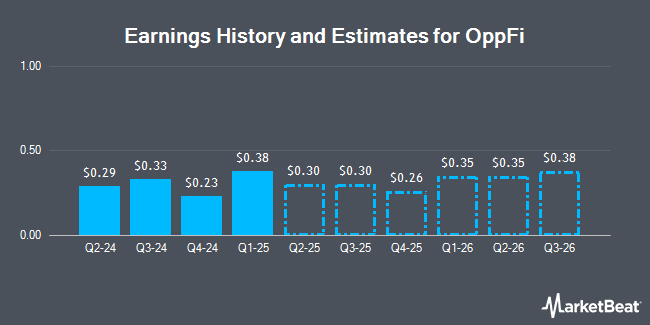

OppFi Inc. (NYSE:OPFI - Free Report) - Analysts at Northland Capmk raised their Q3 2025 earnings per share estimates for shares of OppFi in a research note issued on Friday, December 13th. Northland Capmk analyst M. Grondahl now anticipates that the company will earn $0.34 per share for the quarter, up from their previous estimate of $0.29. The consensus estimate for OppFi's current full-year earnings is $0.86 per share. Northland Capmk also issued estimates for OppFi's Q4 2025 earnings at $0.22 EPS and FY2025 earnings at $1.00 EPS.

Separately, Northland Securities increased their target price on OppFi from $8.00 to $10.00 and gave the stock an "outperform" rating in a research note on Friday.

Get Our Latest Research Report on OPFI

OppFi Price Performance

OPFI stock traded up $0.23 on Monday, reaching $7.57. 503,919 shares of the company traded hands, compared to its average volume of 307,907. The firm has a fifty day simple moving average of $6.28 and a 200-day simple moving average of $4.79. The company has a market cap of $652.64 million, a P/E ratio of 47.31 and a beta of 1.45. OppFi has a one year low of $2.35 and a one year high of $8.54.

Institutional Trading of OppFi

A number of hedge funds and other institutional investors have recently bought and sold shares of the stock. Quadrature Capital Ltd purchased a new stake in OppFi in the 3rd quarter worth $60,000. Brendel Financial Advisors LLC purchased a new position in OppFi in the 3rd quarter worth approximately $105,000. Jane Street Group LLC lifted its holdings in OppFi by 28.9% in the 3rd quarter. Jane Street Group LLC now owns 25,842 shares of the company's stock worth $122,000 after purchasing an additional 5,795 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in OppFi by 120.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 36,690 shares of the company's stock worth $124,000 after purchasing an additional 20,048 shares during the period. Finally, XTX Topco Ltd purchased a new stake in OppFi during the 3rd quarter valued at approximately $136,000. Hedge funds and other institutional investors own 7.10% of the company's stock.

Insider Transactions at OppFi

In other news, Director Jocelyn Moore sold 23,149 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $6.70, for a total value of $155,098.30. Following the transaction, the director now owns 99,072 shares in the company, valued at $663,782.40. This represents a 18.94 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director David Vennettilli sold 100,000 shares of the business's stock in a transaction that occurred on Friday, November 8th. The shares were sold at an average price of $6.45, for a total transaction of $645,000.00. Following the sale, the director now owns 143,825 shares of the company's stock, valued at $927,671.25. This trade represents a 41.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 145,450 shares of company stock worth $971,370. Corporate insiders own 84.00% of the company's stock.

About OppFi

(

Get Free Report)

OppFi Inc operates a cialty finance platform that allows banks to offer credit access. Its platform facilitates the OppLoans, an installment loan product; SalaryTap, a payroll deduction secured installment loan product; and OppFi Card, a credit card product. OppFi Inc was founded in 2012 and is headquartered in Chicago, Illinois.

Read More

Before you consider OppFi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OppFi wasn't on the list.

While OppFi currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.