NS Partners Ltd lessened its holdings in shares of VeriSign, Inc. (NASDAQ:VRSN - Free Report) by 1.4% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 104,610 shares of the information services provider's stock after selling 1,442 shares during the quarter. NS Partners Ltd owned about 0.11% of VeriSign worth $21,650,000 at the end of the most recent reporting period.

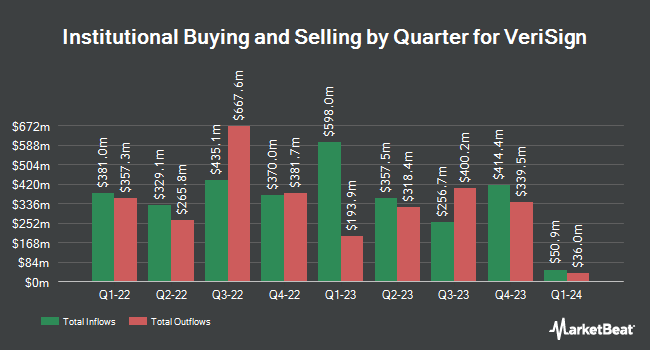

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in VRSN. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors bought a new position in VeriSign during the fourth quarter worth about $141,129,000. Nordea Investment Management AB boosted its position in VeriSign by 544.1% during the fourth quarter. Nordea Investment Management AB now owns 391,319 shares of the information services provider's stock worth $81,003,000 after purchasing an additional 330,561 shares during the period. Allspring Global Investments Holdings LLC boosted its position in VeriSign by 322.2% during the fourth quarter. Allspring Global Investments Holdings LLC now owns 261,526 shares of the information services provider's stock worth $53,639,000 after purchasing an additional 199,583 shares during the period. Point72 Asset Management L.P. bought a new position in VeriSign during the third quarter worth about $35,665,000. Finally, Assenagon Asset Management S.A. boosted its position in VeriSign by 56.8% during the fourth quarter. Assenagon Asset Management S.A. now owns 383,100 shares of the information services provider's stock worth $79,286,000 after purchasing an additional 138,796 shares during the period. Institutional investors own 92.90% of the company's stock.

Analysts Set New Price Targets

VRSN has been the subject of a number of research reports. Baird R W upgraded shares of VeriSign from a "hold" rating to a "strong-buy" rating in a research report on Monday, December 9th. Citigroup increased their price target on shares of VeriSign from $246.00 to $250.00 and gave the stock a "buy" rating in a report on Tuesday, February 4th. Robert W. Baird raised shares of VeriSign from a "neutral" rating to an "outperform" rating and increased their price target for the stock from $200.00 to $250.00 in a report on Monday, December 9th. Finally, StockNews.com downgraded shares of VeriSign from a "buy" rating to a "hold" rating in a report on Wednesday.

View Our Latest Report on VRSN

Insider Activity at VeriSign

In related news, SVP John Calys sold 447 shares of the firm's stock in a transaction that occurred on Monday, February 24th. The shares were sold at an average price of $231.75, for a total value of $103,592.25. Following the sale, the senior vice president now directly owns 23,735 shares of the company's stock, valued at $5,500,586.25. This trade represents a 1.85 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. 0.84% of the stock is currently owned by insiders.

VeriSign Trading Down 0.4 %

Shares of VeriSign stock traded down $0.94 on Wednesday, reaching $235.60. The stock had a trading volume of 712,715 shares, compared to its average volume of 808,455. VeriSign, Inc. has a 1 year low of $167.04 and a 1 year high of $242.23. The company has a market cap of $22.29 billion, a P/E ratio of 29.45 and a beta of 0.87. The business's 50 day moving average is $221.53 and its two-hundred day moving average is $199.18.

VeriSign (NASDAQ:VRSN - Get Free Report) last announced its earnings results on Thursday, February 6th. The information services provider reported $2.00 earnings per share for the quarter, meeting analysts' consensus estimates of $2.00. VeriSign had a net margin of 50.47% and a negative return on equity of 43.01%.

VeriSign Company Profile

(

Free Report)

VeriSign, Inc, together with its subsidiaries, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names worldwide. The company enables the security, stability, and resiliency of internet infrastructure and services, including providing root zone maintainer services, operating two of thirteen internet root servers; and offering registration services and authoritative resolution for the .com and .net domains, which supports global e-commerce.

See Also

Before you consider VeriSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VeriSign wasn't on the list.

While VeriSign currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.