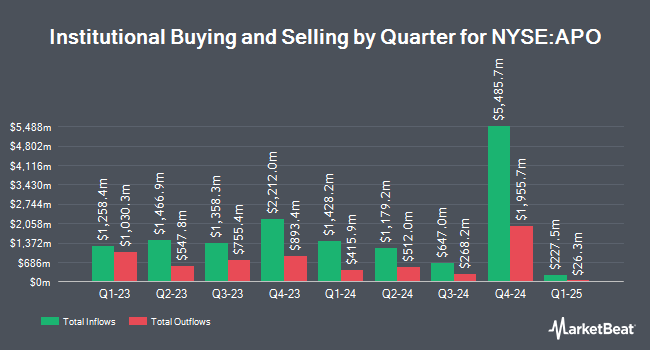

Norinchukin Bank The bought a new position in Apollo Global Management, Inc. (NYSE:APO - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 15,616 shares of the financial services provider's stock, valued at approximately $2,579,000.

Other hedge funds have also added to or reduced their stakes in the company. Hopwood Financial Services Inc. bought a new position in Apollo Global Management in the fourth quarter worth approximately $33,000. Kohmann Bosshard Financial Services LLC bought a new position in Apollo Global Management during the 4th quarter worth about $34,000. Byrne Asset Management LLC purchased a new position in Apollo Global Management during the 4th quarter valued at about $37,000. Retirement Wealth Solutions LLC bought a new stake in shares of Apollo Global Management in the 4th quarter valued at about $39,000. Finally, HM Payson & Co. bought a new position in shares of Apollo Global Management during the fourth quarter valued at approximately $45,000. 77.06% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several analysts have issued reports on the company. Piper Sandler dropped their target price on Apollo Global Management from $202.00 to $193.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 2nd. Keefe, Bruyette & Woods lowered their price target on shares of Apollo Global Management from $196.00 to $194.00 and set an "outperform" rating on the stock in a report on Wednesday, February 5th. Morgan Stanley lowered their target price on shares of Apollo Global Management from $170.00 to $131.00 and set an "equal weight" rating for the company in a research note on Monday, April 14th. Barclays reduced their price target on Apollo Global Management from $196.00 to $145.00 and set an "overweight" rating on the stock in a research report on Monday, April 7th. Finally, Wells Fargo & Company lowered their price objective on Apollo Global Management from $177.00 to $139.00 and set an "overweight" rating for the company in a research report on Tuesday, April 8th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, sixteen have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Apollo Global Management presently has a consensus rating of "Moderate Buy" and an average price target of $156.00.

Get Our Latest Stock Report on APO

Insider Activity

In other news, insider Lb 2018 Gst Trust acquired 607,725 shares of the firm's stock in a transaction on Friday, April 4th. The stock was acquired at an average price of $111.39 per share, for a total transaction of $67,694,487.75. Following the completion of the transaction, the insider now owns 621,754 shares in the company, valued at approximately $69,257,178.06. The trade was a 4,331.92 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Martin Kelly sold 5,000 shares of the stock in a transaction dated Thursday, February 13th. The stock was sold at an average price of $158.28, for a total transaction of $791,400.00. Following the sale, the chief financial officer now directly owns 377,164 shares in the company, valued at approximately $59,697,517.92. The trade was a 1.31 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 8.50% of the company's stock.

Apollo Global Management Stock Performance

Shares of Apollo Global Management stock traded up $2.94 during trading on Wednesday, hitting $126.65. 3,812,561 shares of the company's stock were exchanged, compared to its average volume of 3,812,992. The stock has a market capitalization of $72.25 billion, a price-to-earnings ratio of 17.33, a PEG ratio of 1.17 and a beta of 1.66. The business has a 50-day simple moving average of $135.86 and a 200-day simple moving average of $153.05. Apollo Global Management, Inc. has a 52-week low of $95.11 and a 52-week high of $189.49. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.44 and a current ratio of 1.44.

Apollo Global Management Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, February 28th. Shareholders of record on Tuesday, February 18th were paid a dividend of $0.4625 per share. The ex-dividend date of this dividend was Tuesday, February 18th. This represents a $1.85 dividend on an annualized basis and a dividend yield of 1.46%. Apollo Global Management's payout ratio is currently 25.31%.

About Apollo Global Management

(

Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Read More

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.