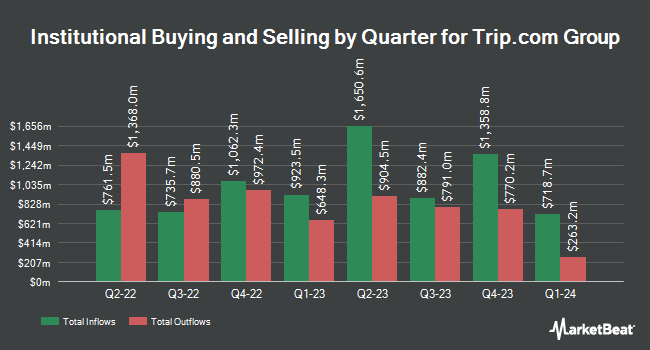

NS Partners Ltd lowered its stake in Trip.com Group Limited (NASDAQ:TCOM - Free Report) by 17.4% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 835,900 shares of the company's stock after selling 176,100 shares during the quarter. Trip.com Group makes up approximately 2.1% of NS Partners Ltd's investment portfolio, making the stock its 9th largest position. NS Partners Ltd owned approximately 0.13% of Trip.com Group worth $49,678,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Mitsubishi UFJ Trust & Banking Corp raised its position in Trip.com Group by 0.9% during the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 40,632 shares of the company's stock worth $1,908,000 after acquiring an additional 375 shares in the last quarter. O Shaughnessy Asset Management LLC lifted its stake in Trip.com Group by 10.5% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 33,512 shares of the company's stock valued at $1,471,000 after purchasing an additional 3,196 shares during the last quarter. CANADA LIFE ASSURANCE Co boosted its stake in shares of Trip.com Group by 4.7% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 237,368 shares of the company's stock worth $10,434,000 after acquiring an additional 10,689 shares during the period. Natixis lifted its holdings in Trip.com Group by 50.9% during the 1st quarter. Natixis now owns 28,960 shares of the company's stock valued at $1,271,000 after purchasing an additional 9,763 shares during the last quarter. Finally, Advisors Asset Management Inc. increased its holdings in shares of Trip.com Group by 29.5% in the first quarter. Advisors Asset Management Inc. now owns 2,692 shares of the company's stock valued at $118,000 after purchasing an additional 613 shares during the last quarter. Institutional investors own 35.41% of the company's stock.

Trip.com Group Price Performance

Trip.com Group stock traded up $2.05 during midday trading on Wednesday, reaching $64.79. The company's stock had a trading volume of 3,836,833 shares, compared to its average volume of 4,038,008. The stock has a market cap of $41.73 billion, a PE ratio of 18.78 and a beta of 0.39. The company has a current ratio of 1.32, a quick ratio of 1.32 and a debt-to-equity ratio of 0.15. Trip.com Group Limited has a 52 week low of $31.55 and a 52 week high of $69.67. The business has a 50-day moving average price of $59.93 and a 200-day moving average price of $52.28.

Trip.com Group (NASDAQ:TCOM - Get Free Report) last released its quarterly earnings data on Monday, August 26th. The company reported $0.87 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.65 by $0.22. The business had revenue of $1.76 billion during the quarter, compared to analysts' expectations of $1.80 billion. Trip.com Group had a net margin of 28.78% and a return on equity of 11.52%. On average, sell-side analysts predict that Trip.com Group Limited will post 2.93 EPS for the current year.

Wall Street Analyst Weigh In

A number of analysts have recently issued reports on the stock. HSBC upgraded shares of Trip.com Group from a "hold" rating to a "buy" rating and set a $75.00 target price for the company in a research note on Tuesday. StockNews.com cut shares of Trip.com Group from a "buy" rating to a "hold" rating in a research note on Tuesday, August 13th. Hsbc Global Res lowered shares of Trip.com Group from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, October 8th. Benchmark lifted their price target on shares of Trip.com Group from $72.00 to $80.00 and gave the company a "buy" rating in a research report on Tuesday. Finally, Barclays increased their price target on Trip.com Group from $76.00 to $84.00 and gave the stock an "overweight" rating in a research report on Wednesday. Four research analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $74.18.

Get Our Latest Research Report on Trip.com Group

Trip.com Group Profile

(

Free Report)

Trip.com Group Limited, through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally. The company acts as an agent for hotel-related transactions and selling air tickets, as well as provides train, long-distance bus, and ferry tickets; travel insurance products, such as flight delay, air accident, and baggage loss coverage; and air-ticket delivery, online check-in and seat selection, express security screening, real-time flight status tracker, and airport VIP lounge services.

Featured Articles

Before you consider Trip.com Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trip.com Group wasn't on the list.

While Trip.com Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.