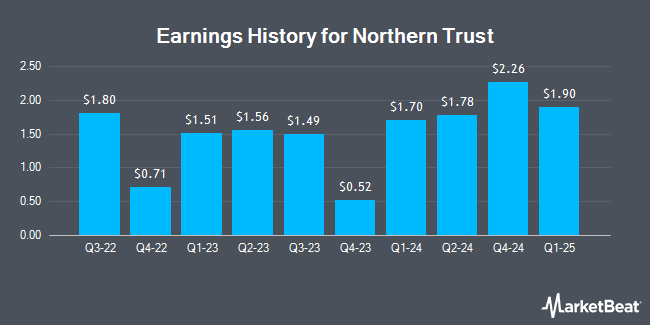

Northern Trust (NASDAQ:NTRS - Get Free Report) is projected to post its quarterly earnings results before the market opens on Thursday, January 23rd. Analysts expect Northern Trust to post earnings of $1.96 per share and revenue of $1,932,920.25 billion for the quarter. Individual interested in listening to the company's earnings conference call can do so using this link.

Northern Trust Trading Up 0.3 %

Shares of NASDAQ:NTRS traded up $0.37 during midday trading on Thursday, hitting $106.49. 890,711 shares of the stock were exchanged, compared to its average volume of 1,100,771. The stock has a market capitalization of $21.11 billion, a price-to-earnings ratio of 13.25, a P/E/G ratio of 1.06 and a beta of 1.08. The company has a debt-to-equity ratio of 0.58, a quick ratio of 0.71 and a current ratio of 0.71. The business's 50-day moving average price is $105.67 and its 200 day moving average price is $95.50. Northern Trust has a 12 month low of $76.67 and a 12 month high of $111.87.

Northern Trust Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, January 1st. Stockholders of record on Friday, December 6th were issued a dividend of $0.75 per share. This represents a $3.00 annualized dividend and a dividend yield of 2.82%. The ex-dividend date of this dividend was Friday, December 6th. Northern Trust's dividend payout ratio (DPR) is currently 37.31%.

Analysts Set New Price Targets

NTRS has been the topic of a number of recent analyst reports. Truist Financial initiated coverage on Northern Trust in a research note on Tuesday, January 7th. They issued a "hold" rating and a $110.00 price objective on the stock. Keefe, Bruyette & Woods upped their target price on Northern Trust from $100.00 to $113.00 and gave the stock a "market perform" rating in a research report on Tuesday, December 3rd. Morgan Stanley decreased their price target on Northern Trust from $127.00 to $125.00 and set an "equal weight" rating for the company in a report on Friday, January 3rd. Evercore ISI upped their price objective on Northern Trust from $86.00 to $103.00 and gave the company an "in-line" rating in a research note on Thursday, October 24th. Finally, Deutsche Bank Aktiengesellschaft upped their price objective on Northern Trust from $100.00 to $108.00 and gave the company a "hold" rating in a research note on Monday, November 11th. One analyst has rated the stock with a sell rating, nine have assigned a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $107.17.

Get Our Latest Stock Report on NTRS

Insider Activity

In other Northern Trust news, EVP Thomas A. South sold 5,000 shares of the firm's stock in a transaction on Thursday, November 7th. The shares were sold at an average price of $105.80, for a total value of $529,000.00. Following the completion of the transaction, the executive vice president now directly owns 49,756 shares of the company's stock, valued at $5,264,184.80. This trade represents a 9.13 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Vice Chairman Steven L. Fradkin sold 27,874 shares of the business's stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $100.50, for a total value of $2,801,337.00. Following the transaction, the insider now owns 46,078 shares of the company's stock, valued at approximately $4,630,839. The trade was a 37.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 82,151 shares of company stock valued at $8,489,889 in the last 90 days. Insiders own 0.64% of the company's stock.

Northern Trust Company Profile

(

Get Free Report)

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services.

Featured Articles

Before you consider Northern Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Trust wasn't on the list.

While Northern Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.