Norges Bank purchased a new position in shares of Mueller Industries, Inc. (NYSE:MLI - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 1,478,720 shares of the industrial products company's stock, valued at approximately $117,351,000. Norges Bank owned 1.30% of Mueller Industries at the end of the most recent reporting period.

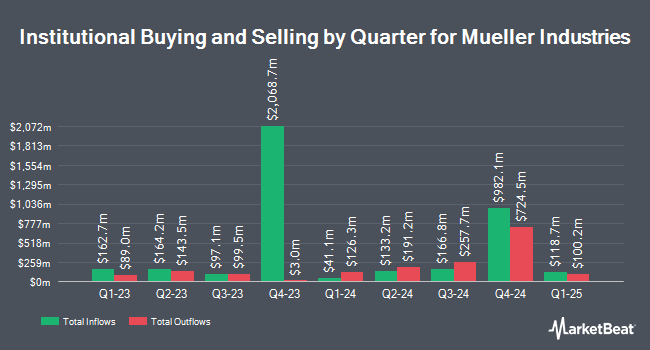

Several other institutional investors also recently bought and sold shares of the company. Westside Investment Management Inc. purchased a new stake in shares of Mueller Industries in the third quarter valued at about $41,000. SBI Securities Co. Ltd. purchased a new stake in Mueller Industries in the 4th quarter valued at approximately $47,000. Mirae Asset Global Investments Co. Ltd. acquired a new position in Mueller Industries during the 4th quarter worth approximately $53,000. City State Bank purchased a new position in shares of Mueller Industries during the 4th quarter worth approximately $58,000. Finally, GAMMA Investing LLC lifted its holdings in shares of Mueller Industries by 46.7% in the 4th quarter. GAMMA Investing LLC now owns 810 shares of the industrial products company's stock valued at $64,000 after buying an additional 258 shares during the period. 94.50% of the stock is owned by institutional investors and hedge funds.

Mueller Industries Stock Down 4.6 %

Shares of NYSE MLI traded down $3.41 during midday trading on Friday, hitting $70.67. The company had a trading volume of 1,163,961 shares, compared to its average volume of 903,389. The firm has a market capitalization of $8.00 billion, a price-to-earnings ratio of 13.31 and a beta of 0.99. Mueller Industries, Inc. has a twelve month low of $50.85 and a twelve month high of $96.81. The business has a 50-day simple moving average of $79.31 and a two-hundred day simple moving average of $79.93.

Mueller Industries (NYSE:MLI - Get Free Report) last posted its quarterly earnings results on Tuesday, February 4th. The industrial products company reported $1.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.12 by $0.09. Mueller Industries had a net margin of 16.05% and a return on equity of 22.97%.

Mueller Industries Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 28th. Shareholders of record on Friday, March 14th were issued a $0.25 dividend. This is a positive change from Mueller Industries's previous quarterly dividend of $0.20. The ex-dividend date of this dividend was Friday, March 14th. This represents a $1.00 annualized dividend and a yield of 1.42%. Mueller Industries's dividend payout ratio is 18.83%.

Analyst Ratings Changes

Separately, Northcoast Research raised Mueller Industries from a "neutral" rating to a "buy" rating and set a $105.00 price objective on the stock in a report on Wednesday, December 11th.

Read Our Latest Research Report on MLI

Insider Activity

In other news, Director Scott Jay Goldman sold 10,000 shares of the stock in a transaction that occurred on Thursday, February 13th. The shares were sold at an average price of $79.81, for a total value of $798,100.00. Following the sale, the director now directly owns 56,098 shares in the company, valued at $4,477,181.38. This represents a 15.13 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 2.80% of the company's stock.

Mueller Industries Profile

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Featured Articles

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.