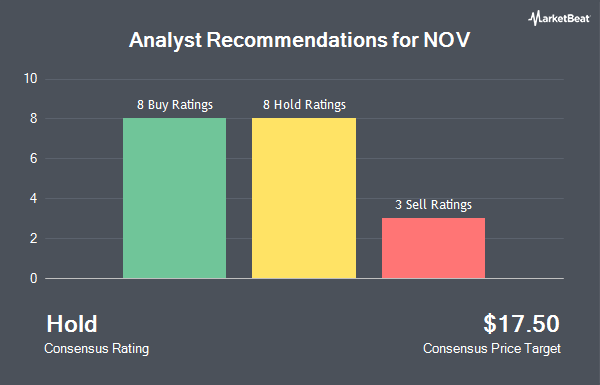

NOV Inc. (NYSE:NOV - Get Free Report) has been assigned an average rating of "Moderate Buy" from the sixteen analysts that are covering the company, Marketbeat reports. Two equities research analysts have rated the stock with a sell rating, five have assigned a hold rating, eight have given a buy rating and one has given a strong buy rating to the company. The average twelve-month target price among analysts that have issued ratings on the stock in the last year is $21.64.

NOV has been the topic of several research analyst reports. Evercore ISI upgraded shares of NOV to a "strong-buy" rating in a research report on Friday, July 26th. Benchmark reaffirmed a "hold" rating on shares of NOV in a research report on Friday, July 26th. Barclays decreased their target price on shares of NOV from $17.00 to $16.00 and set an "underweight" rating on the stock in a research report on Tuesday, October 29th. JPMorgan Chase & Co. dropped their price objective on NOV from $23.00 to $22.00 and set an "overweight" rating for the company in a research report on Thursday, October 3rd. Finally, Susquehanna reduced their price objective on NOV from $22.00 to $21.00 and set a "positive" rating on the stock in a research note on Monday, October 28th.

Get Our Latest Report on NOV

Institutional Investors Weigh In On NOV

Several hedge funds and other institutional investors have recently bought and sold shares of the business. Pzena Investment Management LLC boosted its holdings in shares of NOV by 22.3% during the third quarter. Pzena Investment Management LLC now owns 43,027,106 shares of the oil and gas exploration company's stock worth $687,143,000 after purchasing an additional 7,851,220 shares during the period. Hotchkis & Wiley Capital Management LLC increased its position in shares of NOV by 23.1% during the third quarter. Hotchkis & Wiley Capital Management LLC now owns 37,153,173 shares of the oil and gas exploration company's stock valued at $593,336,000 after purchasing an additional 6,963,660 shares during the period. Boston Partners acquired a new position in shares of NOV in the first quarter valued at $119,686,000. Bank of New York Mellon Corp lifted its position in NOV by 67.2% in the second quarter. Bank of New York Mellon Corp now owns 9,928,911 shares of the oil and gas exploration company's stock worth $188,749,000 after purchasing an additional 3,989,095 shares during the period. Finally, Dimensional Fund Advisors LP increased its holdings in NOV by 40.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 12,138,093 shares of the oil and gas exploration company's stock valued at $230,743,000 after buying an additional 3,470,860 shares during the period. 93.27% of the stock is currently owned by institutional investors.

NOV Stock Performance

NYSE:NOV traded up $0.26 during mid-day trading on Wednesday, hitting $16.26. The company's stock had a trading volume of 3,062,990 shares, compared to its average volume of 3,711,370. The stock has a market cap of $6.32 billion, a price-to-earnings ratio of 6.00, a PEG ratio of 0.93 and a beta of 1.66. The business's fifty day moving average is $16.02 and its two-hundred day moving average is $17.46. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.57 and a quick ratio of 1.65. NOV has a 1 year low of $14.98 and a 1 year high of $21.23.

NOV Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be paid a $0.075 dividend. This represents a $0.30 dividend on an annualized basis and a dividend yield of 1.85%. The ex-dividend date of this dividend is Friday, December 6th. NOV's dividend payout ratio is currently 11.07%.

About NOV

(

Get Free ReportNOV Inc designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally. It operates through two segments, Energy Equipment, and Energy Products and Services. The company provides solids control and waste management equipment and services, managed pressure drilling, drilling fluids, premium drillpipe, wired pipe, drilling optimization services, tubular inspection and coating services, instrumentation, downhole tools, and drill bits.

Featured Stories

Before you consider NOV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NOV wasn't on the list.

While NOV currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.