Northwest & Ethical Investments L.P. bought a new stake in On Holding AG (NYSE:ONON - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 20,738 shares of the company's stock, valued at approximately $1,136,000.

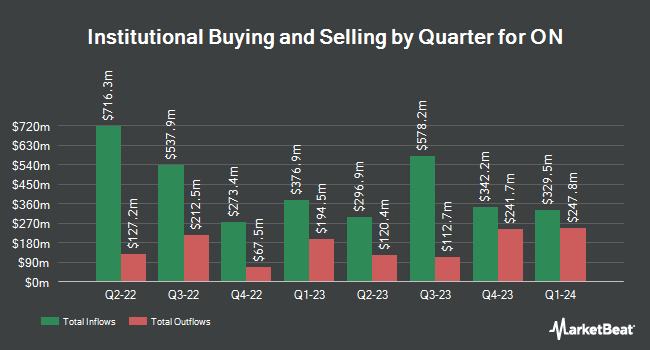

A number of other institutional investors and hedge funds also recently modified their holdings of the business. Jennison Associates LLC boosted its stake in ON by 27.4% in the fourth quarter. Jennison Associates LLC now owns 2,049,644 shares of the company's stock valued at $112,259,000 after acquiring an additional 440,685 shares during the last quarter. Allspring Global Investments Holdings LLC raised its holdings in shares of ON by 34.1% in the 4th quarter. Allspring Global Investments Holdings LLC now owns 1,376,850 shares of the company's stock worth $76,213,000 after purchasing an additional 349,789 shares during the period. Cerity Partners LLC lifted its stake in ON by 189.9% in the third quarter. Cerity Partners LLC now owns 719,493 shares of the company's stock valued at $36,083,000 after purchasing an additional 471,323 shares during the last quarter. Lord Abbett & CO. LLC grew its holdings in ON by 338.3% during the third quarter. Lord Abbett & CO. LLC now owns 594,901 shares of the company's stock valued at $29,834,000 after purchasing an additional 459,157 shares during the period. Finally, Raymond James Financial Inc. bought a new position in ON during the fourth quarter valued at $28,575,000. 36.39% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of brokerages have recently commented on ONON. Williams Trading upped their price target on ON from $60.00 to $62.00 and gave the company a "buy" rating in a research report on Tuesday, March 4th. Hsbc Global Res upgraded shares of ON from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, March 11th. Barclays lifted their target price on shares of ON from $63.00 to $64.00 and gave the stock an "overweight" rating in a research note on Wednesday, March 5th. Morgan Stanley upped their price target on shares of ON from $62.00 to $66.00 and gave the company an "overweight" rating in a research note on Wednesday, March 5th. Finally, The Goldman Sachs Group lowered shares of ON from a "buy" rating to a "neutral" rating and set a $57.00 price objective for the company. in a research note on Wednesday, February 12th. Two research analysts have rated the stock with a hold rating, nineteen have given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $61.90.

Check Out Our Latest Research Report on ON

ON Price Performance

ONON stock traded down $1.94 during midday trading on Wednesday, reaching $46.04. The company had a trading volume of 3,880,706 shares, compared to its average volume of 4,326,749. The firm has a 50-day moving average price of $52.78 and a 200-day moving average price of $52.71. The company has a market capitalization of $28.99 billion, a P/E ratio of 107.06, a P/E/G ratio of 1.02 and a beta of 2.35. On Holding AG has a 1 year low of $29.84 and a 1 year high of $64.05.

ON Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, and all-day activities. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own high-end stores.

Featured Articles

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.