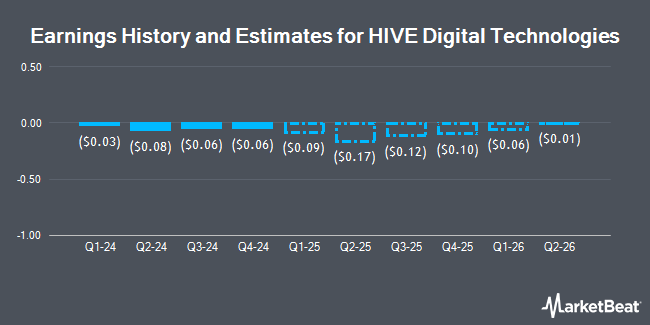

HIVE Digital Technologies Ltd. (NASDAQ:HIVE - Free Report) - Research analysts at Northland Capmk reduced their Q3 2025 earnings per share (EPS) estimates for HIVE Digital Technologies in a report issued on Wednesday, December 4th. Northland Capmk analyst M. Grondahl now anticipates that the company will post earnings per share of ($0.10) for the quarter, down from their previous estimate of ($0.06). Northland Capmk has a "Strong-Buy" rating on the stock. The consensus estimate for HIVE Digital Technologies' current full-year earnings is ($0.33) per share. Northland Capmk also issued estimates for HIVE Digital Technologies' Q4 2025 earnings at ($0.07) EPS, FY2025 earnings at ($0.33) EPS and Q1 2026 earnings at ($0.04) EPS.

A number of other research analysts have also recently issued reports on HIVE. StockNews.com upgraded HIVE Digital Technologies to a "sell" rating in a research note on Tuesday. Cantor Fitzgerald reiterated an "overweight" rating and issued a $9.00 price target on shares of HIVE Digital Technologies in a research note on Tuesday, November 19th. HC Wainwright restated a "buy" rating and set a $8.00 price objective on shares of HIVE Digital Technologies in a research note on Tuesday. Northland Securities lifted their target price on shares of HIVE Digital Technologies from $5.50 to $7.00 and gave the stock an "outperform" rating in a report on Thursday, November 14th. Finally, Canaccord Genuity Group increased their price target on shares of HIVE Digital Technologies from $6.00 to $7.00 and gave the company a "buy" rating in a report on Thursday, November 14th. One analyst has rated the stock with a sell rating, five have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, HIVE Digital Technologies currently has an average rating of "Moderate Buy" and an average price target of $7.40.

Get Our Latest Research Report on HIVE Digital Technologies

HIVE Digital Technologies Stock Up 6.1 %

Shares of HIVE traded up $0.25 during mid-day trading on Friday, reaching $4.35. The company had a trading volume of 12,845,741 shares, compared to its average volume of 6,752,980. The company has a debt-to-equity ratio of 0.06, a quick ratio of 5.56 and a current ratio of 5.56. The company has a market capitalization of $575.55 million, a price-to-earnings ratio of -31.07 and a beta of 3.39. The firm has a 50-day moving average price of $3.84 and a 200 day moving average price of $3.39. HIVE Digital Technologies has a 52 week low of $2.18 and a 52 week high of $5.74.

HIVE Digital Technologies (NASDAQ:HIVE - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.06) EPS for the quarter, topping the consensus estimate of ($0.09) by $0.03. HIVE Digital Technologies had a negative net margin of 12.04% and a negative return on equity of 10.78%. The business had revenue of $22.65 million for the quarter, compared to analyst estimates of $25.32 million. During the same quarter in the previous year, the firm posted ($0.29) earnings per share.

Institutional Investors Weigh In On HIVE Digital Technologies

Several institutional investors and hedge funds have recently added to or reduced their stakes in HIVE. Lifeworks Advisors LLC bought a new stake in HIVE Digital Technologies during the third quarter valued at approximately $35,000. Vanguard Personalized Indexing Management LLC purchased a new position in shares of HIVE Digital Technologies during the 2nd quarter worth $36,000. Gladstone Institutional Advisory LLC bought a new stake in shares of HIVE Digital Technologies during the 3rd quarter valued at $44,000. Quadrature Capital Ltd purchased a new stake in shares of HIVE Digital Technologies in the 3rd quarter worth $50,000. Finally, Wellington Management Group LLP bought a new position in HIVE Digital Technologies in the 3rd quarter worth $120,000. Hedge funds and other institutional investors own 24.42% of the company's stock.

About HIVE Digital Technologies

(

Get Free Report)

HIVE Digital Technologies Ltd. operates as a cryptocurrency mining company in Canada, Sweden, and Iceland. The company engages in the mining and sale of digital currencies, including Ethereum Classic, Bitcoin, and other coins. It also operates data centers; and offers infrastructure solutions. The company was formerly known as HIVE Blockchain Technologies Ltd.

Featured Stories

Before you consider HIVE Digital Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HIVE Digital Technologies wasn't on the list.

While HIVE Digital Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.