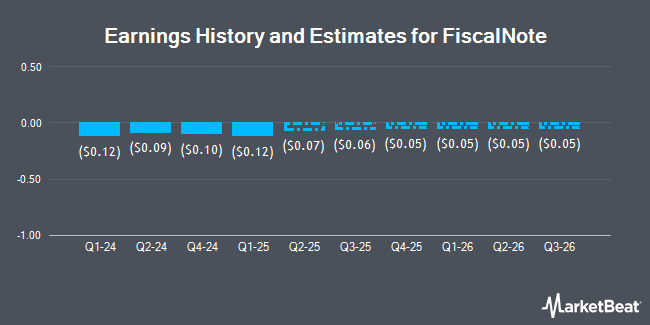

FiscalNote Holdings, Inc. (NYSE:NOTE - Free Report) - Investment analysts at Northland Capmk issued their FY2026 earnings estimates for FiscalNote in a research note issued to investors on Tuesday, November 12th. Northland Capmk analyst M. Latimore forecasts that the company will earn ($0.29) per share for the year. The consensus estimate for FiscalNote's current full-year earnings is ($0.43) per share.

A number of other research firms have also issued reports on NOTE. DA Davidson dropped their target price on FiscalNote from $1.35 to $1.05 and set a "neutral" rating on the stock in a report on Friday, August 9th. B. Riley decreased their target price on FiscalNote from $2.00 to $1.75 and set a "buy" rating on the stock in a research report on Wednesday. EF Hutton Acquisition Co. I upgraded shares of FiscalNote to a "strong-buy" rating in a research report on Monday, October 28th. Finally, Northland Securities dropped their price target on FiscalNote from $6.00 to $5.00 and set an "outperform" rating for the company in a research report on Monday, August 12th. Two investment analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $2.60.

Check Out Our Latest Stock Report on NOTE

FiscalNote Price Performance

NYSE:NOTE remained flat at $0.80 during trading hours on Friday. 377,972 shares of the company were exchanged, compared to its average volume of 664,156. The company has a quick ratio of 1.01, a current ratio of 0.81 and a debt-to-equity ratio of 1.44. The firm has a market cap of $111.61 million, a price-to-earnings ratio of -3.68 and a beta of 0.49. FiscalNote has a 12-month low of $0.73 and a 12-month high of $2.27. The firm's fifty day moving average is $1.11 and its 200-day moving average is $1.33.

Insider Activity at FiscalNote

In other news, CEO Tim Hwang sold 25,000 shares of FiscalNote stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $1.24, for a total value of $31,000.00. Following the completion of the sale, the chief executive officer now owns 2,516,513 shares of the company's stock, valued at $3,120,476.12. The trade was a 0.98 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Over the last 90 days, insiders have sold 125,149 shares of company stock valued at $154,823. Company insiders own 47.59% of the company's stock.

Institutional Trading of FiscalNote

Hedge funds have recently added to or reduced their stakes in the business. Stonehill Capital Management LLC acquired a new position in shares of FiscalNote in the 3rd quarter valued at $995,000. Marshall Wace LLP acquired a new position in FiscalNote in the second quarter valued at $608,000. Squarepoint Ops LLC grew its position in FiscalNote by 181.9% during the second quarter. Squarepoint Ops LLC now owns 149,490 shares of the company's stock valued at $218,000 after acquiring an additional 96,457 shares during the period. International Assets Investment Management LLC increased its stake in FiscalNote by 35.1% during the third quarter. International Assets Investment Management LLC now owns 134,656 shares of the company's stock worth $172,000 after acquiring an additional 34,956 shares during the last quarter. Finally, Natixis purchased a new position in shares of FiscalNote in the 1st quarter worth about $40,000. 54.31% of the stock is owned by institutional investors and hedge funds.

About FiscalNote

(

Get Free Report)

FiscalNote Holdings, Inc operates as technology company North America, Europe, Australia, and Asia. It combines artificial intelligence technology, machine learning, and other technologies with analytics, workflow tools, and expert research. The company also delivers that intelligence through its suite of public policy and issues management products, as well as powerful tools to manage workflows, advocacy campaigns, and constituent relationships.

Recommended Stories

Before you consider FiscalNote, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FiscalNote wasn't on the list.

While FiscalNote currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.