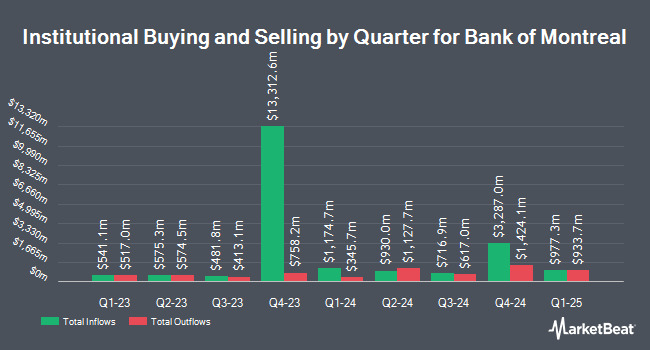

Northwest Bancshares Inc. cut its holdings in shares of Bank of Montreal (NYSE:BMO - Free Report) TSE: BMO by 13.0% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 63,493 shares of the bank's stock after selling 9,480 shares during the period. Bank of Montreal accounts for about 1.0% of Northwest Bancshares Inc.'s holdings, making the stock its 28th biggest position. Northwest Bancshares Inc.'s holdings in Bank of Montreal were worth $5,727,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Pathway Financial Advisers LLC increased its position in Bank of Montreal by 2,701.7% during the 3rd quarter. Pathway Financial Advisers LLC now owns 30,454 shares of the bank's stock worth $2,747,000 after purchasing an additional 29,367 shares in the last quarter. Newport Trust Company LLC increased its holdings in shares of Bank of Montreal by 1.1% in the 2nd quarter. Newport Trust Company LLC now owns 1,411,695 shares of the bank's stock valued at $118,371,000 after acquiring an additional 14,809 shares during the last quarter. Intact Investment Management Inc. grew its holdings in shares of Bank of Montreal by 72.9% during the third quarter. Intact Investment Management Inc. now owns 588,209 shares of the bank's stock valued at $53,082,000 after purchasing an additional 248,098 shares during the last quarter. Fiera Capital Corp raised its holdings in shares of Bank of Montreal by 2.1% during the second quarter. Fiera Capital Corp now owns 3,403,431 shares of the bank's stock valued at $285,789,000 after buying an additional 69,111 shares during the last quarter. Finally, EverSource Wealth Advisors LLC raised its position in shares of Bank of Montreal by 34.6% during the 1st quarter. EverSource Wealth Advisors LLC now owns 623 shares of the bank's stock worth $56,000 after buying an additional 160 shares in the last quarter. Hedge funds and other institutional investors own 45.82% of the company's stock.

Bank of Montreal Price Performance

Shares of BMO stock traded down $0.30 during trading on Wednesday, hitting $93.79. The company had a trading volume of 126,783 shares, compared to its average volume of 895,730. The company has a debt-to-equity ratio of 0.13, a quick ratio of 0.98 and a current ratio of 0.98. The firm has a market capitalization of $68.43 billion, a P/E ratio of 14.82, a price-to-earnings-growth ratio of 2.39 and a beta of 1.10. The stock's 50-day moving average price is $91.30 and its 200 day moving average price is $88.18. Bank of Montreal has a one year low of $76.98 and a one year high of $100.12.

Bank of Montreal (NYSE:BMO - Get Free Report) TSE: BMO last announced its quarterly earnings results on Tuesday, August 27th. The bank reported $2.64 EPS for the quarter, missing analysts' consensus estimates of $2.76 by ($0.12). The firm had revenue of $8.21 billion during the quarter, compared to the consensus estimate of $8.25 billion. Bank of Montreal had a net margin of 8.50% and a return on equity of 11.23%. The firm's revenue was up .2% on a year-over-year basis. During the same quarter in the previous year, the company posted $2.08 earnings per share. Equities analysts expect that Bank of Montreal will post 8 EPS for the current fiscal year.

Bank of Montreal Cuts Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, November 26th. Shareholders of record on Wednesday, October 30th will be given a dividend of $1.123 per share. The ex-dividend date of this dividend is Wednesday, October 30th. This represents a $4.49 annualized dividend and a dividend yield of 4.79%. Bank of Montreal's dividend payout ratio is currently 72.13%.

Analyst Ratings Changes

BMO has been the subject of several research reports. Jefferies Financial Group lowered Bank of Montreal from a "buy" rating to a "hold" rating in a research note on Tuesday, August 27th. Royal Bank of Canada lowered shares of Bank of Montreal from an "outperform" rating to a "sector perform" rating in a research note on Tuesday, July 30th. Scotiabank cut Bank of Montreal from a "sector outperform" rating to a "sector perform" rating and reduced their price objective for the company from $123.00 to $112.00 in a research report on Wednesday, August 28th. Barclays dropped their target price on Bank of Montreal from $132.00 to $126.00 and set an "overweight" rating on the stock in a research report on Wednesday, August 28th. Finally, TD Securities cut Bank of Montreal from a "buy" rating to a "hold" rating in a research report on Tuesday, August 27th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $119.75.

View Our Latest Stock Report on BMO

Bank of Montreal Profile

(

Free Report)

Bank of Montreal provides diversified financial services primarily in North America. It operates through Canadian P&C, U.S P&C, BMO Wealth Management, and BMO Capital Markets segments. The company's personal banking products and services include deposits, mortgages, home lending, consumer credit, small business lending, credit cards, cash management, financial and investment advice, and other banking services; and commercial banking products and services comprise various of financing options and treasury and payment solutions, as well as risk management products.

Featured Stories

Before you consider Bank of Montreal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Montreal wasn't on the list.

While Bank of Montreal currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.