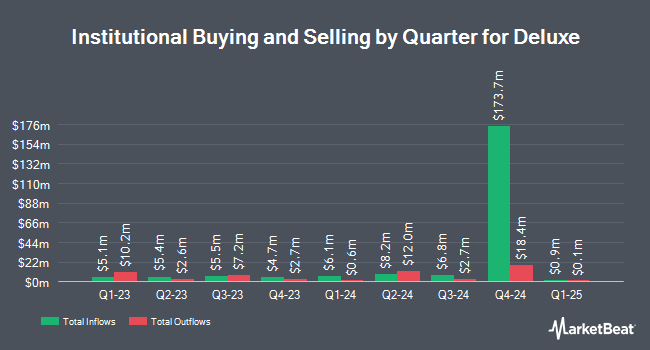

Norges Bank bought a new position in shares of Deluxe Co. (NYSE:DLX - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The institutional investor bought 142,096 shares of the business services provider's stock, valued at approximately $3,210,000. Norges Bank owned approximately 0.32% of Deluxe at the end of the most recent quarter.

A number of other institutional investors also recently modified their holdings of the company. Smartleaf Asset Management LLC raised its position in Deluxe by 93.7% in the 4th quarter. Smartleaf Asset Management LLC now owns 1,104 shares of the business services provider's stock valued at $25,000 after buying an additional 534 shares during the last quarter. Wilmington Savings Fund Society FSB acquired a new stake in shares of Deluxe during the 3rd quarter worth about $36,000. FMR LLC boosted its holdings in shares of Deluxe by 57.2% during the third quarter. FMR LLC now owns 3,206 shares of the business services provider's stock worth $62,000 after acquiring an additional 1,166 shares during the period. KBC Group NV grew its holdings in Deluxe by 63.5% in the 4th quarter. KBC Group NV now owns 3,237 shares of the business services provider's stock valued at $73,000 after buying an additional 1,257 shares in the last quarter. Finally, EMC Capital Management increased its position in Deluxe by 231.9% during the 4th quarter. EMC Capital Management now owns 5,417 shares of the business services provider's stock worth $122,000 after buying an additional 3,785 shares during the period. 93.90% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

DLX has been the topic of several research reports. StockNews.com downgraded shares of Deluxe from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, March 26th. Sidoti upgraded shares of Deluxe to a "hold" rating in a research report on Thursday, January 30th.

Read Our Latest Analysis on DLX

Insider Activity at Deluxe

In related news, CEO Barry C. Mccarthy bought 3,926 shares of the firm's stock in a transaction on Monday, March 10th. The shares were purchased at an average price of $16.45 per share, with a total value of $64,582.70. Following the completion of the purchase, the chief executive officer now owns 272,851 shares in the company, valued at $4,488,398.95. This represents a 1.46 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through this link. 5.60% of the stock is currently owned by insiders.

Deluxe Price Performance

Shares of DLX traded down $0.14 during trading hours on Wednesday, hitting $14.49. 13,047 shares of the company were exchanged, compared to its average volume of 278,386. Deluxe Co. has a fifty-two week low of $13.70 and a fifty-two week high of $24.87. The firm's fifty day moving average is $16.25 and its 200 day moving average is $19.84. The company has a quick ratio of 0.83, a current ratio of 0.98 and a debt-to-equity ratio of 2.36. The company has a market cap of $647.95 million, a price-to-earnings ratio of 12.28, a P/E/G ratio of 0.52 and a beta of 1.41.

Deluxe (NYSE:DLX - Get Free Report) last posted its quarterly earnings results on Wednesday, February 5th. The business services provider reported $0.75 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.80 by ($0.05). Deluxe had a return on equity of 21.33% and a net margin of 2.49%. On average, equities analysts anticipate that Deluxe Co. will post 2.77 earnings per share for the current fiscal year.

Deluxe Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, March 3rd. Shareholders of record on Tuesday, February 18th were given a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a yield of 8.28%. The ex-dividend date of this dividend was Tuesday, February 18th. Deluxe's dividend payout ratio is presently 101.69%.

Deluxe Company Profile

(

Free Report)

Deluxe Corporation provides technology-enabled solutions to enterprises, small businesses, and financial institutions in the United States, Canada, and Australia. It operates through Merchant Services, B2B Payments, Data Solutions, and Print segments. The Merchant Services offers credit and debit card authorization and payment systems, as well as processing services primarily to small and medium-sized retail and service businesses.

Recommended Stories

Before you consider Deluxe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deluxe wasn't on the list.

While Deluxe currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.