NU (NYSE:NU - Free Report) had its target price increased by Susquehanna from $16.00 to $18.00 in a report released on Thursday morning,Benzinga reports. Susquehanna currently has a positive rating on the stock.

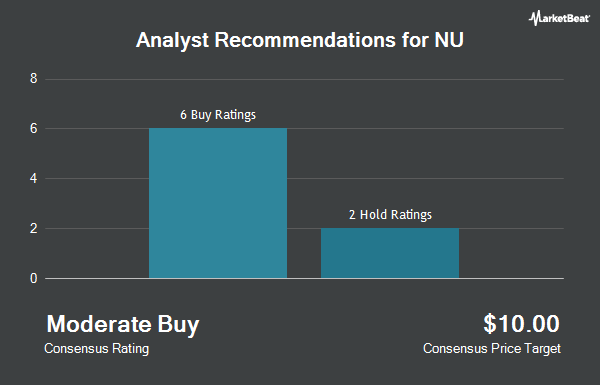

NU has been the subject of several other research reports. Bank of America boosted their price objective on NU from $12.80 to $15.00 and gave the company a "neutral" rating in a report on Thursday, September 12th. JPMorgan Chase & Co. upped their target price on shares of NU from $14.50 to $15.00 and gave the stock a "neutral" rating in a report on Monday, August 19th. KeyCorp increased their target price on shares of NU from $15.00 to $17.00 and gave the company an "overweight" rating in a research report on Thursday. UBS Group lowered shares of NU from a "buy" rating to a "neutral" rating and set a $13.50 price target on the stock. in a research report on Friday, August 2nd. Finally, Barclays increased their price objective on shares of NU from $15.00 to $17.00 and gave the company an "overweight" rating in a report on Friday, August 16th. Four equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, NU has a consensus rating of "Moderate Buy" and a consensus price target of $16.21.

Check Out Our Latest Stock Analysis on NU

NU Stock Performance

NYSE NU traded down $0.60 during trading hours on Thursday, reaching $15.04. The stock had a trading volume of 81,232,785 shares, compared to its average volume of 32,146,225. NU has a 52-week low of $7.74 and a 52-week high of $16.15. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.49 and a current ratio of 0.49. The stock has a market cap of $71.68 billion, a P/E ratio of 46.19, a price-to-earnings-growth ratio of 0.72 and a beta of 1.13. The stock has a fifty day moving average of $14.45 and a 200 day moving average of $13.17.

NU (NYSE:NU - Get Free Report) last released its quarterly earnings data on Tuesday, August 13th. The company reported $0.12 earnings per share for the quarter, topping analysts' consensus estimates of $0.10 by $0.02. NU had a net margin of 15.11% and a return on equity of 27.00%. The firm had revenue of $2.85 billion for the quarter, compared to analyst estimates of $2.90 billion. During the same quarter in the prior year, the business earned $0.05 earnings per share. Sell-side analysts predict that NU will post 0.41 earnings per share for the current year.

Institutional Investors Weigh In On NU

A number of institutional investors and hedge funds have recently made changes to their positions in the stock. Baillie Gifford & Co. lifted its stake in NU by 13.0% during the 3rd quarter. Baillie Gifford & Co. now owns 210,103,451 shares of the company's stock worth $2,867,912,000 after acquiring an additional 24,140,416 shares in the last quarter. Capital Research Global Investors increased its stake in NU by 15.7% during the 1st quarter. Capital Research Global Investors now owns 202,618,338 shares of the company's stock worth $2,417,237,000 after buying an additional 27,420,994 shares during the period. Jennison Associates LLC lifted its holdings in NU by 7.1% during the 3rd quarter. Jennison Associates LLC now owns 96,754,946 shares of the company's stock worth $1,320,705,000 after buying an additional 6,435,526 shares in the last quarter. FMR LLC lifted its holdings in NU by 16.4% during the 3rd quarter. FMR LLC now owns 61,801,891 shares of the company's stock worth $843,596,000 after buying an additional 8,728,833 shares in the last quarter. Finally, Whale Rock Capital Management LLC increased its position in shares of NU by 0.8% during the first quarter. Whale Rock Capital Management LLC now owns 25,004,827 shares of the company's stock worth $298,308,000 after acquiring an additional 204,305 shares during the period. 80.90% of the stock is owned by hedge funds and other institutional investors.

NU Company Profile

(

Get Free Report)

Nu Holdings Ltd. provides digital banking platform and digital financial services in Brazil, Mexico, Colombia, and internationally. It offers Nu credit and debit cards; Ultraviolet credit and debit cards; and mobile payment solutions for NuAccount customers to make and receive transfers, pay bills, and make everyday purchases through their mobile phones.

Featured Stories

Before you consider NU, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NU wasn't on the list.

While NU currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.