Norges Bank purchased a new stake in Douglas Dynamics, Inc. (NYSE:PLOW - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund purchased 26,100 shares of the auto parts company's stock, valued at approximately $617,000. Norges Bank owned about 0.11% of Douglas Dynamics at the end of the most recent quarter.

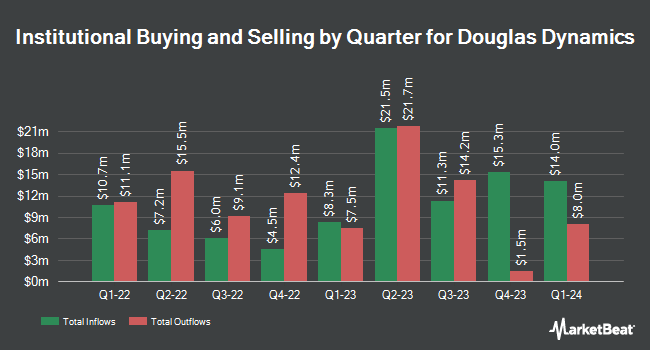

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in PLOW. Allspring Global Investments Holdings LLC boosted its stake in shares of Douglas Dynamics by 0.8% in the fourth quarter. Allspring Global Investments Holdings LLC now owns 2,440,641 shares of the auto parts company's stock valued at $57,819,000 after buying an additional 20,233 shares during the period. Pzena Investment Management LLC raised its holdings in Douglas Dynamics by 3.3% in the 4th quarter. Pzena Investment Management LLC now owns 1,679,041 shares of the auto parts company's stock valued at $39,676,000 after acquiring an additional 54,221 shares in the last quarter. Geode Capital Management LLC lifted its position in shares of Douglas Dynamics by 1.3% during the 3rd quarter. Geode Capital Management LLC now owns 516,457 shares of the auto parts company's stock valued at $14,247,000 after acquiring an additional 6,657 shares during the period. Harbor Capital Advisors Inc. grew its holdings in shares of Douglas Dynamics by 0.7% during the 4th quarter. Harbor Capital Advisors Inc. now owns 355,977 shares of the auto parts company's stock worth $8,412,000 after purchasing an additional 2,445 shares in the last quarter. Finally, Bank of New York Mellon Corp grew its holdings in shares of Douglas Dynamics by 19.7% during the 4th quarter. Bank of New York Mellon Corp now owns 296,867 shares of the auto parts company's stock worth $7,015,000 after purchasing an additional 48,936 shares in the last quarter. 91.85% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

PLOW has been the subject of a number of recent analyst reports. StockNews.com raised shares of Douglas Dynamics from a "hold" rating to a "buy" rating in a report on Wednesday, February 26th. DA Davidson restated a "buy" rating and set a $32.00 target price on shares of Douglas Dynamics in a research note on Tuesday, February 25th.

View Our Latest Analysis on PLOW

Douglas Dynamics Trading Down 0.0 %

Shares of PLOW traded down $0.01 during trading hours on Wednesday, hitting $23.50. 166,030 shares of the stock were exchanged, compared to its average volume of 190,048. Douglas Dynamics, Inc. has a fifty-two week low of $21.30 and a fifty-two week high of $30.98. The business has a 50-day moving average of $24.57 and a 200-day moving average of $24.97. The firm has a market capitalization of $542.80 million, a P/E ratio of 10.22, a price-to-earnings-growth ratio of 1.14 and a beta of 1.17. The company has a debt-to-equity ratio of 0.56, a current ratio of 2.14 and a quick ratio of 1.13.

Douglas Dynamics Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Tuesday, March 18th were paid a $0.295 dividend. This represents a $1.18 dividend on an annualized basis and a dividend yield of 5.02%. The ex-dividend date of this dividend was Tuesday, March 18th. Douglas Dynamics's dividend payout ratio is 50.43%.

Douglas Dynamics Profile

(

Free Report)

Douglas Dynamics, Inc operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America. It operates through two segments, Work Truck Attachments and Work Truck Solutions. The Work Truck Attachments segment manufactures and sells snow and ice control attachments, including snowplows, and sand and salt spreaders for light trucks and heavy duty trucks, as well as various related parts and accessories.

Featured Articles

Before you consider Douglas Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Dynamics wasn't on the list.

While Douglas Dynamics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.