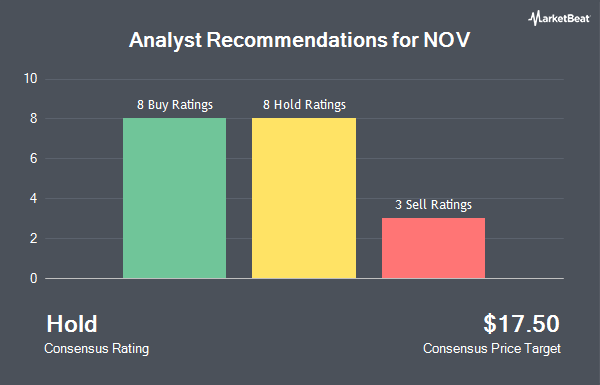

NOV Inc. (NYSE:NOV - Get Free Report) has received a consensus rating of "Hold" from the seventeen analysts that are currently covering the company, Marketbeat Ratings reports. Two analysts have rated the stock with a sell rating, seven have given a hold rating, seven have issued a buy rating and one has issued a strong buy rating on the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $20.64.

Several research analysts have issued reports on the stock. Wells Fargo & Company lowered their price objective on shares of NOV from $16.00 to $15.00 and set an "underweight" rating on the stock in a research report on Monday, November 4th. Barclays dropped their price target on NOV from $17.00 to $16.00 and set an "underweight" rating on the stock in a research report on Tuesday, October 29th. BMO Capital Markets decreased their price objective on NOV from $22.00 to $20.00 and set a "market perform" rating for the company in a research report on Thursday, October 10th. Bank of America dropped their target price on NOV from $22.00 to $20.00 and set a "buy" rating on the stock in a report on Monday, October 14th. Finally, JPMorgan Chase & Co. decreased their price target on NOV from $23.00 to $22.00 and set an "overweight" rating for the company in a report on Thursday, October 3rd.

Check Out Our Latest Stock Analysis on NOV

Insider Activity

In related news, Director David D. Harrison sold 1,784 shares of NOV stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $16.10, for a total transaction of $28,722.40. Following the completion of the sale, the director now owns 110,951 shares in the company, valued at approximately $1,786,311.10. This trade represents a 1.58 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Company insiders own 1.85% of the company's stock.

Institutional Investors Weigh In On NOV

Hedge funds have recently made changes to their positions in the business. Truist Financial Corp grew its holdings in NOV by 3.4% in the second quarter. Truist Financial Corp now owns 29,729 shares of the oil and gas exploration company's stock valued at $565,000 after purchasing an additional 991 shares during the period. HM Payson & Co. grew its stake in shares of NOV by 2.1% during the 3rd quarter. HM Payson & Co. now owns 49,000 shares of the oil and gas exploration company's stock valued at $783,000 after buying an additional 1,000 shares during the period. KBC Group NV increased its holdings in shares of NOV by 11.8% during the 3rd quarter. KBC Group NV now owns 11,060 shares of the oil and gas exploration company's stock worth $177,000 after buying an additional 1,163 shares during the last quarter. Vanguard Personalized Indexing Management LLC increased its holdings in shares of NOV by 2.3% during the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 51,567 shares of the oil and gas exploration company's stock worth $980,000 after buying an additional 1,164 shares during the last quarter. Finally, Envestnet Portfolio Solutions Inc. boosted its holdings in NOV by 7.1% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 18,960 shares of the oil and gas exploration company's stock valued at $360,000 after acquiring an additional 1,261 shares during the last quarter. Institutional investors and hedge funds own 93.27% of the company's stock.

NOV Stock Performance

Shares of NOV traded down $0.12 during mid-day trading on Friday, reaching $14.97. 4,663,468 shares of the company's stock were exchanged, compared to its average volume of 3,709,524. The business's fifty day simple moving average is $15.84 and its 200-day simple moving average is $17.10. The stock has a market capitalization of $5.82 billion, a PE ratio of 5.52, a price-to-earnings-growth ratio of 0.89 and a beta of 1.66. NOV has a 52-week low of $14.83 and a 52-week high of $21.23. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.57 and a quick ratio of 1.65.

NOV Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, December 6th will be issued a $0.075 dividend. This represents a $0.30 annualized dividend and a dividend yield of 2.00%. The ex-dividend date is Friday, December 6th. NOV's dividend payout ratio (DPR) is presently 11.07%.

About NOV

(

Get Free ReportNOV Inc designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally. It operates through two segments, Energy Equipment, and Energy Products and Services. The company provides solids control and waste management equipment and services, managed pressure drilling, drilling fluids, premium drillpipe, wired pipe, drilling optimization services, tubular inspection and coating services, instrumentation, downhole tools, and drill bits.

See Also

Before you consider NOV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NOV wasn't on the list.

While NOV currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.