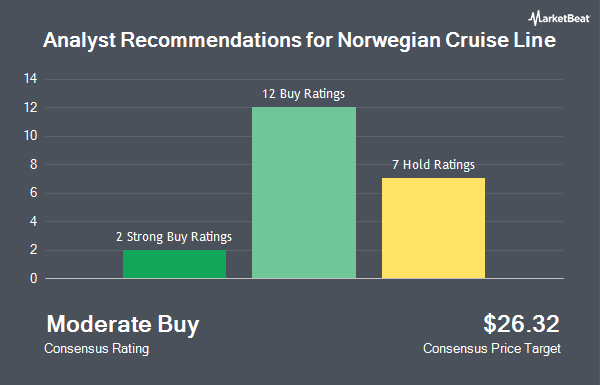

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Get Free Report) has received an average recommendation of "Hold" from the sixteen brokerages that are currently covering the stock, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, eight have given a hold recommendation, six have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 1-year price target among brokerages that have covered the stock in the last year is $25.80.

Several equities analysts recently issued reports on NCLH shares. StockNews.com lowered shares of Norwegian Cruise Line from a "hold" rating to a "sell" rating in a report on Wednesday, October 30th. Deutsche Bank Aktiengesellschaft lifted their price target on shares of Norwegian Cruise Line from $21.00 to $24.00 and gave the company a "hold" rating in a research note on Friday, November 1st. The Goldman Sachs Group lifted their price target on shares of Norwegian Cruise Line from $24.00 to $29.00 and gave the company a "neutral" rating in a research note on Friday, November 1st. Macquarie lifted their price target on shares of Norwegian Cruise Line from $24.00 to $30.00 and gave the company an "outperform" rating in a research note on Friday, November 1st. Finally, Stifel Nicolaus lifted their price target on shares of Norwegian Cruise Line from $27.00 to $29.00 and gave the company a "buy" rating in a research note on Friday, October 4th.

View Our Latest Stock Report on Norwegian Cruise Line

Norwegian Cruise Line Trading Up 7.0 %

NCLH stock traded up $1.82 during midday trading on Wednesday, hitting $27.76. The stock had a trading volume of 18,523,584 shares, compared to its average volume of 12,939,206. The firm has a market cap of $12.21 billion, a P/E ratio of 25.08, a price-to-earnings-growth ratio of 0.27 and a beta of 2.67. The company has a current ratio of 0.20, a quick ratio of 0.17 and a debt-to-equity ratio of 10.35. Norwegian Cruise Line has a 1-year low of $12.70 and a 1-year high of $27.93. The business has a fifty day moving average price of $21.02 and a two-hundred day moving average price of $18.66.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last released its earnings results on Thursday, October 31st. The company reported $0.99 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.94 by $0.05. The business had revenue of $2.81 billion for the quarter, compared to analyst estimates of $2.77 billion. Norwegian Cruise Line had a net margin of 5.87% and a return on equity of 99.31%. Norwegian Cruise Line's revenue for the quarter was up 10.7% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.71 earnings per share. On average, sell-side analysts predict that Norwegian Cruise Line will post 1.65 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Vanguard Group Inc. boosted its stake in Norwegian Cruise Line by 0.7% in the first quarter. Vanguard Group Inc. now owns 49,539,911 shares of the company's stock valued at $1,036,870,000 after acquiring an additional 324,287 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its stake in Norwegian Cruise Line by 120.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 22,498,217 shares of the company's stock valued at $470,889,000 after acquiring an additional 12,313,426 shares during the last quarter. Capital International Investors lifted its stake in shares of Norwegian Cruise Line by 0.5% during the 1st quarter. Capital International Investors now owns 20,216,746 shares of the company's stock valued at $423,136,000 after buying an additional 102,948 shares in the last quarter. Baillie Gifford & Co. purchased a new stake in shares of Norwegian Cruise Line during the 3rd quarter valued at approximately $179,146,000. Finally, Dimensional Fund Advisors LP lifted its stake in shares of Norwegian Cruise Line by 32.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,568,122 shares of the company's stock valued at $85,835,000 after buying an additional 1,129,770 shares in the last quarter. 69.58% of the stock is currently owned by hedge funds and other institutional investors.

About Norwegian Cruise Line

(

Get Free ReportNorwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Read More

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.