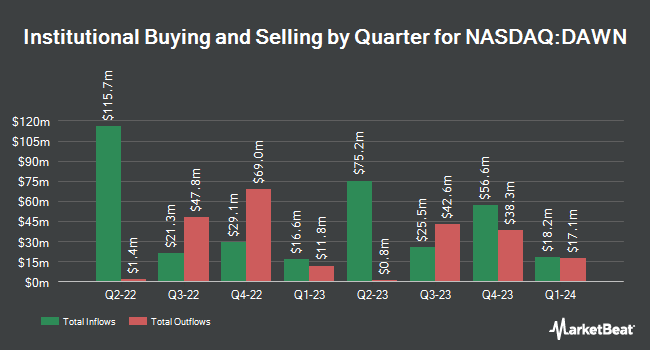

Norges Bank purchased a new stake in Day One Biopharmaceuticals, Inc. (NASDAQ:DAWN - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 169,000 shares of the company's stock, valued at approximately $2,141,000. Norges Bank owned 0.17% of Day One Biopharmaceuticals as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors and hedge funds have also recently modified their holdings of the company. R Squared Ltd acquired a new position in shares of Day One Biopharmaceuticals during the 4th quarter valued at $31,000. E Fund Management Co. Ltd. acquired a new stake in shares of Day One Biopharmaceuticals in the 4th quarter valued at about $143,000. KLP Kapitalforvaltning AS bought a new stake in Day One Biopharmaceuticals in the 4th quarter valued at about $150,000. XTX Topco Ltd acquired a new position in Day One Biopharmaceuticals during the 3rd quarter worth approximately $178,000. Finally, Teacher Retirement System of Texas boosted its holdings in Day One Biopharmaceuticals by 20.9% in the fourth quarter. Teacher Retirement System of Texas now owns 17,825 shares of the company's stock worth $226,000 after acquiring an additional 3,086 shares in the last quarter. 87.95% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently weighed in on DAWN shares. Needham & Company LLC reaffirmed a "buy" rating and set a $32.00 target price on shares of Day One Biopharmaceuticals in a research report on Wednesday, February 26th. HC Wainwright restated a "buy" rating and issued a $36.00 target price on shares of Day One Biopharmaceuticals in a report on Thursday, April 3rd. Wedbush reiterated an "outperform" rating and set a $32.00 price target on shares of Day One Biopharmaceuticals in a research note on Wednesday, February 26th. The Goldman Sachs Group decreased their price objective on Day One Biopharmaceuticals from $39.00 to $27.00 and set a "buy" rating for the company in a report on Tuesday, March 25th. Finally, JPMorgan Chase & Co. cut their target price on Day One Biopharmaceuticals from $39.00 to $34.00 and set an "overweight" rating on the stock in a research report on Wednesday, March 5th. Seven analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus price target of $32.29.

Read Our Latest Stock Analysis on Day One Biopharmaceuticals

Day One Biopharmaceuticals Stock Down 0.4 %

Day One Biopharmaceuticals stock traded down $0.03 during mid-day trading on Tuesday, reaching $7.19. 856,025 shares of the company's stock were exchanged, compared to its average volume of 1,118,064. The business's fifty day simple moving average is $9.23 and its 200 day simple moving average is $11.98. Day One Biopharmaceuticals, Inc. has a one year low of $6.41 and a one year high of $18.07. The firm has a market capitalization of $728.74 million, a PE ratio of -6.98 and a beta of -1.24.

Day One Biopharmaceuticals (NASDAQ:DAWN - Get Free Report) last released its earnings results on Tuesday, February 25th. The company reported ($0.69) EPS for the quarter, missing analysts' consensus estimates of ($0.35) by ($0.34). The firm had revenue of $29.21 million during the quarter, compared to the consensus estimate of $27.11 million. On average, sell-side analysts forecast that Day One Biopharmaceuticals, Inc. will post -0.72 earnings per share for the current year.

Insiders Place Their Bets

In other news, CEO Jeremy Bender sold 12,048 shares of the stock in a transaction on Tuesday, February 18th. The stock was sold at an average price of $11.96, for a total transaction of $144,094.08. Following the completion of the transaction, the chief executive officer now owns 128,015 shares in the company, valued at approximately $1,531,059.40. This represents a 8.60 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Charles N. York II sold 4,370 shares of the business's stock in a transaction dated Tuesday, February 18th. The shares were sold at an average price of $11.96, for a total value of $52,265.20. Following the completion of the sale, the chief financial officer now owns 252,638 shares in the company, valued at $3,021,550.48. This represents a 1.70 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 21,064 shares of company stock valued at $251,925. Company insiders own 8.40% of the company's stock.

Day One Biopharmaceuticals Profile

(

Free Report)

Day One Biopharmaceuticals, Inc, a clinical-stage biopharmaceutical company, develops and commercializes targeted therapies for patients with genomically defined cancers. Its lead product candidate is tovorafenib, an oral brain-penetrant type II pan-rapidly accelerated fibrosarcoma kinase inhibitor that is in Phase II clinical trial for pediatric patients with relapsed/ refractory low-grade glioma.

See Also

Before you consider Day One Biopharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Day One Biopharmaceuticals wasn't on the list.

While Day One Biopharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.