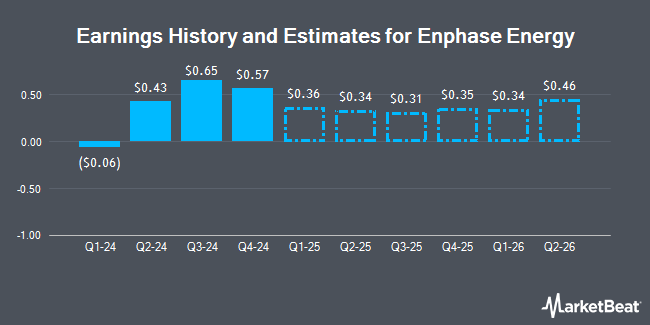

Enphase Energy, Inc. (NASDAQ:ENPH - Free Report) - Equities researchers at Northland Capmk decreased their Q1 2025 earnings per share (EPS) estimates for Enphase Energy in a research note issued to investors on Tuesday, November 19th. Northland Capmk analyst G. Richard now forecasts that the semiconductor company will earn $0.21 per share for the quarter, down from their previous forecast of $0.23. The consensus estimate for Enphase Energy's current full-year earnings is $0.91 per share. Northland Capmk also issued estimates for Enphase Energy's Q2 2025 earnings at $0.44 EPS, Q4 2025 earnings at $0.57 EPS and FY2025 earnings at $1.95 EPS.

A number of other brokerages have also weighed in on ENPH. StockNews.com upgraded shares of Enphase Energy from a "sell" rating to a "hold" rating in a report on Thursday, October 24th. Susquehanna dropped their target price on shares of Enphase Energy from $104.00 to $85.00 and set a "neutral" rating for the company in a research report on Thursday, October 24th. BNP Paribas lowered shares of Enphase Energy from an "outperform" rating to a "neutral" rating and set a $88.00 price target for the company. in a research note on Friday, November 8th. Citigroup cut their price target on shares of Enphase Energy from $114.00 to $99.00 and set a "neutral" rating on the stock in a report on Tuesday, October 22nd. Finally, Canaccord Genuity Group reiterated a "hold" rating and issued a $76.00 price objective on shares of Enphase Energy in a research note on Tuesday. Four investment analysts have rated the stock with a sell rating, sixteen have issued a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $102.09.

Read Our Latest Stock Report on ENPH

Enphase Energy Trading Up 1.2 %

Shares of ENPH traded up $0.71 during mid-day trading on Wednesday, reaching $62.07. The company had a trading volume of 2,162,757 shares, compared to its average volume of 4,050,707. The stock has a market cap of $8.39 billion, a price-to-earnings ratio of 139.70, a price-to-earnings-growth ratio of 18.32 and a beta of 1.77. The firm has a fifty day simple moving average of $93.59 and a 200-day simple moving average of $107.09. Enphase Energy has a fifty-two week low of $58.33 and a fifty-two week high of $141.63. The company has a current ratio of 4.16, a quick ratio of 3.88 and a debt-to-equity ratio of 1.29.

Enphase Energy (NASDAQ:ENPH - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The semiconductor company reported $0.65 earnings per share for the quarter, missing analysts' consensus estimates of $0.77 by ($0.12). Enphase Energy had a return on equity of 10.56% and a net margin of 4.91%. The business had revenue of $380.90 million for the quarter, compared to analysts' expectations of $392.51 million. During the same period last year, the business earned $0.84 earnings per share. The company's revenue for the quarter was down 30.9% on a year-over-year basis.

Hedge Funds Weigh In On Enphase Energy

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Avior Wealth Management LLC lifted its holdings in Enphase Energy by 6,975.0% during the third quarter. Avior Wealth Management LLC now owns 283 shares of the semiconductor company's stock valued at $32,000 after purchasing an additional 279 shares during the last quarter. UMB Bank n.a. lifted its position in Enphase Energy by 784.8% during the third quarter. UMB Bank n.a. now owns 292 shares of the semiconductor company's stock valued at $33,000 after buying an additional 259 shares during the period. nVerses Capital LLC purchased a new position in Enphase Energy during the third quarter valued at $34,000. Stone House Investment Management LLC purchased a new position in Enphase Energy during the third quarter valued at $34,000. Finally, Quarry LP purchased a new position in Enphase Energy during the third quarter valued at $37,000. 72.12% of the stock is owned by hedge funds and other institutional investors.

About Enphase Energy

(

Get Free Report)

Enphase Energy, Inc, together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control.

Read More

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.