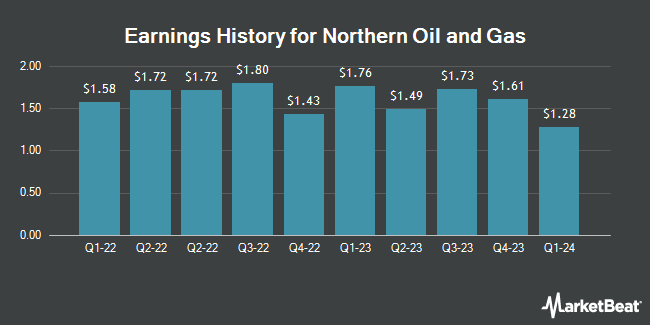

Northern Oil and Gas (NYSE:NOG - Get Free Report) is anticipated to issue its quarterly earnings data after the market closes on Wednesday, February 19th. Analysts expect the company to announce earnings of $1.27 per share and revenue of $563.21 million for the quarter. Parties interested in registering for the company's conference call can do so using this link.

Northern Oil and Gas Stock Up 1.8 %

NOG traded up $0.61 during trading on Friday, hitting $35.12. The stock had a trading volume of 1,307,240 shares, compared to its average volume of 1,433,516. Northern Oil and Gas has a twelve month low of $33.05 and a twelve month high of $44.31. The stock has a 50 day simple moving average of $38.07 and a two-hundred day simple moving average of $38.44. The company has a debt-to-equity ratio of 0.84, a quick ratio of 1.23 and a current ratio of 1.23. The company has a market capitalization of $3.51 billion, a PE ratio of 4.22 and a beta of 1.81.

Northern Oil and Gas Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Friday, March 28th will be paid a dividend of $0.45 per share. This is an increase from Northern Oil and Gas's previous quarterly dividend of $0.42. This represents a $1.80 annualized dividend and a dividend yield of 5.13%. The ex-dividend date of this dividend is Friday, March 28th. Northern Oil and Gas's payout ratio is presently 20.17%.

Analyst Ratings Changes

Several research firms have recently commented on NOG. Truist Financial lifted their price objective on shares of Northern Oil and Gas from $52.00 to $55.00 and gave the stock a "buy" rating in a research note on Monday, January 13th. Mizuho downgraded shares of Northern Oil and Gas from an "outperform" rating to a "neutral" rating and set a $47.00 price objective for the company. in a research note on Monday, December 16th. Royal Bank of Canada lowered their price objective on shares of Northern Oil and Gas from $45.00 to $40.00 and set a "sector perform" rating for the company in a research note on Thursday. Finally, Piper Sandler decreased their target price on shares of Northern Oil and Gas from $37.00 to $35.00 and set a "neutral" rating for the company in a research report on Wednesday, January 29th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $47.00.

Get Our Latest Report on Northern Oil and Gas

Insider Activity at Northern Oil and Gas

In other Northern Oil and Gas news, President Adam A. Dirlam sold 836 shares of Northern Oil and Gas stock in a transaction on Monday, January 6th. The shares were sold at an average price of $39.00, for a total value of $32,604.00. Following the completion of the transaction, the president now owns 96,223 shares of the company's stock, valued at approximately $3,752,697. The trade was a 0.86 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. 2.80% of the stock is currently owned by insiders.

Northern Oil and Gas Company Profile

(

Get Free Report)

Northern Oil and Gas, Inc, an independent energy company, engages in the acquisition, exploration, exploitation, development, and production of crude oil and natural gas properties in the United States. It primarily holds interests in the Williston Basin, the Appalachian Basin, and the Permian Basin in the United States.

Recommended Stories

Before you consider Northern Oil and Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Oil and Gas wasn't on the list.

While Northern Oil and Gas currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.