Citigroup Inc. reduced its holdings in shares of Nova Ltd. (NASDAQ:NVMI - Free Report) by 55.1% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 87,144 shares of the semiconductor company's stock after selling 107,036 shares during the period. Citigroup Inc. owned about 0.30% of Nova worth $18,156,000 at the end of the most recent quarter.

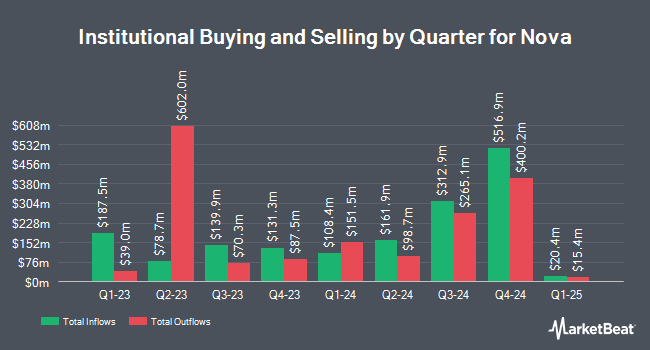

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Migdal Insurance & Financial Holdings Ltd. increased its stake in shares of Nova by 6.5% during the third quarter. Migdal Insurance & Financial Holdings Ltd. now owns 1,273,985 shares of the semiconductor company's stock worth $265,422,000 after buying an additional 78,000 shares during the period. Vanguard Group Inc. increased its position in shares of Nova by 1.5% in the 1st quarter. Vanguard Group Inc. now owns 987,071 shares of the semiconductor company's stock valued at $175,087,000 after purchasing an additional 14,115 shares during the last quarter. Meitav Investment House Ltd. increased its position in shares of Nova by 16.3% in the 3rd quarter. Meitav Investment House Ltd. now owns 647,722 shares of the semiconductor company's stock valued at $135,513,000 after purchasing an additional 90,883 shares during the last quarter. Massachusetts Financial Services Co. MA raised its holdings in shares of Nova by 45.2% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 645,203 shares of the semiconductor company's stock valued at $151,319,000 after purchasing an additional 200,816 shares in the last quarter. Finally, Y.D. More Investments Ltd lifted its position in shares of Nova by 2,733.2% during the 2nd quarter. Y.D. More Investments Ltd now owns 288,986 shares of the semiconductor company's stock worth $67,510,000 after purchasing an additional 278,786 shares during the last quarter. Hedge funds and other institutional investors own 82.99% of the company's stock.

Wall Street Analyst Weigh In

NVMI has been the topic of several recent analyst reports. Benchmark increased their target price on Nova from $240.00 to $245.00 and gave the company a "buy" rating in a report on Friday, November 8th. Needham & Company LLC restated a "hold" rating on shares of Nova in a report on Friday, November 8th. Finally, Citigroup lowered shares of Nova from a "buy" rating to a "neutral" rating and cut their price target for the stock from $273.00 to $224.00 in a research note on Monday, September 16th. Two analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, Nova has a consensus rating of "Moderate Buy" and a consensus price target of $227.80.

View Our Latest Analysis on NVMI

Nova Price Performance

Shares of NVMI stock traded down $2.14 during trading hours on Thursday, hitting $172.39. The stock had a trading volume of 292,226 shares, compared to its average volume of 191,138. The firm has a market capitalization of $5.01 billion, a PE ratio of 32.16, a PEG ratio of 1.66 and a beta of 1.47. The stock's 50 day moving average is $192.84 and its 200 day moving average is $208.31. Nova Ltd. has a twelve month low of $123.44 and a twelve month high of $247.21.

Nova Profile

(

Free Report)

Nova Ltd. designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally. Its product portfolio includes a set of metrology platforms for dimensional, films, and materials and chemical metrology measurements for process control for various semiconductor manufacturing process steps, including lithography, etch, chemical mechanical planarization, deposition, electrochemical plating, and advanced packaging.

Featured Articles

Before you consider Nova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nova wasn't on the list.

While Nova currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.