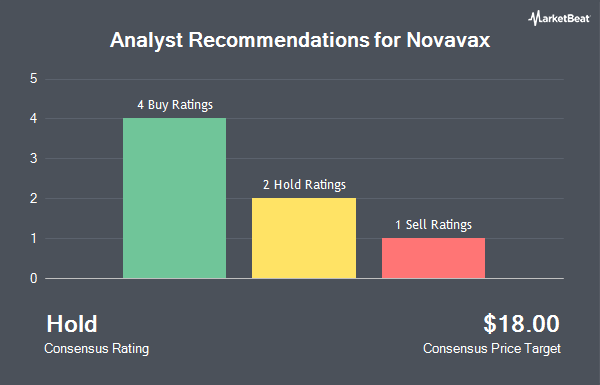

Novavax, Inc. (NASDAQ:NVAX - Get Free Report) has received an average rating of "Hold" from the six research firms that are covering the company, Marketbeat Ratings reports. One equities research analyst has rated the stock with a sell recommendation, two have given a hold recommendation and three have issued a buy recommendation on the company. The average twelve-month price objective among analysts that have issued ratings on the stock in the last year is $17.83.

A number of research analysts have issued reports on NVAX shares. JPMorgan Chase & Co. boosted their price target on Novavax from $8.00 to $9.00 and gave the company an "underweight" rating in a report on Monday, August 12th. HC Wainwright reiterated a "buy" rating and issued a $19.00 target price on shares of Novavax in a research note on Tuesday, November 12th. Jefferies Financial Group lowered their price target on shares of Novavax from $31.00 to $25.00 and set a "buy" rating on the stock in a report on Wednesday, October 16th. Finally, B. Riley reaffirmed a "buy" rating and issued a $26.00 price objective (up previously from $23.00) on shares of Novavax in a report on Thursday, October 10th.

Check Out Our Latest Analysis on Novavax

Novavax Stock Performance

NASDAQ NVAX traded up $0.10 on Friday, hitting $8.72. 1,709,703 shares of the company's stock traded hands, compared to its average volume of 9,574,993. The firm's 50-day moving average price is $10.49 and its two-hundred day moving average price is $12.60. Novavax has a 1-year low of $3.53 and a 1-year high of $23.86.

Novavax (NASDAQ:NVAX - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The biopharmaceutical company reported ($0.76) EPS for the quarter, beating the consensus estimate of ($0.83) by $0.07. The business had revenue of $84.51 million during the quarter, compared to analysts' expectations of $65.80 million. Novavax's revenue for the quarter was down 54.8% compared to the same quarter last year. During the same period in the previous year, the company posted ($1.26) earnings per share. As a group, analysts predict that Novavax will post -1.4 earnings per share for the current year.

Hedge Funds Weigh In On Novavax

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Shah Capital Management raised its position in shares of Novavax by 19.0% during the 2nd quarter. Shah Capital Management now owns 9,662,090 shares of the biopharmaceutical company's stock worth $122,322,000 after purchasing an additional 1,544,263 shares during the last quarter. Vontobel Holding Ltd. increased its stake in Novavax by 110.3% during the 3rd quarter. Vontobel Holding Ltd. now owns 498,532 shares of the biopharmaceutical company's stock worth $6,296,000 after buying an additional 261,464 shares in the last quarter. Squarepoint Ops LLC purchased a new stake in Novavax during the 2nd quarter worth approximately $1,251,000. Bank of Montreal Can raised its holdings in shares of Novavax by 26.7% during the third quarter. Bank of Montreal Can now owns 2,454,325 shares of the biopharmaceutical company's stock valued at $32,643,000 after acquiring an additional 517,727 shares during the last quarter. Finally, SG Americas Securities LLC lifted its position in shares of Novavax by 940.7% in the third quarter. SG Americas Securities LLC now owns 1,154,276 shares of the biopharmaceutical company's stock valued at $14,579,000 after acquiring an additional 1,043,363 shares in the last quarter. 53.04% of the stock is owned by hedge funds and other institutional investors.

Novavax Company Profile

(

Get Free ReportNovavax, Inc, a biotechnology company, that promotes improved health by discovering, developing, and commercializing vaccines to protect against serious infectious diseases. It offers vaccine platform that combines a recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response.

See Also

Before you consider Novavax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novavax wasn't on the list.

While Novavax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.