NS Partners Ltd raised its position in Equinix, Inc. (NASDAQ:EQIX - Free Report) by 1.9% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 31,234 shares of the financial services provider's stock after purchasing an additional 583 shares during the quarter. Equinix comprises 1.2% of NS Partners Ltd's investment portfolio, making the stock its 29th biggest position. NS Partners Ltd's holdings in Equinix were worth $27,724,000 at the end of the most recent quarter.

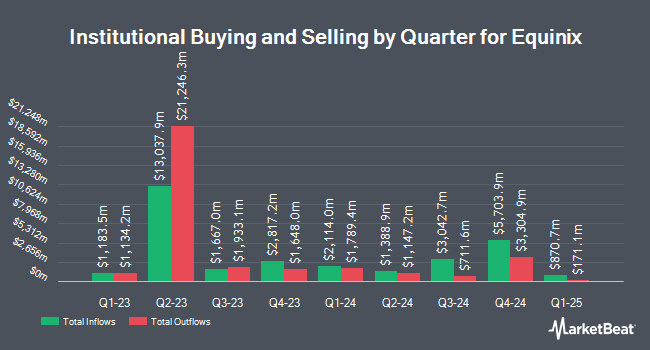

Other large investors have also recently made changes to their positions in the company. BDF Gestion purchased a new stake in shares of Equinix in the second quarter valued at about $2,659,000. Van ECK Associates Corp boosted its position in shares of Equinix by 9.2% during the 3rd quarter. Van ECK Associates Corp now owns 20,309 shares of the financial services provider's stock valued at $18,099,000 after purchasing an additional 1,716 shares in the last quarter. Bessemer Group Inc. boosted its holdings in shares of Equinix by 159.4% in the first quarter. Bessemer Group Inc. now owns 2,246 shares of the financial services provider's stock worth $1,854,000 after buying an additional 1,380 shares during the period. E. Ohman J or Asset Management AB lifted its position in shares of Equinix by 3.0% in the third quarter. E. Ohman J or Asset Management AB now owns 37,420 shares of the financial services provider's stock worth $33,215,000 after purchasing an additional 1,103 shares in the last quarter. Finally, Duff & Phelps Investment Management Co. raised its position in Equinix by 25.9% during the second quarter. Duff & Phelps Investment Management Co. now owns 369,437 shares of the financial services provider's stock valued at $279,516,000 after acquiring an additional 75,888 shares in the last quarter. 94.94% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on EQIX shares. Truist Financial lifted their price target on shares of Equinix from $915.00 to $935.00 and gave the stock a "buy" rating in a research note on Wednesday, August 21st. BMO Capital Markets upped their price objective on Equinix from $975.00 to $1,020.00 and gave the stock an "outperform" rating in a research note on Thursday, October 31st. HSBC raised Equinix from a "hold" rating to a "buy" rating and increased their target price for the stock from $865.00 to $1,000.00 in a report on Friday, October 4th. Stifel Nicolaus raised their price objective on Equinix from $995.00 to $1,080.00 and gave the company a "buy" rating in a research note on Wednesday. Finally, Wells Fargo & Company upped their target price on Equinix from $875.00 to $975.00 and gave the company an "overweight" rating in a report on Thursday, October 17th. Five equities research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $952.88.

Get Our Latest Stock Analysis on EQIX

Insider Buying and Selling at Equinix

In other Equinix news, Director Christopher B. Paisley sold 100 shares of Equinix stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $891.00, for a total transaction of $89,100.00. Following the completion of the transaction, the director now owns 17,794 shares in the company, valued at approximately $15,854,454. This trade represents a 0.56 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, EVP Jonathan Lin sold 93 shares of Equinix stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $820.99, for a total value of $76,352.07. Following the completion of the sale, the executive vice president now owns 7,141 shares in the company, valued at approximately $5,862,689.59. The trade was a 1.29 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 13,754 shares of company stock worth $11,666,756 over the last ninety days. Company insiders own 0.27% of the company's stock.

Equinix Stock Down 0.4 %

Shares of EQIX stock traded down $3.96 during mid-day trading on Wednesday, hitting $919.04. The company's stock had a trading volume of 563,188 shares, compared to its average volume of 526,659. The stock has a market cap of $88.68 billion, a price-to-earnings ratio of 82.73, a PEG ratio of 2.25 and a beta of 0.71. The company has a debt-to-equity ratio of 1.12, a quick ratio of 1.16 and a current ratio of 1.16. Equinix, Inc. has a 52-week low of $684.14 and a 52-week high of $943.02. The business has a 50-day moving average price of $888.28 and a 200 day moving average price of $821.59.

Equinix Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Wednesday, November 13th will be paid a dividend of $4.26 per share. This represents a $17.04 dividend on an annualized basis and a yield of 1.85%. The ex-dividend date of this dividend is Wednesday, November 13th. Equinix's payout ratio is presently 153.65%.

Equinix Profile

(

Free Report)

Equinix Nasdaq: EQIX is the world's digital infrastructure company . Digital leaders harness Equinix's trusted platform to bring together and interconnect foundational infrastructure at software speed. Equinix enables organizations to access all the right places, partners and possibilities to scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value, while supporting their sustainability goals.

Further Reading

Before you consider Equinix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equinix wasn't on the list.

While Equinix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.