Northern Trust (NASDAQ:NTRS - Get Free Report) was upgraded by equities researchers at Morgan Stanley from an "underweight" rating to an "equal weight" rating in a research report issued on Monday, MarketBeat.com reports. The brokerage currently has a $127.00 target price on the asset manager's stock, up from their previous target price of $103.00. Morgan Stanley's target price would indicate a potential upside of 16.94% from the company's current price.

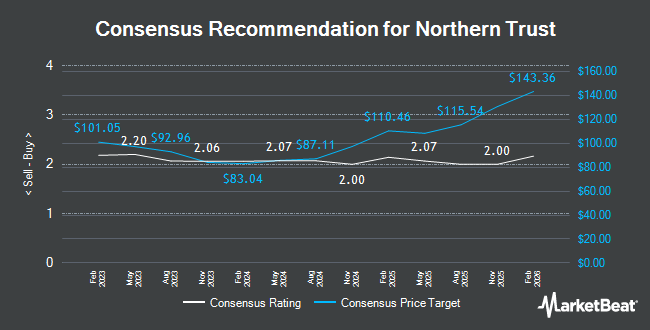

Several other brokerages have also recently weighed in on NTRS. Keefe, Bruyette & Woods raised their price objective on Northern Trust from $100.00 to $113.00 and gave the company a "market perform" rating in a research note on Tuesday, December 3rd. Barclays raised their price objective on shares of Northern Trust from $98.00 to $115.00 and gave the stock an "equal weight" rating in a report on Thursday, October 24th. The Goldman Sachs Group cut Northern Trust from a "neutral" rating to a "sell" rating and reduced their price target for the company from $84.00 to $82.00 in a research report on Thursday, September 26th. StockNews.com lowered Northern Trust from a "buy" rating to a "hold" rating in a report on Wednesday, November 27th. Finally, Wells Fargo & Company increased their price target on shares of Northern Trust from $108.00 to $110.00 and gave the stock an "equal weight" rating in a report on Friday, November 15th. Two equities research analysts have rated the stock with a sell rating, eight have assigned a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $105.00.

Check Out Our Latest Report on NTRS

Northern Trust Trading Up 0.6 %

NASDAQ NTRS traded up $0.68 during trading hours on Monday, reaching $108.60. The company's stock had a trading volume of 1,594,171 shares, compared to its average volume of 1,295,274. The stock has a market cap of $21.53 billion, a P/E ratio of 13.42, a P/E/G ratio of 1.21 and a beta of 1.07. The firm has a fifty day simple moving average of $101.57 and a 200-day simple moving average of $91.50. The company has a debt-to-equity ratio of 0.58, a current ratio of 0.71 and a quick ratio of 0.71. Northern Trust has a 52 week low of $76.67 and a 52 week high of $111.87.

Insiders Place Their Bets

In related news, Vice Chairman Steven L. Fradkin sold 9,100 shares of the stock in a transaction on Friday, November 29th. The stock was sold at an average price of $111.00, for a total transaction of $1,010,100.00. Following the sale, the insider now owns 47,797 shares in the company, valued at approximately $5,305,467. This represents a 15.99 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, EVP Susan Cohen Levy sold 19,585 shares of the firm's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $102.26, for a total transaction of $2,002,762.10. Following the transaction, the executive vice president now directly owns 17,132 shares in the company, valued at approximately $1,751,918.32. This trade represents a 53.34 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 84,006 shares of company stock worth $8,653,352 over the last three months. 0.64% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of NTRS. Innealta Capital LLC purchased a new position in shares of Northern Trust during the 2nd quarter valued at approximately $26,000. Ridgewood Investments LLC purchased a new stake in shares of Northern Trust in the second quarter valued at approximately $30,000. Northwest Investment Counselors LLC acquired a new stake in shares of Northern Trust in the third quarter valued at approximately $39,000. Capital Performance Advisors LLP purchased a new position in Northern Trust during the third quarter worth approximately $48,000. Finally, Eastern Bank acquired a new position in Northern Trust during the third quarter worth $51,000. 83.19% of the stock is currently owned by hedge funds and other institutional investors.

About Northern Trust

(

Get Free Report)

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services.

Read More

Before you consider Northern Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Trust wasn't on the list.

While Northern Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.