASND

Ascendis Pharma A/S Stock Performance

Shares of NASDAQ ASND traded down $2.53 during mid-day trading on Monday, hitting $140.14. The stock had a trading volume of 871,190 shares, compared to its average volume of 473,456. The business has a 50 day moving average price of $146.68 and a two-hundred day moving average price of $137.84. Ascendis Pharma A/S has a 1 year low of $111.09 and a 1 year high of $169.37. The firm has a market cap of $8.50 billion, a P/E ratio of -19.74 and a beta of 0.54.

Ascendis Pharma A/S (NASDAQ:ASND - Get Free Report) last released its quarterly earnings data on Wednesday, February 12th. The biotechnology company reported ($0.68) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($1.32) by $0.64. Equities research analysts predict that Ascendis Pharma A/S will post -4.34 EPS for the current fiscal year.

About Ascendis Pharma A/S

(

Free Report)

Ascendis Pharma A/S, a biopharmaceutical company, focuses on developing therapies for unmet medical needs. It offers SKYTROFA for treating patients with growth hormone deficiency (GHD). The company is also developing a pipeline of three independent endocrinology rare disease product candidates in clinical development, as well as focuses on advancing oncology therapeutic candidates.

See Also

Before you consider Ascendis Pharma A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ascendis Pharma A/S wasn't on the list.

While Ascendis Pharma A/S currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.